Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8934

Pages:88

Published On:October 2025

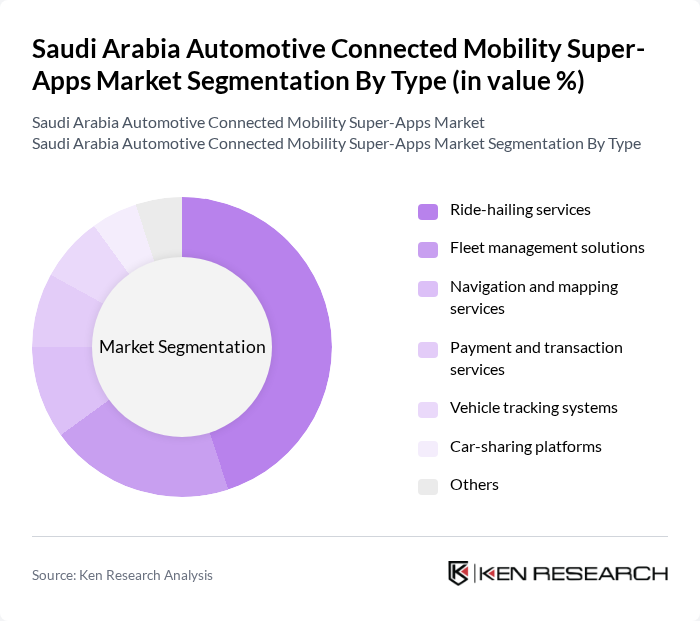

By Type:The market is segmented into various types, including ride-hailing services, fleet management solutions, navigation and mapping services, payment and transaction services, vehicle tracking systems, car-sharing platforms, and others. Among these, ride-hailing services have emerged as the dominant segment due to the increasing preference for on-demand transportation solutions among consumers. The convenience and flexibility offered by these services have led to a significant rise in user adoption, making it a key driver of market growth.

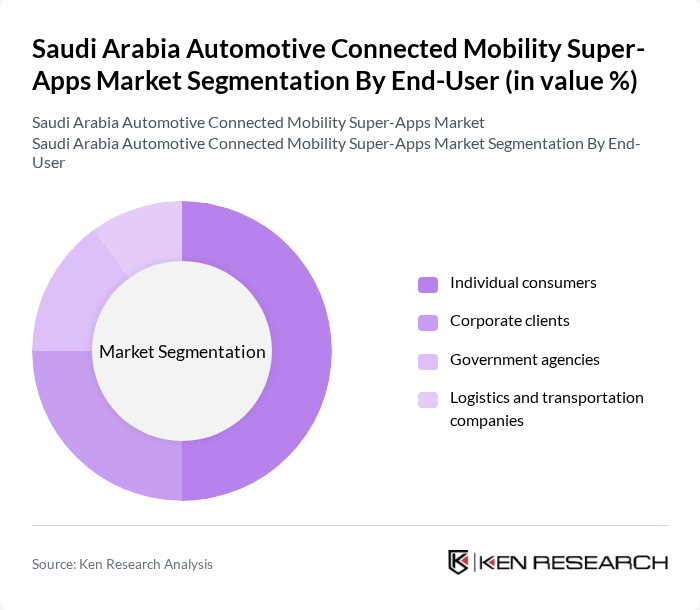

By End-User:The end-user segmentation includes individual consumers, corporate clients, government agencies, and logistics and transportation companies. Individual consumers represent the largest segment, driven by the growing trend of shared mobility and the increasing reliance on mobile applications for transportation needs. The convenience and cost-effectiveness of these services have made them particularly appealing to urban dwellers, thus solidifying their position as the leading end-user segment.

The Saudi Arabia Automotive Connected Mobility Super-Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem, Uber Technologies, Inc., STC Pay, Mobily, Zain KSA, Al-Futtaim Group, Al-Jomaih Automotive, Abdul Latif Jameel Motors, Al-Muhaidib Group, National Industrialization Company (Tasnee), Al Habtoor Group, Al-Mansour Automotive, Al-Faisaliah Group, Al-Jazira Capital, Al-Rajhi Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive connected mobility super-apps market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As urban populations grow, the demand for efficient, integrated mobility solutions will likely increase. Additionally, the government's commitment to smart city initiatives will foster an environment conducive to innovation. Companies that leverage AI and data analytics to enhance user experiences and operational efficiency will be well-positioned to capitalize on emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ride-hailing services Fleet management solutions Navigation and mapping services Payment and transaction services Vehicle tracking systems Car-sharing platforms Others |

| By End-User | Individual consumers Corporate clients Government agencies Logistics and transportation companies |

| By Application | Urban mobility Intercity travel Last-mile delivery Public transportation integration |

| By Distribution Channel | Mobile applications Web platforms Third-party aggregators |

| By Pricing Model | Subscription-based Pay-per-use Freemium models |

| By Customer Segment | Millennials Business professionals Tourists |

| By Policy Support | Government subsidies Tax incentives for electric vehicles Grants for smart mobility projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Connected Vehicle Manufacturers | 100 | Product Managers, R&D Directors |

| Mobility Service Providers | 80 | Operations Managers, Business Development Executives |

| Fleet Management Companies | 70 | Fleet Managers, IT Directors |

| Consumer Insights on Mobility Apps | 90 | End Users, App Developers |

| Government and Regulatory Bodies | 50 | Policy Makers, Urban Planners |

The Saudi Arabia Automotive Connected Mobility Super-Apps Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of smart mobility solutions and urbanization, alongside government initiatives for digital transformation in transportation.