Region:Middle East

Author(s):Rebecca

Product Code:KRAD8235

Pages:94

Published On:December 2025

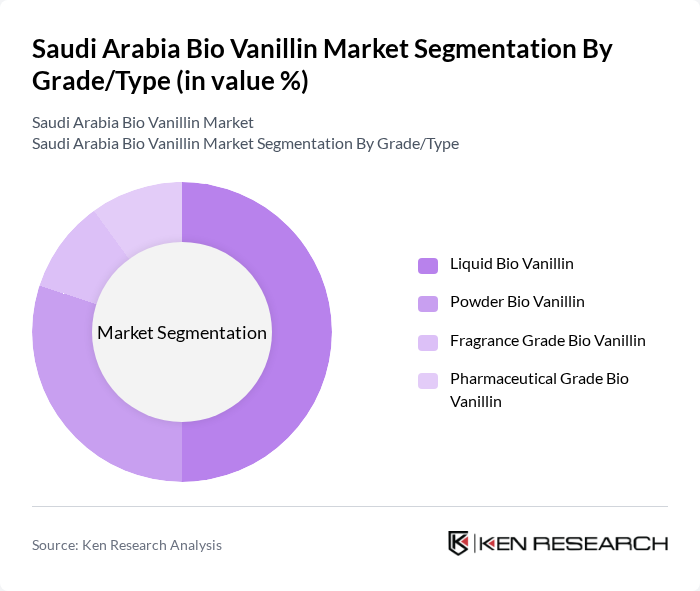

By Grade/Type:The market is segmented into various grades/types of bio vanillin, including Liquid Bio Vanillin, Powder Bio Vanillin, Fragrance Grade Bio Vanillin, and Pharmaceutical Grade Bio Vanillin. Among these, Liquid Bio Vanillin is the most dominant segment due to its versatility and widespread application in food and beverage products. The increasing trend towards natural flavoring agents has led to a surge in demand for liquid forms, which are easier to incorporate into various formulations and offer rapid flavor release in beverages and enhanced bioavailability in pharmaceutical applications. Powder Bio Vanillin also holds a significant share, particularly in the baking and confectionery sectors, where it is favored for its stability and ease of use. Fragrance grade bio vanillin supports clean beauty trends in cosmetics, while pharmaceutical grade meets stringent quality standards leveraging antioxidant properties.

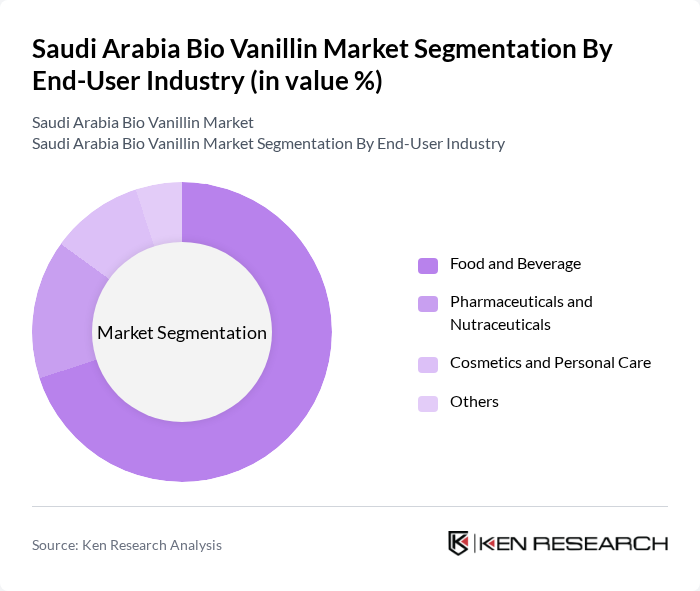

By End-User Industry:The bio vanillin market is primarily driven by the food and beverage industry, which accounts for the largest share due to the increasing demand for natural flavoring agents. The pharmaceuticals and nutraceuticals sector is also growing, as bio vanillin is recognized for its antioxidant properties and potential health benefits. The cosmetics and personal care industry is emerging as a significant user of bio vanillin, leveraging its fragrance properties in various products. Other industries, including household products, also contribute to the market.

The Saudi Arabia Bio Vanillin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Givaudan, Firmenich, Symrise, International Flavors & Fragrances (IFF), Sensient Technologies, Takasago International Corporation, Mane, Robertet, Aurochemicals, Solvay, Shanghai Zelixir Biotechnology Co., Ltd., Biolandes, Conagen, Evolva, Genomatica contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio vanillin market in Saudi Arabia appears promising, driven by increasing consumer demand for natural ingredients and supportive government initiatives. As the food and beverage industry continues to expand, the adoption of bio vanillin is expected to rise significantly. Innovations in production techniques and a growing trend towards clean label products will further enhance market dynamics, positioning bio vanillin as a key ingredient in various sectors, including food, cosmetics, and personal care.

| Segment | Sub-Segments |

|---|---|

| By Grade/Type | Liquid Bio Vanillin Powder Bio Vanillin Fragrance Grade Bio Vanillin Pharmaceutical Grade Bio Vanillin |

| By End-User Industry | Food and Beverage Pharmaceuticals and Nutraceuticals Cosmetics and Personal Care Others |

| By Production Source | Lignin-Based Guaiacol-Based Fermentation-Based (Biotech) Others |

| By Distribution Channel | Direct Sales to Manufacturers Distributors and Wholesalers Online Retail Platforms Specialty Chemical Retailers |

| By Application | Flavoring Agent Fragrance Component Antioxidant and Functional Ingredient Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region (Abha, Jizan) |

| By Customer Segment | Large Food and Beverage Manufacturers SMEs and Regional Producers Pharmaceutical and Cosmetic Companies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Heads |

| Fragrance and Cosmetic Companies | 80 | Formulation Chemists, Brand Managers |

| Pharmaceutical Companies | 70 | Regulatory Affairs Specialists, R&D Directors |

| Bio Vanillin Producers | 60 | Operations Managers, Supply Chain Coordinators |

| Retail Sector Buyers | 90 | Category Managers, Procurement Officers |

The Saudi Arabia Bio Vanillin Market is valued at approximately USD 5 million, driven by the increasing demand for natural flavoring agents in the food and beverage industry and a growing consumer preference for clean-label products.