Region:Asia

Author(s):Dev

Product Code:KRAC4749

Pages:93

Published On:October 2025

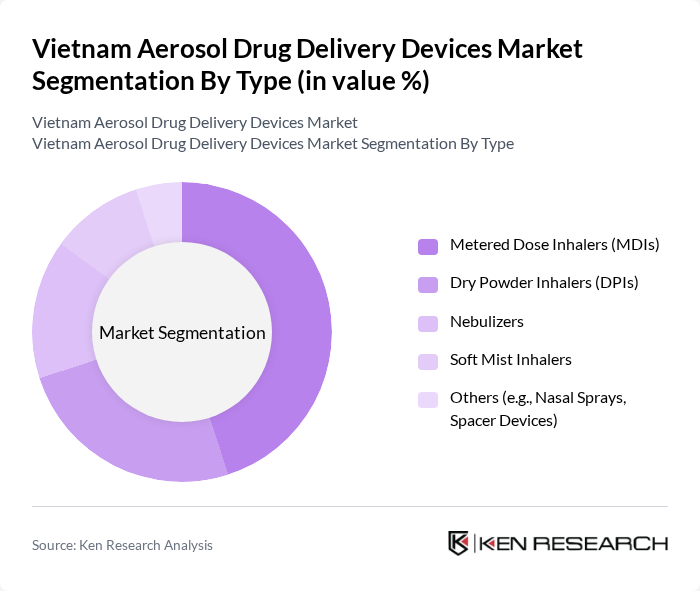

By Type:The aerosol drug delivery devices market can be segmented into various types, including Metered Dose Inhalers (MDIs), Dry Powder Inhalers (DPIs), Nebulizers, Soft Mist Inhalers, and Others (e.g., Nasal Sprays, Spacer Devices). Among these, Metered Dose Inhalers (MDIs) remain the most widely used due to their convenience, portability, and effectiveness in delivering medication directly to the lungs. The growing burden of respiratory diseases and the need for rapid symptom relief have led to increased adoption of MDIs, making them the dominant segment in the market .

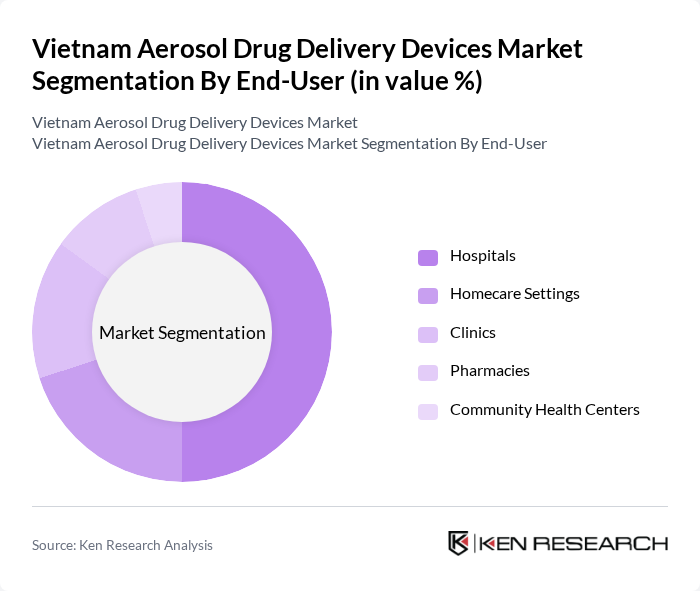

By End-User:The market can also be segmented based on end-users, which include Hospitals, Homecare Settings, Clinics, Pharmacies, and Community Health Centers. Hospitals are the leading end-user segment, primarily due to the high volume of patients requiring acute and chronic respiratory treatments. The increasing number of hospital admissions for respiratory ailments, including severe influenza and pneumonia, has driven the demand for aerosol drug delivery devices in these settings, making hospitals a critical component of patient care .

The Vietnam Aerosol Drug Delivery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca, Boehringer Ingelheim, GlaxoSmithKline plc, Novartis AG, Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., Sanofi S.A., Viatris Inc. (formerly Mylan N.V.), Chiesi Farmaceutici S.p.A., Cipla Ltd., Hikma Pharmaceuticals PLC, Sun Pharmaceutical Industries Ltd., Sandoz (a Novartis division), Aurobindo Pharma Ltd., Dr. Reddy's Laboratories Ltd., AptarGroup, Inc., Koninklijke Philips N.V., OMRON Healthcare Co., Ltd., PARI GmbH, Traphaco JSC, DHG Pharmaceutical JSC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam aerosol drug delivery devices market appears promising, driven by increasing healthcare investments and a focus on innovative technologies. The government’s commitment to enhancing healthcare infrastructure, with an expected budget increase of 20% in future, will facilitate better access to these devices. Additionally, the integration of telehealth services is likely to expand the reach of aerosol therapies, making them more accessible to patients across various demographics, particularly in rural areas.

| Segment | Sub-Segments |

|---|---|

| By Type | Metered Dose Inhalers (MDIs) Dry Powder Inhalers (DPIs) Nebulizers Soft Mist Inhalers Others (e.g., Nasal Sprays, Spacer Devices) |

| By End-User | Hospitals Homecare Settings Clinics Pharmacies Community Health Centers |

| By Application | Asthma Treatment COPD Management Allergic Rhinitis Treatment Cystic Fibrosis Management Others (e.g., Pulmonary Infections) |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Hospital Pharmacies Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Brand | Local Brands International Brands Generic Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Respiratory Therapists, Pulmonologists |

| Device Manufacturers | 60 | Product Managers, R&D Directors |

| Pharmacy Sector | 50 | Pharmacists, Pharmacy Managers |

| Patient User Groups | 80 | Chronic Respiratory Disease Patients, Caregivers |

| Regulatory Bodies | 40 | Health Policy Analysts, Regulatory Affairs Specialists |

The Vietnam Aerosol Drug Delivery Devices Market is valued at approximately USD 165 million, reflecting a significant growth driven by the rising prevalence of respiratory diseases and advancements in aerosol technology.