Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4191

Pages:80

Published On:December 2025

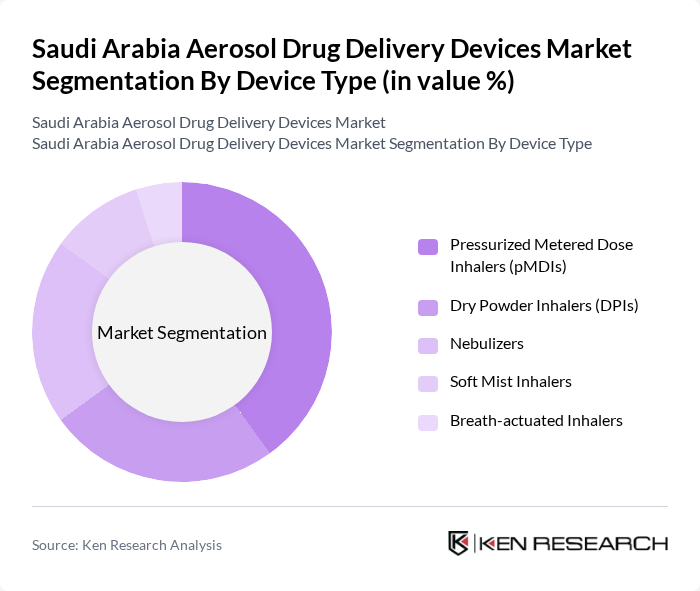

By Device Type:The aerosol drug delivery devices market is segmented into various device types, including Pressurized Metered Dose Inhalers (pMDIs), Dry Powder Inhalers (DPIs), Nebulizers, Soft Mist Inhalers, and Breath-actuated Inhalers. This mix is consistent with global clinical practice, where pMDIs and DPIs are the mainstay for maintenance and reliever therapy in asthma and COPD, while nebulizers are widely used in hospital and homecare settings for acute management and in pediatric and elderly patients. Among these, pMDIs are generally the most widely used, supported by clinical guidelines for their effectiveness in delivering bronchodilators and inhaled corticosteroids directly to the lungs when used with correct technique. The increasing prevalence and growing recognition of asthma and COPD in Saudi Arabia, alongside underdiagnosis being progressively addressed through awareness campaigns and screening programs, has further propelled demand for these devices.

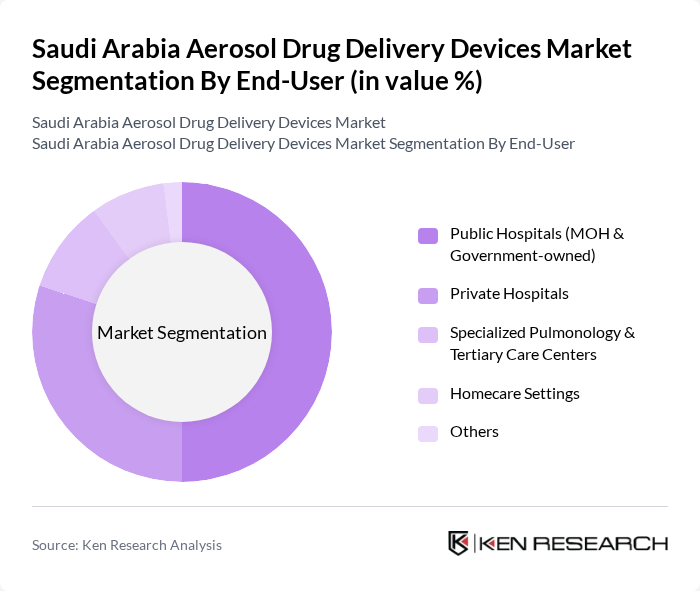

By End-User:The market is also segmented by end-user, which includes Public Hospitals (MOH & Government-owned), Private Hospitals, Specialized Pulmonology & Tertiary Care Centers, Homecare Settings, and Others. Public hospitals are the leading end-users due to their extensive patient base, dominance of government-funded service provision in Saudi Arabia, and the central role of Ministry of Health and other governmental providers in managing chronic respiratory diseases. Ongoing expansion of critical care, emergency departments, and specialized respiratory units, combined with national programs to improve asthma and COPD care pathways, is driving sustained utilization of aerosol drug delivery devices in these facilities.

The Saudi Arabia Aerosol Drug Delivery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as GlaxoSmithKline plc (GSK), AstraZeneca plc, Boehringer Ingelheim International GmbH, Novartis AG, Teva Pharmaceutical Industries Ltd., Merck & Co., Inc. (MSD), Sanofi, Pfizer Inc., Viatris Inc. (including legacy Mylan), Hikma Pharmaceuticals plc, Chiesi Farmaceutici S.p.A., Cipla Limited, Sun Pharmaceutical Industries Ltd., Sandoz Group AG, Julphar – Gulf Pharmaceutical Industries PSC, Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Tabuk Pharmaceuticals Manufacturing Company, Jamjoom Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aerosol drug delivery devices market in Saudi Arabia appears promising, driven by increasing healthcare investments and a growing focus on chronic disease management. The integration of digital health technologies is expected to enhance patient engagement and adherence to treatment protocols. Furthermore, the expansion of telemedicine services will facilitate remote monitoring, allowing for better management of respiratory conditions and potentially increasing the adoption of aerosol devices in home healthcare settings.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Pressurized Metered Dose Inhalers (pMDIs) Dry Powder Inhalers (DPIs) Nebulizers Soft Mist Inhalers Breath-actuated Inhalers |

| By End-User | Public Hospitals (MOH & Government-owned) Private Hospitals Specialized Pulmonology & Tertiary Care Centers Homecare Settings Others |

| By Application | Asthma Treatment COPD Management Allergic Rhinitis & Other Upper Airway Diseases Cystic Fibrosis & Other Chronic Lung Diseases Others |

| By Distribution Channel | Hospital Pharmacies Retail Community Pharmacies Online Pharmacies & E?commerce Platforms Tender & Institutional Sales Others |

| By Region | Central Region (Riyadh & Surrounding) Western Region (Makkah, Madinah & Jeddah) Eastern Region (Dammam, Al Khobar & Dhahran) Southern Region Northern Region |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients High-risk & Comorbid Patients |

| By Technology Integration | Smart Inhalers with Sensors Connected Devices with Bluetooth / Cloud Connectivity Mobile Health (mHealth) Applications for Adherence Monitoring Data-integrated & AI-supported Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Pulmonologists, General Practitioners, Pharmacists |

| Aerosol Device Manufacturers | 60 | Product Managers, R&D Directors, Sales Executives |

| Patients Using Aerosol Therapies | 100 | Chronic Respiratory Disease Patients, Caregivers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Affairs Specialists |

| Pharmaceutical Distributors | 50 | Distribution Managers, Supply Chain Coordinators |

The Saudi Arabia Aerosol Drug Delivery Devices Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the rising prevalence of respiratory diseases and advancements in inhaler and nebulizer technology.