Region:Europe

Author(s):Shubham

Product Code:KRAB3166

Pages:96

Published On:October 2025

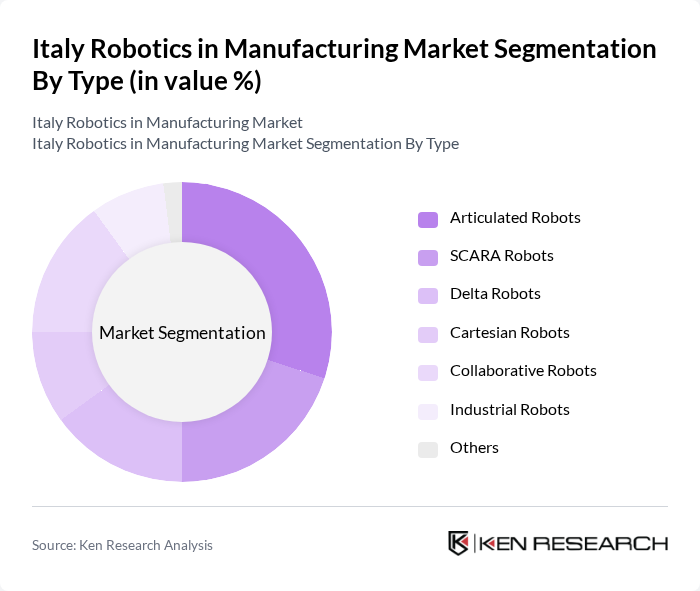

By Type:The market is segmented into various types of robots, including articulated robots, SCARA robots, delta robots, Cartesian robots, collaborative robots, industrial robots, and others. Each type serves specific functions and applications within the manufacturing sector, catering to diverse operational needs.

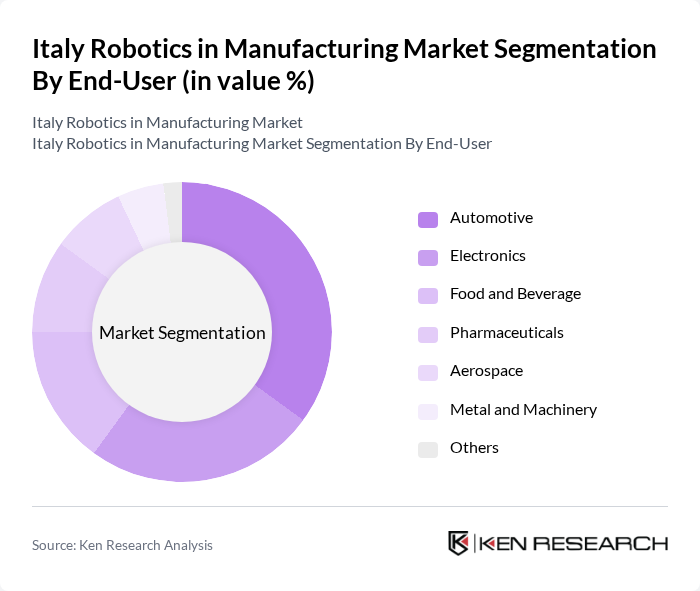

By End-User:The end-user segmentation includes automotive, electronics, food and beverage, pharmaceuticals, aerospace, metal and machinery, and others. Each sector utilizes robotics to enhance efficiency, reduce labor costs, and improve product quality.

The Italy Robotics in Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Siemens AG, Mitsubishi Electric Corporation, Omron Corporation, Universal Robots A/S, Schneider Electric SE, Rockwell Automation, Inc., Epson Robots, Denso Corporation, Staubli Robotics, Comau S.p.A., Kawasaki Heavy Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robotics market in Italy's manufacturing sector appears promising, driven by ongoing technological innovations and increasing demand for automation. As companies continue to invest in advanced robotics, the integration of AI and IoT technologies will enhance operational efficiency and flexibility. Furthermore, the push for sustainability will likely lead to the development of eco-friendly robotic solutions, aligning with global environmental goals. This evolving landscape presents significant opportunities for growth and transformation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Delta Robots Cartesian Robots Collaborative Robots Industrial Robots Others |

| By End-User | Automotive Electronics Food and Beverage Pharmaceuticals Aerospace Metal and Machinery Others |

| By Application | Assembly Packaging Material Handling Welding Painting Inspection Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Offline Online |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Robotics | 100 | Production Managers, Robotics Engineers |

| Electronics Assembly Automation | 80 | Operations Directors, Quality Assurance Managers |

| Consumer Goods Robotics Integration | 70 | Supply Chain Managers, IT Directors |

| Pharmaceutical Manufacturing Automation | 60 | Regulatory Affairs Managers, Process Engineers |

| Food and Beverage Robotics Applications | 90 | Production Supervisors, Facility Managers |

The Italy Robotics in Manufacturing Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of automation technologies and the demand for enhanced productivity and precision in manufacturing processes.