Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4448

Pages:94

Published On:October 2025

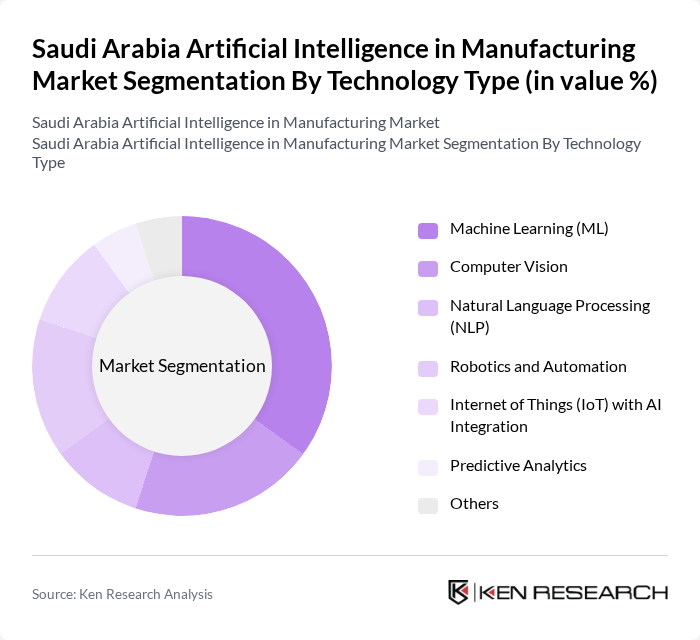

By Technology Type:The technology type segmentation includes Machine Learning (ML), Computer Vision, Natural Language Processing (NLP), Robotics and Automation, Internet of Things (IoT) with AI Integration, Predictive Analytics, and Others. Among these,Machine Learningleads due to its widespread application in predictive maintenance, quality control, and process optimization. The growing demand for data-driven decision-making and automation in manufacturing processes significantly contributes to the expansion of this segment .

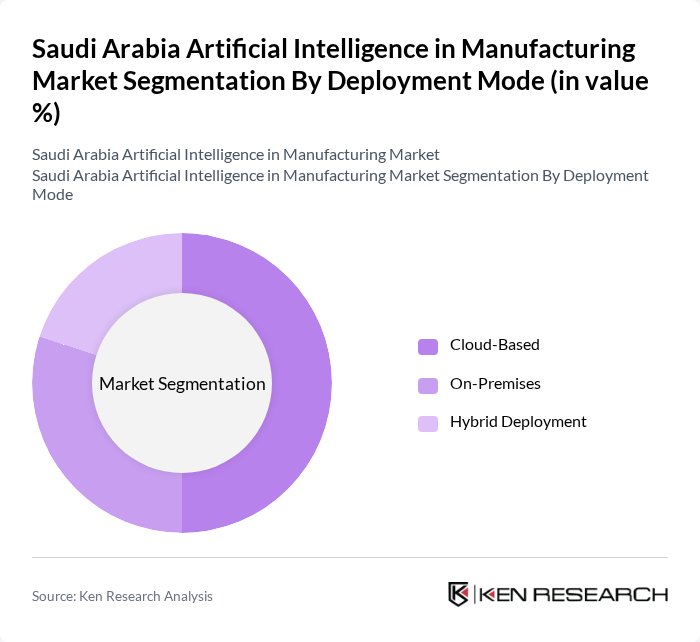

By Deployment Mode:The deployment mode segmentation includes Cloud-Based, On-Premises, and Hybrid Deployment.Cloud-Based deploymentis currently the most popular among manufacturers due to its scalability, cost-effectiveness, and ease of access to advanced AI tools and resources. This trend is driven by the increasing need for flexibility and the ability to leverage big data analytics in real-time .

The Saudi Arabia Artificial Intelligence in Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, IBM Corporation, Microsoft Corporation, ABB Ltd., Honeywell International Inc., Rockwell Automation, Inc., Schneider Electric SE, SAP SE, NVIDIA Corporation, and GE Digital drive innovation, geographic expansion, and service delivery in this space .

The future of AI in Saudi Arabia's manufacturing sector appears promising, driven by ongoing technological advancements and government support. As companies increasingly recognize the value of AI in enhancing operational efficiency, the integration of AI with IoT technologies is expected to gain momentum. Furthermore, the focus on sustainability will likely lead to the development of AI solutions that optimize resource usage, aligning with global environmental goals and enhancing competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Machine Learning (ML) Computer Vision Natural Language Processing (NLP) Robotics and Automation Internet of Things (IoT) with AI Integration Predictive Analytics Others |

| By Deployment Mode | Cloud-Based On-Premises Hybrid Deployment |

| By Company Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Functionality | Planning and Scheduling Product Design and Customization Workforce Management |

| By Application | Predictive Maintenance and Machine Monitoring Quality Control and Inspection Supply Chain Optimization Process Automation Energy Management |

| By Industry Vertical | Automotive Manufacturing Chemical and Petrochemicals Food and Beverage Metals and Machinery Electronics and Semiconductor |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing AI Integration | 100 | Production Managers, AI Implementation Leads |

| Electronics Manufacturing AI Solutions | 80 | Operations Directors, Technology Officers |

| Consumer Goods AI Applications | 70 | Supply Chain Managers, Quality Control Heads |

| Pharmaceutical Manufacturing AI Usage | 60 | Regulatory Affairs Managers, R&D Directors |

| Textile Industry AI Innovations | 40 | Product Development Managers, Sustainability Officers |

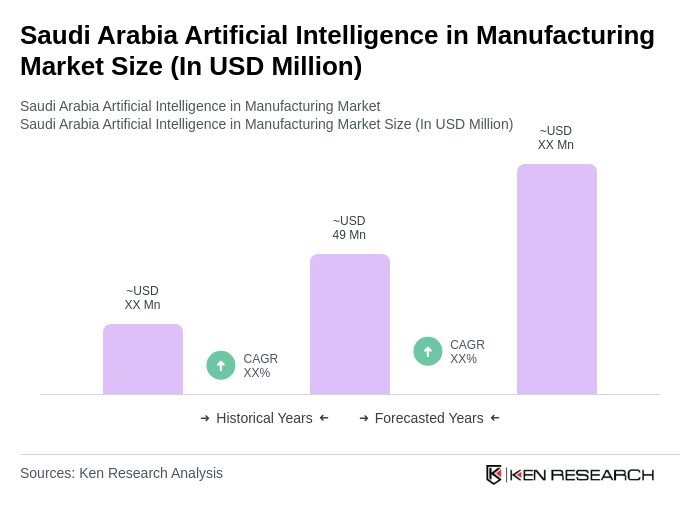

The Saudi Arabia Artificial Intelligence in Manufacturing Market is valued at approximately USD 49 million, reflecting a significant growth trend driven by the increasing adoption of AI technologies to enhance operational efficiency and product quality across various manufacturing sectors.