Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7277

Pages:98

Published On:December 2025

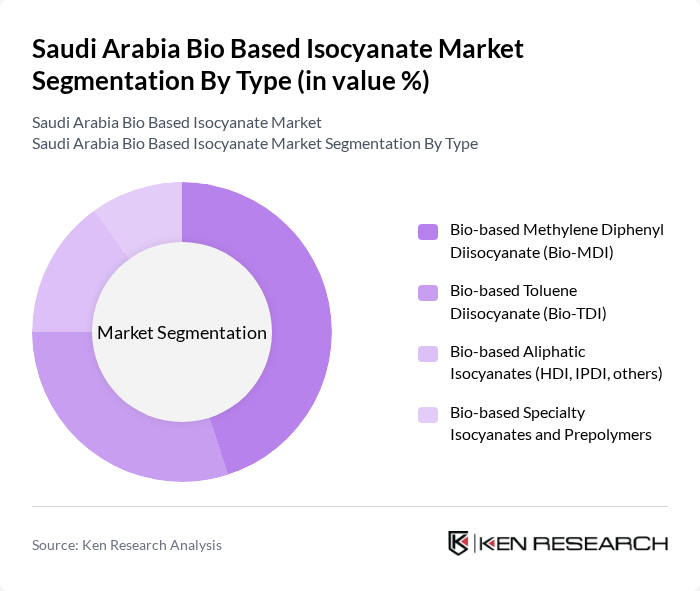

By Type:The market is segmented into various types of bio-based isocyanates, including Bio-based Methylene Diphenyl Diisocyanate (Bio-MDI), Bio-based Toluene Diisocyanate (Bio-TDI), Bio-based Aliphatic Isocyanates, and Bio-based Specialty Isocyanates and Prepolymers, consistent with global renewable isocyanate product categorization. Among these, Bio-MDI is the leading subsegment due to its extensive application in rigid and spray polyurethane foams, insulation panels, and high-performance coatings for building envelopes, refrigeration, and vehicle components, which are expanding in Saudi Arabia’s construction and automotive-related sectors.

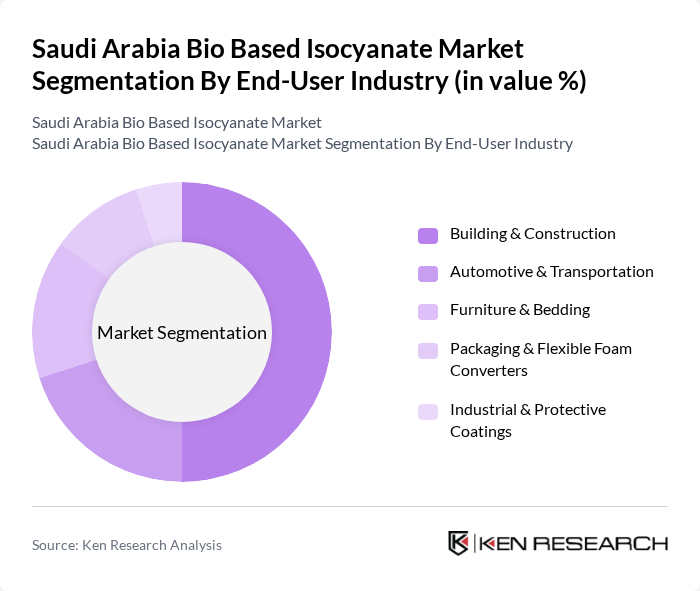

By End-User Industry:The bio-based isocyanate market is further segmented by end-user industries, including Building & Construction, Automotive & Transportation, Furniture & Bedding, Packaging & Flexible Foam Converters, Industrial & Protective Coatings, and Others, in line with the main polyurethane consuming sectors identified for isocyanates globally. The Building & Construction sector is the dominant segment, driven by the increasing demand for energy-efficient and sustainable building materials, particularly rigid and spray foams for thermal insulation, waterproofing coatings, sealants, and roofing systems that align with green building initiatives and higher energy efficiency requirements in Saudi Arabia’s rapidly expanding building stock.

The Saudi Arabia Bio Based Isocyanate Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Covestro AG, Huntsman Corporation, Wanhua Chemical Group Co., Ltd., Dow Inc., Mitsui Chemicals, Inc., Saudi Basic Industries Corporation (SABIC), Sadara Chemical Company, Al Jubail Fertilizer Company (ALFAF) – SABIC Affiliate, Evonik Industries AG, Perstorp Holding AB, Algenesis Corporation, Arkema S.A., INEOS Group Holdings S.A., RAMPF Holding GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space, with global suppliers increasingly developing bio-based or renewable isocyanate grades, including recent launches such as plant-derived Bio-Iso by Algenesis that demonstrate technological progress in fully biogenic isocyanate chemistry.

The future outlook for the Saudi Arabia bio-based isocyanate market appears promising, driven by increasing investments in sustainable technologies and a growing emphasis on environmental regulations. As the Kingdom continues to diversify its economy, the bio-based sector is expected to benefit from enhanced government support and consumer demand for eco-friendly products. Additionally, advancements in production processes are likely to reduce costs, making bio-based isocyanates more competitive against traditional options, thus fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Bio-based Methylene Diphenyl Diisocyanate (Bio-MDI) Bio-based Toluene Diisocyanate (Bio-TDI) Bio-based Aliphatic Isocyanates (HDI, IPDI, others) Bio-based Specialty Isocyanates and Prepolymers |

| By End-User Industry | Building & Construction Automotive & Transportation Furniture & Bedding Packaging & Flexible Foam Converters Industrial & Protective Coatings Others (Electronics, Footwear, etc.) |

| By Application | Rigid Polyurethane Foams (Insulation, Panels) Flexible Polyurethane Foams Adhesives, Sealants & Binders Coatings, Paints & Varnishes Elastomers & Composites |

| By Distribution / Sales Channel | Direct Sales to OEMs and Converters Specialty Chemical Distributors Traders & Importers Online / E-commerce Chemical Platforms |

| By Region within Saudi Arabia | Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Jubail) Western Region (incl. Jeddah, Makkah, Madinah) Southern & Other Regions |

| By Feedstock Source | Vegetable Oil–based (Soy, Castor, etc.) Lignocellulosic / Biomass-based Waste / By?product–derived (e.g., Glycerol, CO?-based routes) Others |

| By Customer Type | Global Polyurethane System Houses Local Polyurethane Blenders & Converters End-use Manufacturers (OEMs) Government & Public Sector Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Development Managers, Procurement Specialists |

| Construction Sector Usage | 80 | Project Managers, Materials Engineers |

| Furniture Manufacturing Insights | 70 | Design Engineers, Operations Managers |

| Adhesives and Coatings Market | 90 | R&D Managers, Quality Assurance Officers |

| Research and Development in Bio-based Materials | 60 | Academic Researchers, Industry Analysts |

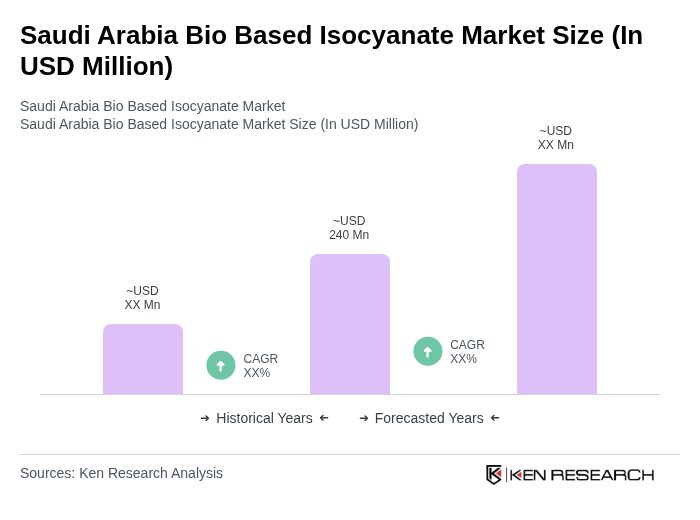

The Saudi Arabia Bio Based Isocyanate Market is valued at approximately USD 240 million, reflecting its share of the global bio-based isocyanate market, which is also experiencing growth due to increasing demand for sustainable materials across various industries.