Region:Middle East

Author(s):Shubham

Product Code:KRAB7096

Pages:96

Published On:October 2025

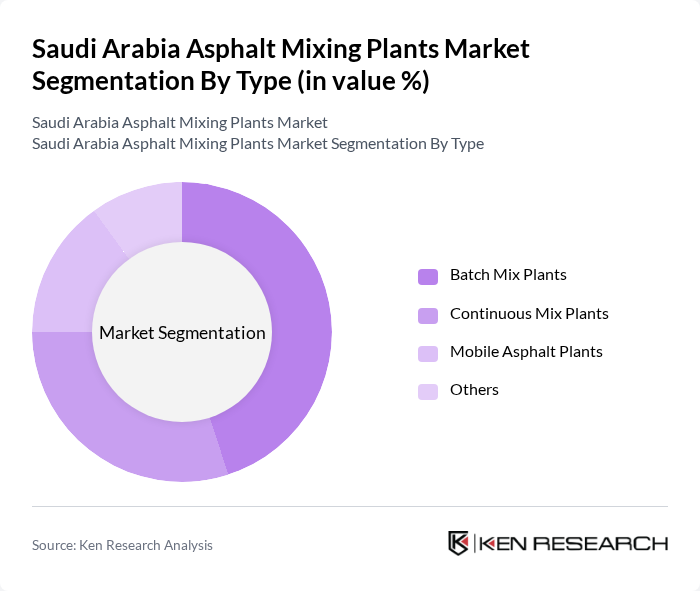

By Type:

The asphalt mixing plants market can be segmented into four main types: Batch Mix Plants, Continuous Mix Plants, Mobile Asphalt Plants, and Others. Among these, Batch Mix Plants dominate the market due to their ability to produce high-quality asphalt in controlled batches, making them ideal for large-scale projects. Continuous Mix Plants are also gaining traction for their efficiency in producing asphalt continuously, catering to high-demand projects. Mobile Asphalt Plants are preferred for their flexibility and ease of transport, especially in remote areas. The "Others" category includes specialized plants that cater to niche requirements.

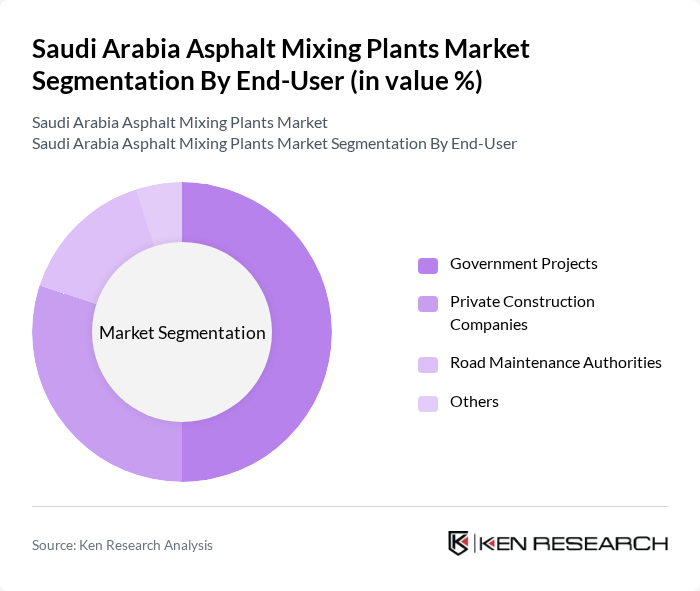

By End-User:

This market is segmented by end-users into Government Projects, Private Construction Companies, Road Maintenance Authorities, and Others. Government Projects are the leading segment, driven by substantial public investments in infrastructure development. Private Construction Companies follow closely, as they seek reliable asphalt solutions for various construction needs. Road Maintenance Authorities also contribute significantly, focusing on the upkeep of existing road networks. The "Others" category includes various smaller players and specialized projects.

The Saudi Arabia Asphalt Mixing Plants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Readymix Concrete Co., Al-Falak Asphalt, Al-Jazira Asphalt, Al-Mabani General Contractors, Al-Rashed Cement Co., Eastern Province Cement Co., Saudi Arabian Oil Company (Saudi Aramco), Al-Babtain Group, Al-Khodari & Sons, Al-Omran Group, Al-Qatami Global for General Trading & Contracting, Al-Suwaidi Industrial Services Co., Al-Tamimi Group, Al-Watania for Industries, Al-Zamil Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia asphalt mixing plants market is poised for significant transformation driven by technological advancements and sustainability initiatives. The integration of IoT technologies is expected to enhance operational efficiency, while the shift towards eco-friendly materials will reshape production processes. Additionally, the government's focus on public-private partnerships will facilitate infrastructure projects, creating a robust demand for asphalt. As these trends evolve, the market will likely witness increased investment in innovative solutions and sustainable practices, positioning it for long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Batch Mix Plants Continuous Mix Plants Mobile Asphalt Plants Others |

| By End-User | Government Projects Private Construction Companies Road Maintenance Authorities Others |

| By Application | Road Construction Airport Runways Parking Lots Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Price Range | Low-End Mid-Range High-End |

| By Component | Mixers Silos Control Systems Others |

| By Technology | Traditional Technology Advanced Technology Hybrid Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Development Projects | 100 | Project Managers, Civil Engineers |

| Asphalt Production Facilities | 80 | Plant Managers, Operations Supervisors |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Officers |

| Construction Firms Utilizing Asphalt | 90 | Procurement Managers, Site Engineers |

| Consultants in Asphalt Technology | 60 | Industry Experts, Technical Advisors |

The Saudi Arabia Asphalt Mixing Plants Market is valued at approximately USD 1.2 billion, driven by significant infrastructure development and increasing demand for high-quality asphalt in construction projects across the region.