Region:Middle East

Author(s):Geetanshi

Product Code:KRAB9133

Pages:91

Published On:October 2025

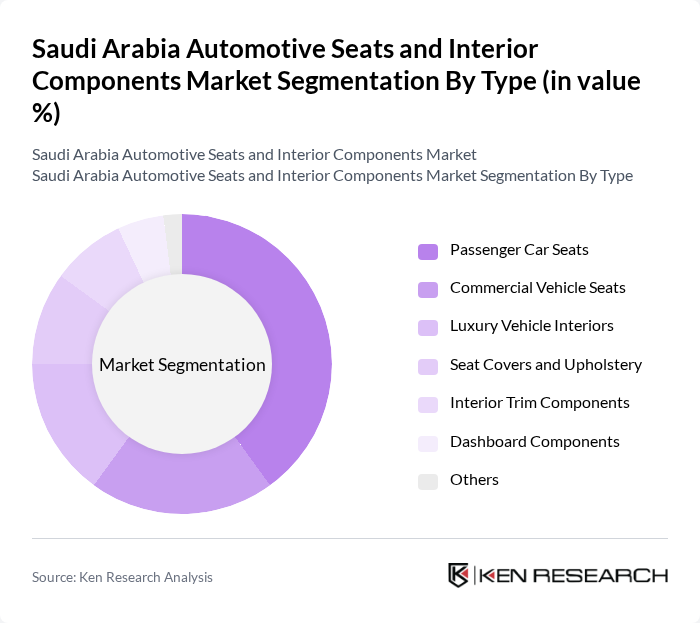

By Type:The market is segmented into various types, including Passenger Car Seats, Commercial Vehicle Seats, Luxury Vehicle Interiors, Seat Covers and Upholstery, Interior Trim Components, Dashboard Components, and Others. Among these, Passenger Car Seats are the most significant segment, driven by the increasing sales of passenger vehicles and consumer preferences for comfort and aesthetics in car interiors.

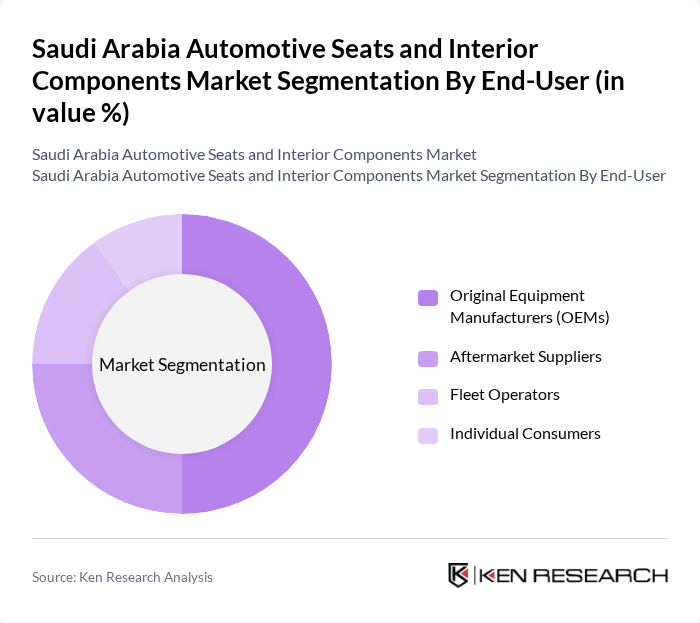

By End-User:The market is categorized into Original Equipment Manufacturers (OEMs), Aftermarket Suppliers, Fleet Operators, and Individual Consumers. The OEMs segment holds a significant share due to the increasing production of vehicles and the demand for high-quality interior components directly from manufacturers.

The Saudi Arabia Automotive Seats and Interior Components Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Boshoku Corporation, Lear Corporation, Adient plc, Faurecia S.A., Magna International Inc., Tachi-S Co., Ltd., NHK Spring Co., Ltd., Grupo Antolin, IAC Group, Seoyon E-Hwa, Kongsberg Automotive, JCI (Johnson Controls International), Dura Automotive Systems, Aisin Seiki Co., Ltd., Brose Fahrzeugteile GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi automotive seats and interior components market appears promising, driven by technological advancements and evolving consumer preferences. As the market shifts towards electric vehicles, manufacturers are expected to innovate in materials and design, enhancing comfort and sustainability. Additionally, the growing trend of customization will likely lead to increased demand for bespoke interior solutions, creating opportunities for local manufacturers to differentiate themselves and capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Car Seats Commercial Vehicle Seats Luxury Vehicle Interiors Seat Covers and Upholstery Interior Trim Components Dashboard Components Others |

| By End-User | Original Equipment Manufacturers (OEMs) Aftermarket Suppliers Fleet Operators Individual Consumers |

| By Vehicle Type | Sedans SUVs Trucks Buses |

| By Material Type | Fabric Leather Synthetic Materials Foam |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Outlets |

| By Price Range | Economy Mid-Range Premium |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs in Automotive Manufacturing | 100 | Product Development Managers, Engineering Leads |

| Tier 1 Suppliers of Interior Components | 80 | Supply Chain Managers, Sales Directors |

| Automotive Design Firms | 60 | Design Engineers, Project Managers |

| Market Analysts and Consultants | 50 | Industry Analysts, Market Research Specialists |

| Automotive Aftermarket Retailers | 70 | Retail Managers, Product Line Managers |

The Saudi Arabia Automotive Seats and Interior Components Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing demand for passenger vehicles and rising disposable incomes among consumers.