Region:Middle East

Author(s):Rebecca

Product Code:KRAC4598

Pages:86

Published On:October 2025

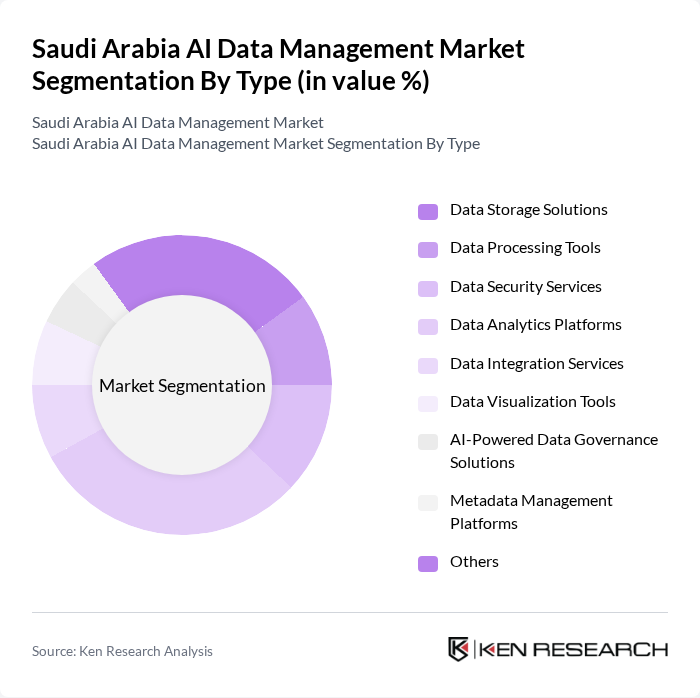

By Type:The market is segmented into Data Storage Solutions, Data Processing Tools, Data Security Services, Data Analytics Platforms, Data Integration Services, Data Visualization Tools, AI-Powered Data Governance Solutions, Metadata Management Platforms, and Others. Among these, Data Analytics Platforms are currently leading the market, driven by surging demand for actionable insights, predictive analytics, and real-time business intelligence. Organizations are prioritizing analytics investments to optimize decision-making and operational efficiency, especially in sectors like finance, healthcare, and retail.

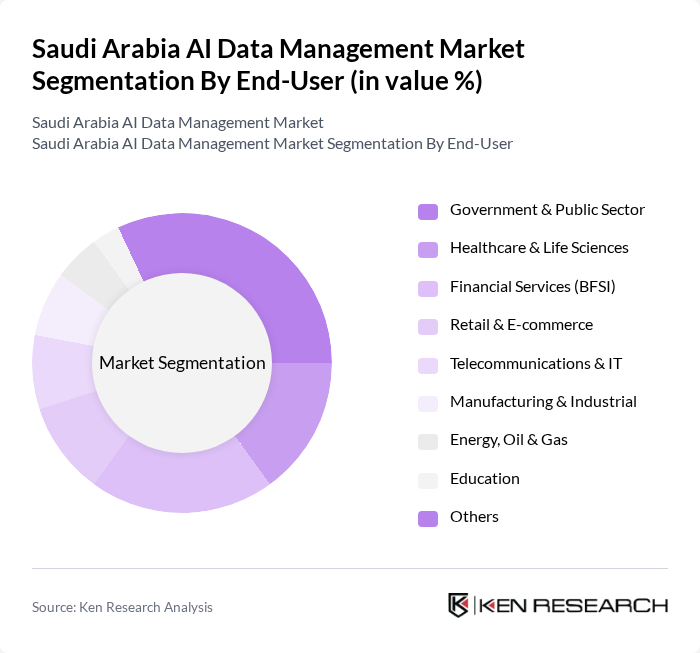

By End-User:The end-user segmentation includes Government & Public Sector, Healthcare & Life Sciences, Financial Services (BFSI), Retail & E-commerce, Telecommunications & IT, Manufacturing & Industrial, Energy, Oil & Gas, Education, and Others. The Government & Public Sector remains the leading segment, propelled by major investments in digital infrastructure, e-government platforms, and AI-driven public services. Healthcare and BFSI sectors are rapidly adopting AI data management for enhanced patient care, risk analytics, and regulatory compliance.

The Saudi Arabia AI Data Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services, Inc., Google Cloud Platform, Dell Technologies Inc., Informatica LLC, Teradata Corporation, Snowflake Inc., Cloudera, Inc., Alteryx, Inc., Micro Focus International plc, Hitachi Vantara Corporation, TIBCO Software Inc., HData Systems, Quant Data & Analytics, Comprehensive Technology Company (CompTechCo), SEIDOR, Sadeem Knowledge, Environmental Systems Research Institute, Inc. (ESRI), SAS Institute Inc., Midis Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI data management market in Saudi Arabia appears promising, driven by ongoing government support and increasing investments in technology. As organizations continue to embrace digital transformation, the integration of AI and machine learning into data management practices will become more prevalent. This shift will enhance data analytics capabilities, enabling businesses to derive actionable insights. Furthermore, the focus on data security and compliance will drive innovation, ensuring that data management solutions evolve to meet emerging challenges and opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Storage Solutions Data Processing Tools Data Security Services Data Analytics Platforms Data Integration Services Data Visualization Tools AI-Powered Data Governance Solutions Metadata Management Platforms Others |

| By End-User | Government & Public Sector Healthcare & Life Sciences Financial Services (BFSI) Retail & E-commerce Telecommunications & IT Manufacturing & Industrial Energy, Oil & Gas Education Others |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) Healthcare and Life Sciences Retail and E-commerce Telecommunications and IT Government and Public Sector Energy, Oil & Gas, Utilities Manufacturing & Industrial Education Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Type | Managed Services Professional Services Consulting Services Data Migration Services Data Quality & Cleansing Services |

| By Data Type | Structured Data Unstructured Data Semi-Structured Data |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee Freemium/Trial-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services AI Data Management | 50 | Data Analysts, IT Managers |

| Healthcare AI Solutions | 45 | Healthcare IT Directors, Data Scientists |

| Retail Sector AI Implementations | 50 | Operations Managers, E-commerce Directors |

| Government AI Initiatives | 40 | Policy Makers, IT Strategists |

| Manufacturing AI Data Applications | 45 | Production Managers, Data Engineers |

The Saudi Arabia AI Data Management Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the increasing adoption of AI technologies across various sectors, including government, healthcare, finance, and retail.