Region:Middle East

Author(s):Rebecca

Product Code:KRAD2881

Pages:82

Published On:November 2025

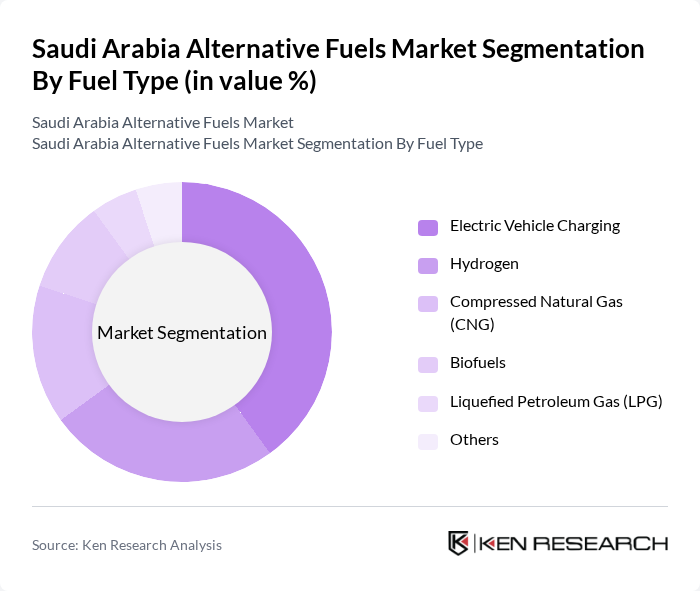

By Fuel Type:The market is segmented into various fuel types, including Electric Vehicle Charging, Hydrogen, Compressed Natural Gas (CNG), Biofuels, Liquefied Petroleum Gas (LPG), and Others. Among these, Electric Vehicle Charging is currently the leading sub-segment, driven by the increasing adoption of electric vehicles and supportive government policies. The growing infrastructure for electric vehicle charging stations, along with investments in hydrogen refueling and CNG stations, is also contributing to its dominance.

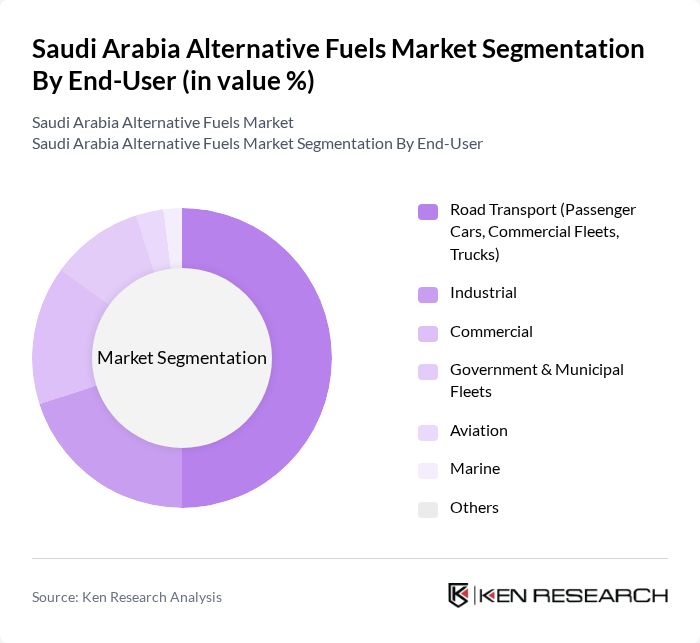

By End-User:The market is segmented by end-users, including Road Transport, Industrial, Commercial, Government & Municipal Fleets, Aviation, Marine, and Others. The Road Transport segment, particularly passenger cars and commercial fleets, is the dominant sub-segment. This is attributed to the increasing demand for cleaner transportation options, the government's push for electric and alternative fuel vehicles, and the expansion of EV charging and CNG infrastructure in urban centers.

The Saudi Arabia Alternative Fuels Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, ACWA Power, Petromin Corporation, Aldrees Petroleum & Transport Services Company, ENOWA (NEOM Energy & Water Company), Alfanar, National Renewable Energy Program (NREP), First Solar, Siemens Energy, TotalEnergies, Masdar, Engie, JGC Corporation, GE Renewable Energy, Schneider Electric, Eni, Vestas, Mitsubishi Power contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia alternative fuels market appears promising, driven by increasing investments in renewable energy and technological innovations. By 2025, the government aims to haveof its energy mix sourced from renewables in future, fostering a conducive environment for alternative fuels. Additionally, the rising consumer demand for cleaner transportation solutions is expected to accelerate the adoption of electric and hybrid vehicles, further enhancing market dynamics and encouraging sustainable practices across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Fuel Type (Electric Vehicle Charging, Hydrogen, Compressed Natural Gas (CNG), Biofuels, LPG, Others) | Electric Vehicle Charging Hydrogen Compressed Natural Gas (CNG) Biofuels Liquefied Petroleum Gas (LPG) Others |

| By End-User (Road Transport, Industrial, Commercial, Government & Municipal Fleets, Aviation, Marine) | Road Transport (Passenger Cars, Commercial Fleets, Trucks) Industrial Commercial Government & Municipal Fleets Aviation Marine Others |

| By Region (Central, Eastern, Western, Southern) | Central Region Eastern Region Western Region Southern Region |

| By Technology (Battery Electric, Hydrogen Fuel Cell, Hybrid, Biofuel Conversion, CNG/LPG Systems) | Battery Electric Technology Hydrogen Fuel Cell Technology Hybrid Systems Biofuel Conversion Technology CNG/LPG Systems Others |

| By Application (Transportation, Power Generation, Industrial Use, Utility-Scale Projects) | Transportation Power Generation Industrial Use Utility-Scale Projects Others |

| By Investment Source (Domestic, Foreign Direct Investment (FDI), Public-Private Partnerships (PPP), Government Schemes, Others) | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, Renewable Energy Certificates (RECs), Others) | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Policy Makers | 45 | Energy Policy Analysts, Regulatory Affairs Managers |

| Alternative Fuel Producers | 50 | Production Managers, R&D Directors |

| Logistics and Fleet Operators | 60 | Fleet Managers, Operations Directors |

| Environmental NGOs | 40 | Sustainability Advocates, Research Analysts |

| Academic Researchers | 45 | University Professors, Research Fellows |

The Saudi Arabia Alternative Fuels Market is valued at approximately USD 5.8 billion, driven by government initiatives to diversify energy sources, reduce carbon emissions, and promote sustainable energy solutions, particularly in transportation and industrial sectors.