India Furniture and Home Decor Market Overview

- The India Furniture and Home Decor Market is valued at USD 25 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, rapid urbanization, expanding middle-class population, and a strong trend towards home improvement and interior design. The rise in e-commerce and online shopping platforms has significantly contributed to market expansion, as consumers seek convenience, a wider variety of products, and access to both domestic and international brands. Social media influence and a booming real estate sector further support market growth, with consumers increasingly opting for fashionable, functional, and space-efficient furnishings and decor solutions .

- Key cities dominating the market include Mumbai, Delhi, Bangalore, and Hyderabad. These urban centers are characterized by a high concentration of affluent consumers, robust real estate development, and a vibrant culture of home decor and design. The demand for innovative and stylish furniture solutions in these cities is further fueled by the influx of international brands, local artisans, and the growing popularity of modular and multifunctional furniture .

- The Furniture (Quality Control) Order, 2023 issued by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry, mandates compliance with specified quality standards for furniture products manufactured, imported, or sold in India. The order requires manufacturers to obtain certification from the Bureau of Indian Standards (BIS), covering operational aspects such as product labeling, material safety, and adherence to eco-friendly manufacturing processes. The regulation aims to promote sustainable practices, ensure consumer safety, and enhance the competitiveness of the Indian furniture sector .

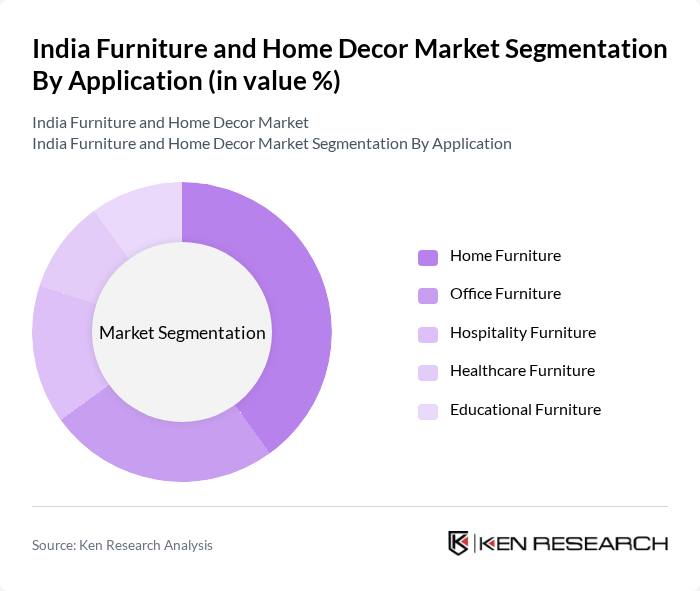

India Furniture and Home Decor Market Segmentation

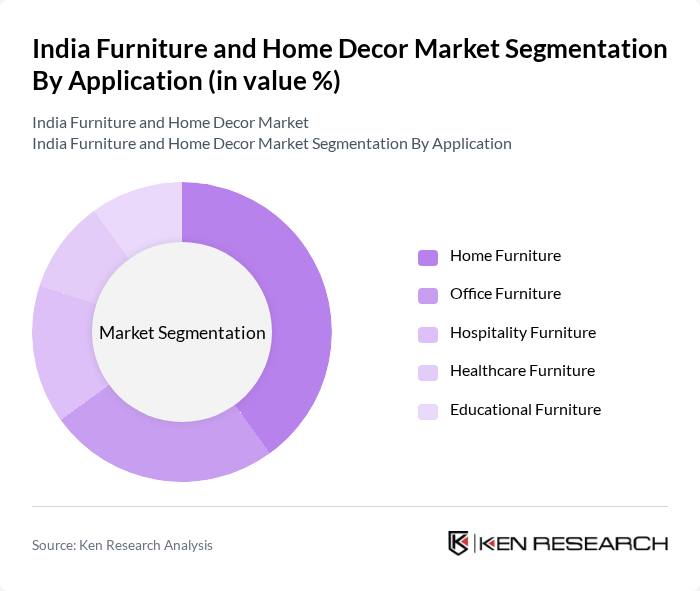

By Application:The application segment of the market includes home furniture, office furniture, hospitality furniture, healthcare furniture, and educational furniture. Among these, home furniture is the leading sub-segment, driven by the increasing trend of home renovation, the growing number of nuclear families, and the demand for stylish, functional, and space-saving solutions. The rise of online shopping platforms and digital marketing has further accelerated consumer access to a wide range of home furniture options, including modular, customizable, and eco-friendly products .

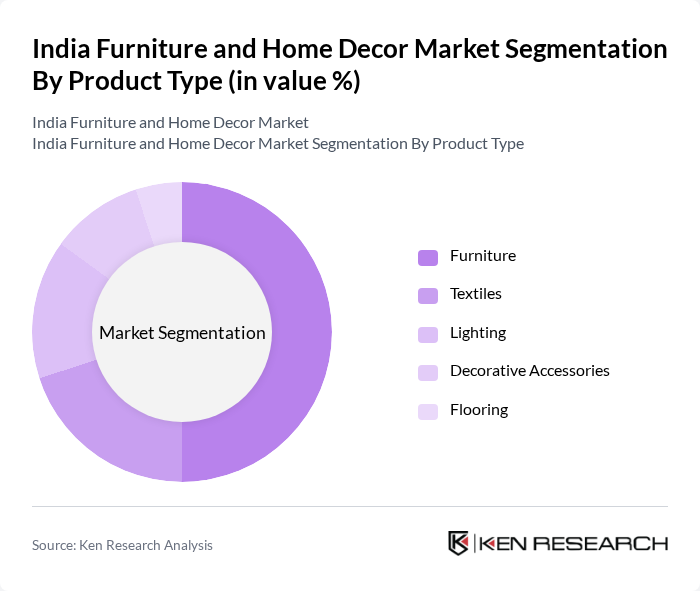

By Product Type:This segment encompasses furniture, textiles, lighting, decorative accessories, and flooring. The furniture sub-segment dominates the market, driven by increasing demand for both functional and aesthetic pieces in homes and offices. Consumers are seeking unique designs, high-quality materials, and sustainable options, leading to a surge in custom furniture solutions, modular designs, and innovative products. Textiles are registering fast growth, supported by evolving consumer preferences for home aesthetics and comfort .

India Furniture and Home Decor Market Competitive Landscape

The India Furniture and Home Decor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Godrej Interio, IKEA India, Nilkamal Limited, Durian Industries, Pepperfry, Urban Ladder, Hometown (Reliance Retail), Spacewood, Royal Oak Furniture, Wooden Street, Fabindia, Home Centre (Landmark Group), Livspace, Wakefit, India Circus contribute to innovation, geographic expansion, and service delivery in this space.

India Furniture and Home Decor Market Industry Analysis

Growth Drivers

- Rising Disposable Incomes:The average disposable income in India is projected to reach approximately ?1,25,000 per annum in future, reflecting a significant increase from ?1,20,000 in recent periods. This rise in disposable income enables consumers to allocate more funds towards home furnishings and decor, driving demand in the furniture market. As households experience improved financial conditions, spending on quality furniture and home decor items is expected to surge, contributing to market growth.

- Urbanization and Housing Demand:India is witnessing rapid urbanization, with urban population growth expected to reach 600 million in future. This urban influx is driving housing demand, with an estimated 10 million new housing units required annually. As new homes are built, the need for furniture and home decor increases significantly. This trend is further supported by government initiatives like the Pradhan Mantri Awas Yojana, which aims to provide affordable housing, thereby boosting the furniture market.

- E-commerce Growth:The e-commerce sector in India is projected to grow to ?10 trillion in future, up from ?7 trillion in recent periods. This rapid growth in online retail is transforming how consumers shop for furniture and home decor, making it more accessible. With platforms like Amazon and Flipkart expanding their furniture categories, consumers are increasingly turning to online shopping for convenience and variety, significantly impacting market dynamics and driving sales.

Market Challenges

- Intense Competition:The Indian furniture market is characterized by intense competition, with over 10,000 organized and unorganized players. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Established brands like Godrej and IKEA dominate the market, creating barriers for smaller companies. As competition intensifies, maintaining product differentiation and customer loyalty becomes increasingly difficult for businesses.

- Supply Chain Disruptions:The furniture industry in India faces significant supply chain challenges, exacerbated by global events such as the COVID-19 pandemic. Disruptions in logistics and transportation have led to delays in raw material procurement, affecting production timelines. For instance, the average lead time for furniture production has increased by approximately 30% due to these disruptions. Such challenges hinder the ability of manufacturers to meet consumer demand promptly, impacting overall market performance.

India Furniture and Home Decor Market Future Outlook

The future of the India furniture and home decor market appears promising, driven by ongoing urbanization and a growing middle class. As disposable incomes rise, consumers are increasingly investing in quality furnishings. Additionally, the integration of technology in furniture design, such as smart furniture, is expected to gain traction. Companies that adapt to these trends and focus on sustainability will likely capture a larger market share, positioning themselves favorably in this evolving landscape.

Market Opportunities

- Expansion of Online Retail Platforms:The surge in e-commerce presents a significant opportunity for furniture retailers. With online sales projected to account for approximately 20% of total furniture sales in future, businesses can leverage digital platforms to reach a broader audience. Investing in user-friendly websites and mobile applications can enhance customer experience and drive sales growth in this segment.

- Customization and Personalization Trends:Consumers increasingly seek personalized furniture solutions, with a significant proportion expressing interest in customized products. This trend offers manufacturers the chance to differentiate their offerings and cater to specific consumer preferences. By providing customization options, companies can enhance customer satisfaction and loyalty, ultimately driving sales and market share.