Region:Middle East

Author(s):Shubham

Product Code:KRAD0979

Pages:90

Published On:November 2025

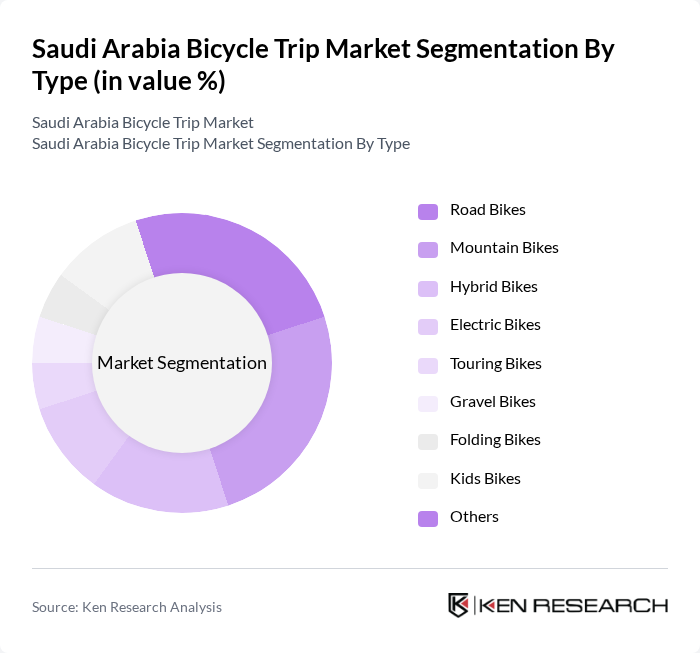

By Type:The market is segmented into various types of bicycles, including Road Bikes, Mountain Bikes, Hybrid Bikes, Electric Bikes, Touring Bikes, Gravel Bikes, Folding Bikes, Kids Bikes, and Others. Each type caters to different consumer preferences and usage scenarios, influencing the overall market dynamics. Road bikes and mountain bikes are favored for their performance and versatility, while electric bikes are gaining traction among urban commuters and tourists seeking convenience. Hybrid and folding bikes appeal to users prioritizing flexibility and portability. The demand for kids bikes is supported by family-oriented recreational activities and cycling clubs .

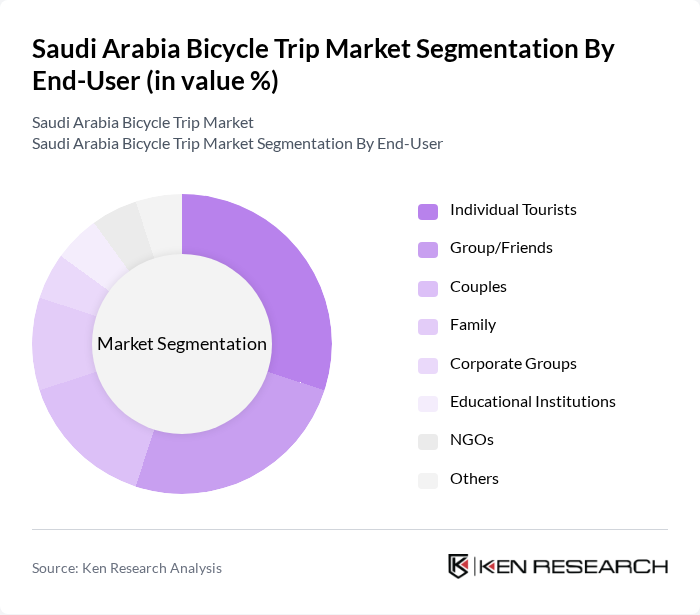

By End-User:The end-user segmentation includes Individual Tourists, Group/Friends, Couples, Family, Corporate Groups, Educational Institutions, NGOs, and Others. This segmentation reflects the diverse demographics and preferences of consumers engaging in bicycle trips. Individual tourists and group/friends segments dominate due to the popularity of solo and group adventure cycling, while family and educational institution segments benefit from organized recreational and wellness programs. Corporate groups and NGOs are increasingly leveraging cycling trips for team-building and community engagement initiatives .

The Saudi Arabia Bicycle Trip Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bicycles Saudi Arabia, Cycle Arabia, Saudi Cycling Federation, Sela Sport Company, TIER Mobility (Saudi Arabia), Wheels of Arabia, Giant Store Riyadh, Trek Bicycle Store Saudi Arabia, Aljazeera Bikes, The Cycle Hub Saudi Arabia, Saudi Tourism Authority, Saudi Arabian Oil Company (Saudi Aramco), Ministry of Tourism, Ministry of Transport, Al-Futtaim Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bicycle trip market in Saudi Arabia appears promising, driven by increasing health consciousness and government support for sustainable transport. As urban infrastructure improves, more residents are likely to embrace cycling as a viable mode of transport. Additionally, the integration of technology in cycling, such as mobile apps for route planning, is expected to enhance user experience. Overall, the market is poised for growth, with a focus on community engagement and eco-friendly initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Bikes Mountain Bikes Hybrid Bikes Electric Bikes Touring Bikes Gravel Bikes Folding Bikes Kids Bikes Others |

| By End-User | Individual Tourists Group/Friends Couples Family Corporate Groups Educational Institutions NGOs Others |

| By Region | Riyadh Jeddah Dammam Mecca Medina Al Khobar Others |

| By Application | Recreational Cycling Commuting Competitive Cycling Tourism Sightseeing & Cultural Exploration Eco-Tourism Health & Wellness Adventure & Thrill Educational & Historical Tours Others |

| By Distribution Channel | Online Retail Physical Retail Stores Direct Sales Rental Services Bicycle Sharing Platforms Others |

| By Price Range | Budget Bikes Mid-Range Bikes Premium Bikes Luxury Bikes Others |

| By Customer Segment | Local Residents International Tourists Cycling Enthusiasts Casual Riders Adventure Seekers Families Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Recreational Cyclists | 60 | Cycling Enthusiasts, Weekend Riders |

| Commuter Cyclists | 50 | Urban Commuters, Office Workers |

| Sports Cyclists | 40 | Competitive Cyclists, Club Members |

| Potential Cyclists | 55 | Individuals Interested in Cycling, Non-Cyclists |

| Industry Stakeholders | 45 | Bicycle Retailers, Manufacturers, and Distributors |

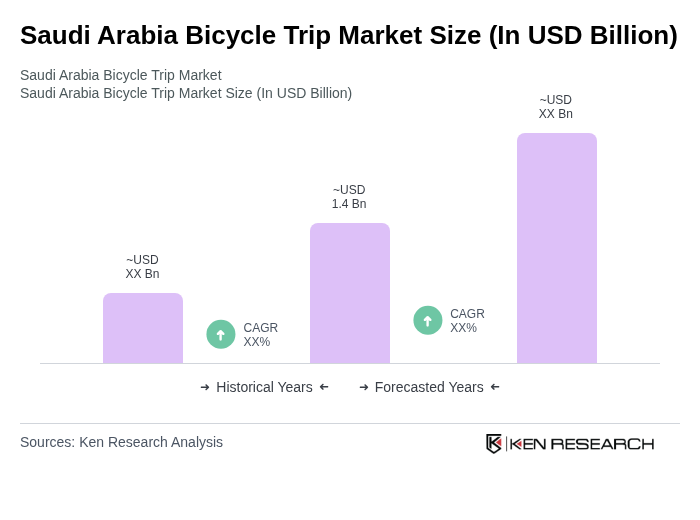

The Saudi Arabia Bicycle Trip Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by urbanization, eco-friendly transportation interests, and government initiatives promoting cycling as a sustainable travel option.