Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7204

Pages:91

Published On:December 2025

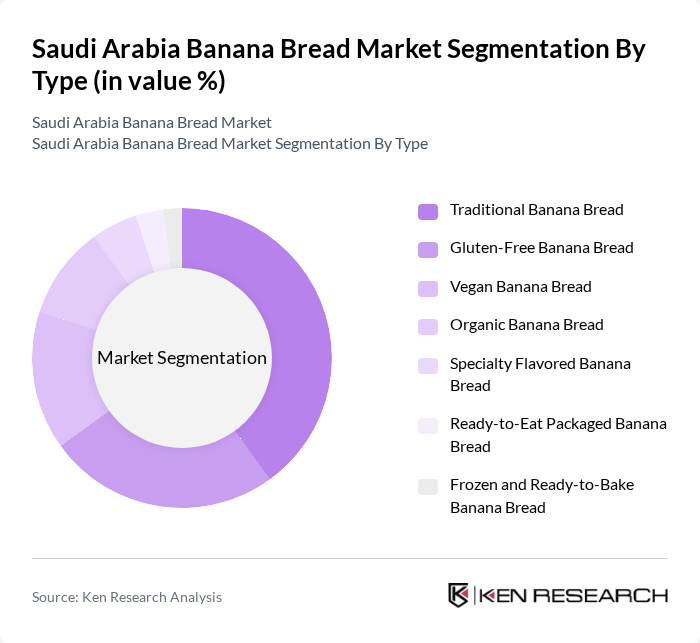

By Type:The market is segmented into various types of banana bread, including Traditional Banana Bread, Gluten-Free Banana Bread, Vegan Banana Bread, Organic Banana Bread, Specialty Flavored Banana Bread, Ready-to-Eat Packaged Banana Bread, and Frozen and Ready-to-Bake Banana Bread. This typology aligns with global product segmentation in the banana bread category, which differentiates between standard, flavored, and health-positioned variants. Among these, Traditional Banana Bread is the most popular due to its classic taste, familiar recipe formats, and wide availability across in-store bakeries, cafés, and home baking. However, the Gluten-Free and Vegan segments are rapidly gaining traction as more consumers seek healthier, allergen-free, and dietary-specific options, in line with the broader regional shift toward free-from and plant-based bakery products. The demand for Organic and Specialty Flavored variants is also on the rise, reflecting changing consumer preferences toward natural ingredients, reduced artificial additives, and unique flavors such as chocolate chip, nuts, dates, and spices that resonate with local tastes.

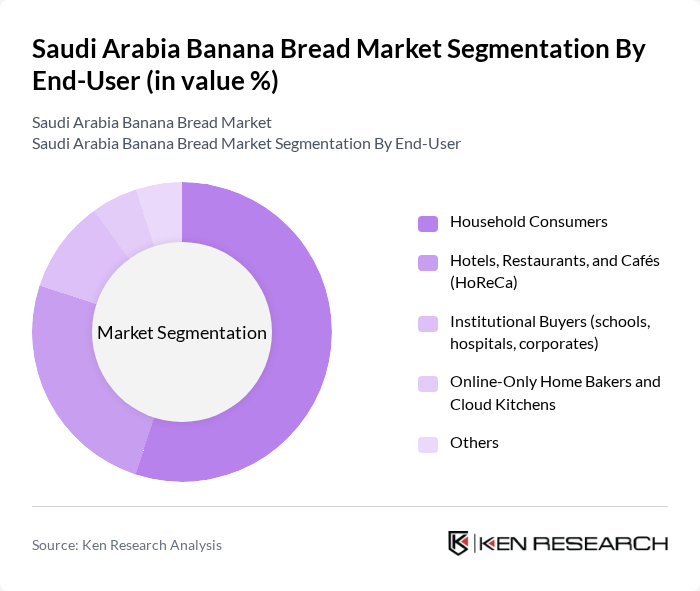

By End-User:The end-user segmentation includes Household Consumers, Hotels, Restaurants, and Cafés (HoReCa), Institutional Buyers (schools, hospitals, corporates), Online-Only Home Bakers and Cloud Kitchens, and Others. This structure is consistent with global banana bread and bakery demand patterns, where retail/household consumption and foodservice channels are the primary demand centers. Household Consumers represent the largest segment, driven by the increasing trend of home baking, greater use of banana bread as a breakfast and snack item, and the convenience of ready-to-eat options available in modern trade and online grocery platforms. The HoReCa sector is also significant, as many cafés, coffee chains, and casual dining restaurants are incorporating banana bread and similar sweet loaves into their menus to appeal to customers looking for indulgent yet perceived-as-better-for-you bakery snacks, often paired with specialty coffee.

The Saudi Arabia Banana Bread Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Almarai–Lusine Bakery Brand, Saadeddin Pastry, Saudia Dairy & Foodstuff Company (SADAFCO), Al Hokair Group – F&B and Café Brands, Starbucks (Alshaya Group, Saudi Arabia), Dunkin’ (Saudi Master Baker Ltd.), Brioche Dorée Saudi Arabia, Paul Bakery & Restaurant Saudi Arabia, Cinnabon Saudi Arabia, Local Artisanal Bakeries (e.g., Bakery & Company, Knead, and similar Riyadh/Jeddah concepts), In-house Bakery Brands of Hypermarkets (e.g., Panda, Carrefour Saudi Arabia, Danube), Online Home-Baking Brands and Cloud Kitchens Offering Banana Bread, International Packaged Cake and Sweet Bread Brands Present in KSA, Private Label Banana Bread under Major Retailers in Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia banana bread market appears promising, driven by evolving consumer preferences towards healthier and convenient snack options. As the population continues to prioritize health and wellness, the demand for innovative and nutritious products is expected to rise. Additionally, the growth of e-commerce platforms will facilitate easier access to banana bread, allowing brands to reach a broader audience. This trend, combined with the increasing popularity of organic and gluten-free options, will likely shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Banana Bread Gluten-Free Banana Bread Vegan Banana Bread Organic Banana Bread Specialty Flavored Banana Bread Ready-to-Eat Packaged Banana Bread Frozen and Ready-to-Bake Banana Bread |

| By End-User | Household Consumers Hotels, Restaurants, and Cafés (HoReCa) Institutional Buyers (schools, hospitals, corporates) Online-Only Home Bakers and Cloud Kitchens Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Grocery Platforms Bakery Chains and Specialty Bakery Stores Cafés and Coffee Chains |

| By Packaging Type | Flexible Plastic Wrappers Paper and Cardboard Boxes Resealable Pouches and Trays Eco-friendly and Compostable Packaging Bulk Foodservice Packaging |

| By Price Range | Economy Mid-Range Premium and Gourmet Private Label |

| By Occasion | Everyday Consumption Breakfast and Brunch Gifting and Seasonal Occasions On-the-Go Snacking |

| By Consumer Demographics | Age Group Income Level Lifestyle and Health Orientation Expat vs Local Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Banana Bread | 150 | Health-conscious Consumers, Young Professionals |

| Retail Bakery Insights | 100 | Bakery Owners, Store Managers |

| Market Trends in Baked Goods | 80 | Food Industry Analysts, Market Researchers |

| Health and Nutrition Perspectives | 70 | Nutritionists, Dietitians |

| Distribution Channels for Banana Bread | 90 | Supply Chain Managers, Retail Buyers |

The Saudi Arabia Banana Bread Market is valued at approximately USD 55 million, reflecting a growing interest in healthier snack options and the expansion of modern retail and café culture within the country.