Region:Europe

Author(s):Rebecca

Product Code:KRAA4826

Pages:92

Published On:September 2025

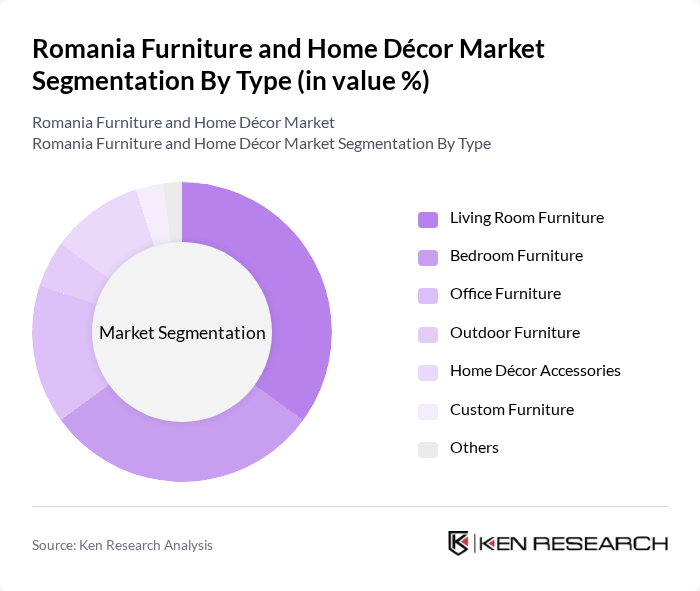

By Type:The market is segmented into various types of furniture and home décor products, including Living Room Furniture, Bedroom Furniture, Office Furniture, Outdoor Furniture, Home Décor Accessories, Custom Furniture, and Others. Among these, Living Room Furniture and Bedroom Furniture are the most prominent segments, driven by consumer demand for comfort and style in personal spaces. The trend towards multifunctional furniture has also gained traction, particularly in urban areas where space is limited.

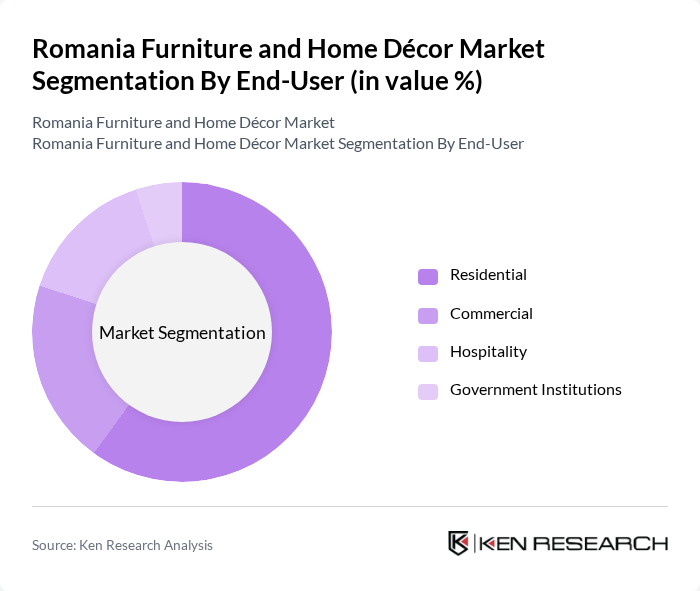

By End-User:The market is categorized into Residential, Commercial, Hospitality, and Government Institutions. The Residential segment holds the largest share, driven by increasing home ownership and renovation activities. The growing trend of remote work has also boosted demand for home office furniture, while the Hospitality sector is witnessing a rise in demand for stylish and durable furnishings to enhance guest experiences.

The Romania Furniture and Home Décor Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Romania, Mobexpert, Elvila, Kika, JYSK Romania, Dedeman, Leroy Merlin, Altex, Bricostore, Casa Rusu, MobiLux, Axioma, Raluca, Targul de Mobil?, MobiFabrica contribute to innovation, geographic expansion, and service delivery in this space.

The Romania furniture and home décor market is poised for significant growth, driven by urbanization, rising disposable incomes, and the increasing adoption of e-commerce. As consumers continue to prioritize home aesthetics, the demand for innovative and sustainable furniture solutions will likely rise. Additionally, the trend towards smart home technologies will create new opportunities for furniture manufacturers to integrate technology into their products, enhancing functionality and appeal. Overall, the market is expected to evolve, reflecting changing consumer preferences and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Home Décor Accessories Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Government Institutions |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Material | Wood Metal Plastic Fabric |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Modern Traditional Rustic Contemporary |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Retail Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 100 | Office Managers, Facility Coordinators |

| Home Décor Trends | 80 | Retail Buyers, Home Staging Professionals |

| Online Furniture Shopping Behavior | 120 | eCommerce Managers, Digital Marketing Specialists |

| Sustainable Furniture Preferences | 90 | Eco-conscious Consumers, Sustainability Advocates |

The Romania Furniture and Home Décor Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by increasing disposable incomes, urbanization, and a rising interest in home improvement and interior design.