Region:Middle East

Author(s):Shubham

Product Code:KRAC2816

Pages:86

Published On:October 2025

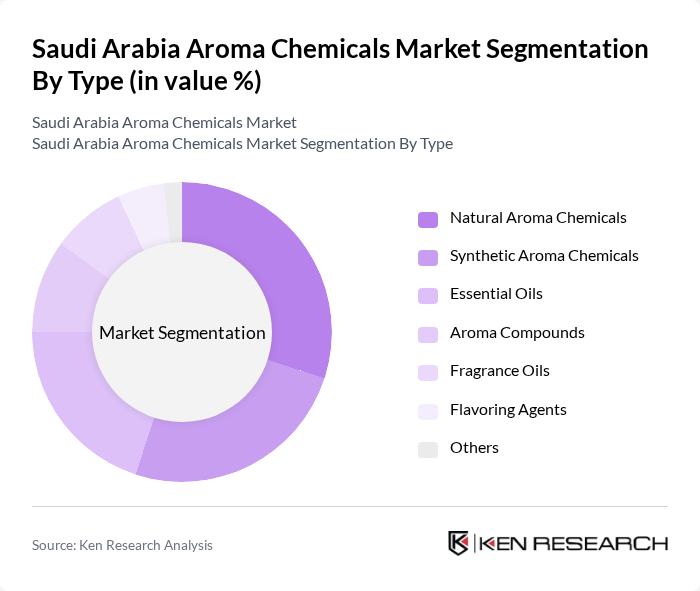

By Type:The aroma chemicals market is segmented into Natural Aroma Chemicals, Synthetic Aroma Chemicals, Essential Oils, Aroma Compounds, Fragrance Oils, Flavoring Agents, and Others. Natural Aroma Chemicals and Essential Oils are experiencing robust growth due to heightened consumer interest in organic and natural products. Synthetic Aroma Chemicals continue to hold significant market share, favored for cost-effectiveness and versatility in diverse applications .

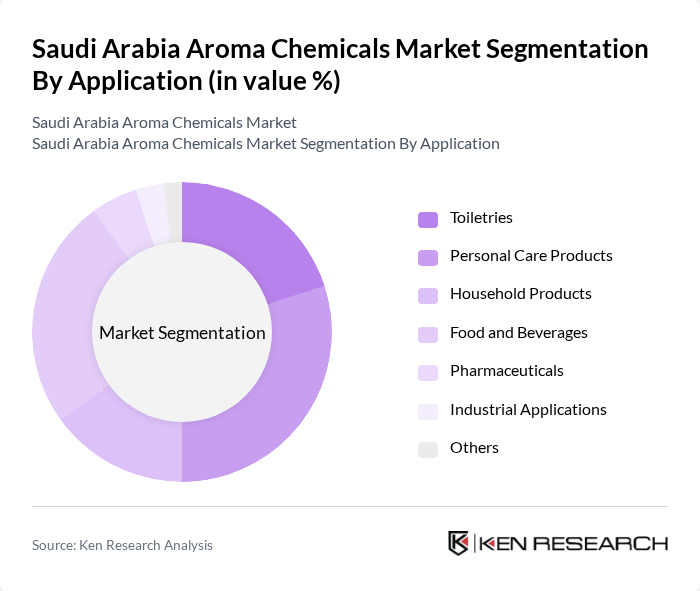

By Application:The aroma chemicals market is segmented by application into Toiletries, Personal Care Products, Household Products, Food and Beverages, Pharmaceuticals, Industrial Applications, and Others. The Personal Care Products segment leads, driven by surging demand for cosmetics and personal hygiene items. Food and Beverages also represent a substantial share, propelled by the need for flavoring agents in processed foods and beverages .

The Saudi Arabia Aroma Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Aromatics Company, Al Haramain Perfumes, Aujan Group Holding, Takasago International Corporation, Givaudan SA, Firmenich AG, International Flavors & Fragrances Inc. (IFF), Symrise AG, Mane SA, Robertet SA, Frutarom Industries Ltd., Sensient Technologies Corporation, Bell Flavors & Fragrances, Drom Fragrances, Alpha Aromatics, Ozone Naturals, Elevance Renewable Sciences, Vigon International, BASF SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia aroma chemicals market appears promising, driven by a growing consumer preference for natural and organic products. As the market evolves, companies are likely to invest in sustainable production methods and innovative formulations. Additionally, the rise of e-commerce platforms is expected to enhance distribution channels, making aroma chemicals more accessible to consumers. This shift towards digital sales will likely create new opportunities for market players to expand their reach and cater to changing consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Aroma Chemicals Synthetic Aroma Chemicals Essential Oils Aroma Compounds Fragrance Oils Flavoring Agents Others |

| By Application | Toiletries Personal Care Products Household Products Food and Beverages Pharmaceuticals Industrial Applications Others |

| By End-User | Cosmetics Industry Food Industry Household Cleaning Products Fragrance Manufacturers Others |

| By Distribution Channel | Indirect Direct Sales Online Retail Distributors Wholesalers Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Price Range | Economy Mid-Range Premium Luxury |

| By Product Form | Liquid Solid Powder Others |

| By Chemical Type | Terpenes Benzenoids Others |

| By Aroma Node | Floral Woody Fruity Spicy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Products | 100 | Product Development Managers, Brand Managers |

| Food & Beverage Applications | 80 | Flavorists, Quality Assurance Managers |

| Household Products | 70 | Procurement Managers, R&D Specialists |

| Fragrance Manufacturing | 90 | Operations Managers, Supply Chain Managers |

| Market Research Firms | 50 | Market Analysts, Industry Consultants |

The Saudi Arabia Aroma Chemicals Market is valued at approximately USD 111 billion, reflecting significant growth driven by increasing demand for fragrance and flavoring agents across various sectors, including personal care, food and beverages, and household products.