Region:Global

Author(s):Geetanshi

Product Code:KRAA3446

Pages:97

Published On:January 2026

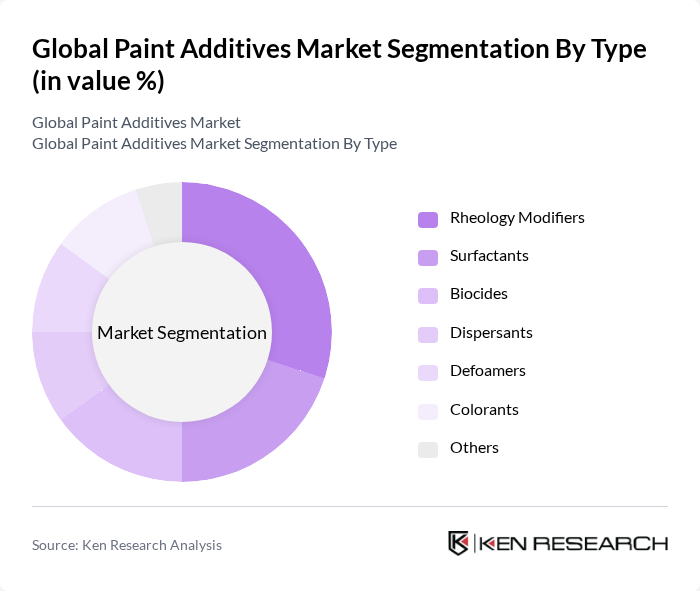

By Type:The paint additives market is segmented into various types, including Rheology Modifiers, Surfactants, Biocides, Dispersing Agents, Defoamers, Colorants, and Others. Among these, Rheology Modifiers are leading the market due to their essential role in enhancing the flow and application properties of paints. The increasing demand for high-quality finishes and improved application characteristics drives the growth of this sub-segment. Surfactants also hold a significant share, as they improve wetting and dispersion, which are critical for achieving uniform coatings.

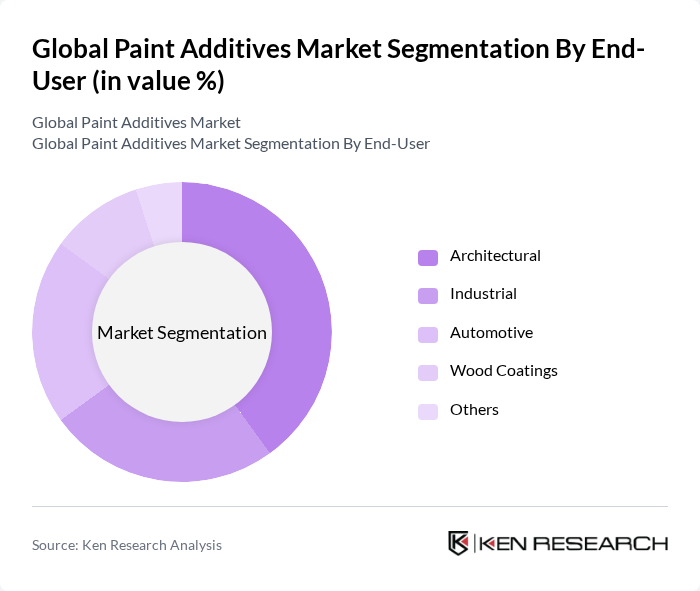

By End-User:The end-user segmentation includes Architectural, Industrial, Automotive, Wood Coatings, and Others. The Architectural segment is the largest due to the growing construction industry and the increasing demand for decorative and protective coatings. The rise in residential and commercial construction projects has significantly boosted the demand for paint additives in this segment. The Automotive sector is also witnessing growth, driven by the need for high-performance coatings that enhance vehicle aesthetics and durability.

The Global Paint Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, AkzoNobel N.V., Dow Inc., Evonik Industries AG, Huntsman Corporation, Eastman Chemical Company, Sherwin-Williams Company, PPG Industries, Inc., Clariant AG, Solvay S.A., Arkema S.A., RPM International Inc., Celanese Corporation, 3M Company, Wacker Chemie AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the paint additives market appears promising, driven by the ongoing transition towards sustainable practices and technological innovations. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest more in developing bio-based additives. Additionally, the integration of smart technologies in coatings is expected to enhance product functionality, catering to the evolving needs of various industries. This dynamic landscape will foster growth opportunities and encourage collaboration among industry players to drive innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Rheology Modifiers Surfactants Biocides Dispersing Agents Defoamers Colorants Others |

| By End-User | Architectural Industrial Automotive Wood Coatings Others |

| By Application | Interior Coatings Exterior Coatings Specialty Coatings Others |

| By Formulation | Water-Based Solvent-Based Powder Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Type | OEMs Retail Customers Contractors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Architectural Coatings | 120 | Product Managers, R&D Chemists |

| Automotive Paints | 100 | Manufacturing Engineers, Quality Control Managers |

| Industrial Coatings | 80 | Procurement Specialists, Operations Managers |

| Specialty Coatings | 70 | Technical Sales Representatives, Application Engineers |

| Consumer Paints | 90 | Retail Managers, Marketing Executives |

The Global Paint Additives Market is valued at approximately USD 9.4 billion, driven by the increasing demand for high-performance coatings across various industries, including automotive and construction, as well as a focus on environmental sustainability.