Region:North America

Author(s):Shubham

Product Code:KRAD0906

Pages:89

Published On:November 2025

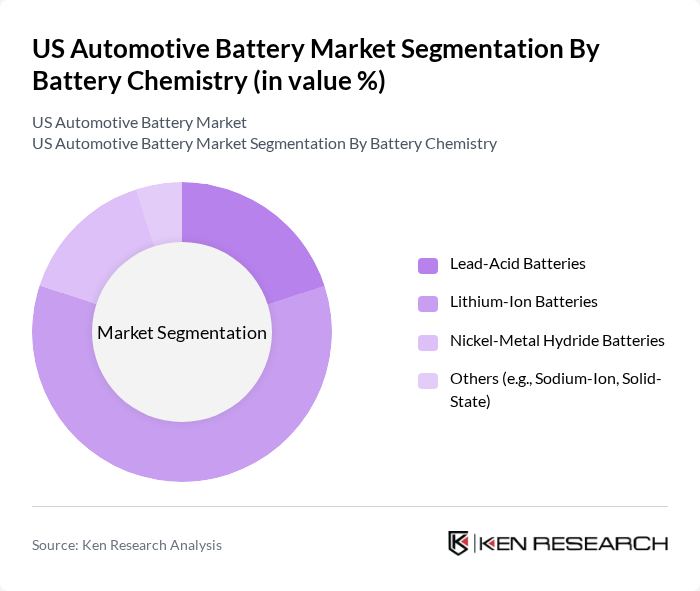

By Battery Chemistry:The battery chemistry segment comprises Lead-Acid Batteries, Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, and Others (such as Sodium-Ion and Solid-State). Lithium-Ion Batteries currently dominate the market due to their superior energy density, longer operational lifespan, and declining costs, making them the preferred choice for electric and hybrid vehicles. Lead-acid batteries remain relevant for conventional vehicles, especially in starting, lighting, and ignition applications, while nickel-metal hydride and emerging chemistries are used in specific hybrid and next-generation applications.

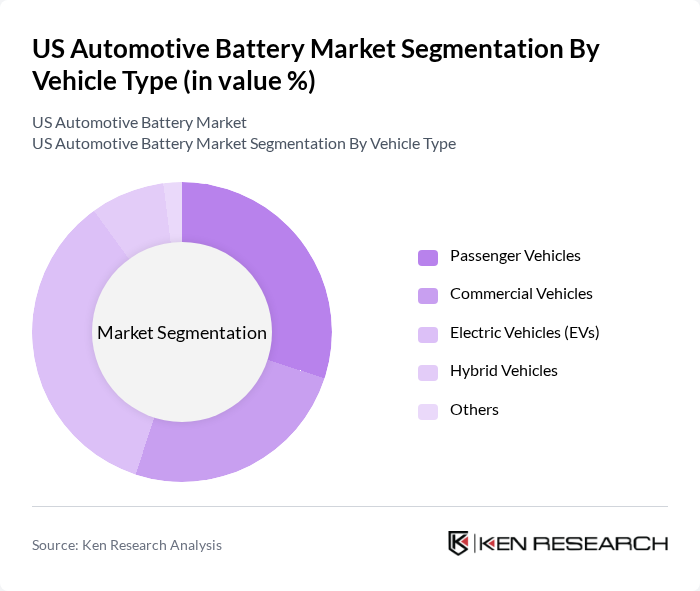

By Vehicle Type:This segment classifies the market by vehicle categories: Passenger Vehicles, Commercial Vehicles, Electric Vehicles (EVs), Hybrid Vehicles, and Others. Electric Vehicles are currently the fastest-growing segment, propelled by consumer demand for sustainable mobility and government incentives. Passenger vehicles and commercial fleets continue to drive significant battery demand, while hybrid vehicles and emerging categories contribute to market diversity.

The US Automotive Battery Market features a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., General Motors Company, Ford Motor Company, Panasonic Corporation, LG Energy Solution Ltd., A123 Systems LLC, East Penn Manufacturing Company, Samsung SDI Co., Ltd., Contemporary Amperex Technology Co., Ltd. (CATL), Exide Technologies, EnerSys, Johnson Controls International plc, Delphi Technologies, BYD Company Limited, and Northvolt AB drive innovation, geographic expansion, and advanced service delivery.

The US automotive battery market is poised for transformative growth, driven by technological innovations and increasing consumer demand for electric vehicles. As manufacturers focus on enhancing battery efficiency and sustainability, the integration of solid-state batteries and AI-driven management systems will become prevalent. Additionally, the expansion of charging infrastructure and partnerships with automotive manufacturers will further facilitate market penetration, ensuring a robust ecosystem for electric mobility in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Battery Chemistry | Lead-Acid Batteries Lithium-Ion Batteries Nickel-Metal Hydride Batteries Others (e.g., Sodium-Ion, Solid-State) |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Electric Vehicles (EVs) Hybrid Vehicles Others |

| By Drive Type | Internal Combustion Engine (ICE) Vehicles Electric Vehicles (EVs) Hybrid Electric Vehicles (HEVs) Plug-in Hybrid Electric Vehicles (PHEVs) |

| By Application | Starting, Lighting, and Ignition (SLI) Propulsion (EV/HEV) Auxiliary Systems Others |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket/Replacement Online Retail Offline Retail Direct Sales Others |

| By Geography | Northeast Midwest South West |

| By Policy Support | Federal Incentives State-Level Programs Tax Credits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 100 | Product Managers, Engineering Leads |

| Battery Technology Developers | 80 | Research Scientists, Technical Directors |

| Automotive Supply Chain Managers | 60 | Procurement Managers, Logistics Coordinators |

| Regulatory Bodies and Policy Makers | 40 | Policy Analysts, Environmental Officers |

| End-Users of Electric Vehicles | 90 | Consumers, Fleet Managers |

The US Automotive Battery Market is valued at approximately USD 14 billion, driven by the increasing adoption of electric vehicles, advancements in battery technology, and expanding EV infrastructure. This growth is supported by government incentives and consumer demand for sustainable transportation.