Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5201

Pages:99

Published On:October 2025

By Type:The biopharma manufacturing market in Saudi Arabia is segmented into Mammalian Cell Products, Non-Mammalian Cell Products, Monoclonal Antibodies, Vaccines, Recombinant Proteins, Gene Therapy Products, Cell Therapy Products, Biosimilars, and Others. Among these, Monoclonal Antibodies hold the largest market share, driven by their extensive application in treating cancer, autoimmune disorders, and metabolic diseases. The increasing emphasis on personalized medicine, rapid advancements in biotechnology, and government support for local production are propelling demand for these products .

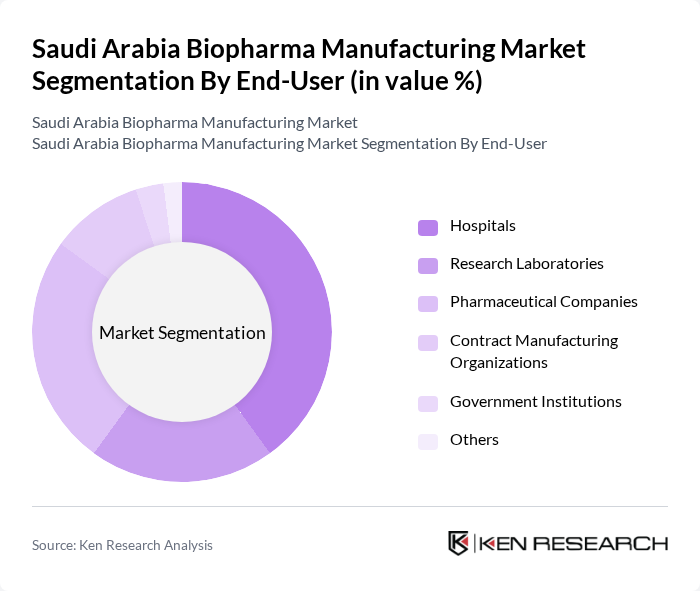

By End-User:The market is segmented by end-users, including Hospitals, Research Laboratories, Pharmaceutical Companies, Contract Manufacturing Organizations, Government Institutions, and Others. Hospitals are the leading end-user segment, attributed to the rising number of patients requiring advanced biologic therapies, the expanding adoption of biopharmaceuticals in clinical settings, and the increasing prevalence of chronic and age-related diseases. Research laboratories and pharmaceutical companies also play a significant role, driven by ongoing R&D and clinical trials for innovative biologic products .

The Saudi Arabia Biopharma Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SPIMACO (Saudi Pharmaceutical Industries and Medical Appliances Corporation), Tabuk Pharmaceuticals, Jamjoom Pharma, Hikma Pharmaceuticals, Pfizer Saudi Arabia, Sanofi Saudi Arabia, Novartis Saudi Arabia, GSK Saudi Arabia, Roche Saudi Arabia, Boehringer Ingelheim, Lonza Group Ltd, WuXi Biologics (Cayman) Inc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biopharma manufacturing market in Saudi Arabia appears promising, driven by increasing investments in research and development and a focus on innovation. As the government continues to support local manufacturing through incentives and infrastructure development, the market is likely to witness significant growth. Additionally, the trend towards personalized medicine and the expansion of export markets will further enhance the competitive landscape, positioning Saudi Arabia as a key player in the biopharmaceutical sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mammalian Cell Products Non-Mammalian Cell Products Monoclonal Antibodies Vaccines Recombinant Proteins Gene Therapy Products Cell Therapy Products Biosimilars Others |

| By End-User | Hospitals Research Laboratories Pharmaceutical Companies Contract Manufacturing Organizations Government Institutions Others |

| By Application | Oncology Infectious Diseases Autoimmune Disorders Cardiovascular Diseases Metabolic Diseases Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Hospital Networks Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies Tax Exemptions Research Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharma Manufacturing Operations | 100 | Production Managers, Quality Assurance Heads |

| Regulatory Compliance in Biopharma | 80 | Regulatory Affairs Specialists, Compliance Officers |

| Research & Development Insights | 70 | R&D Directors, Clinical Research Managers |

| Market Access Strategies | 60 | Market Access Managers, Health Economists |

| Supply Chain Management in Biopharma | 90 | Supply Chain Directors, Logistics Managers |

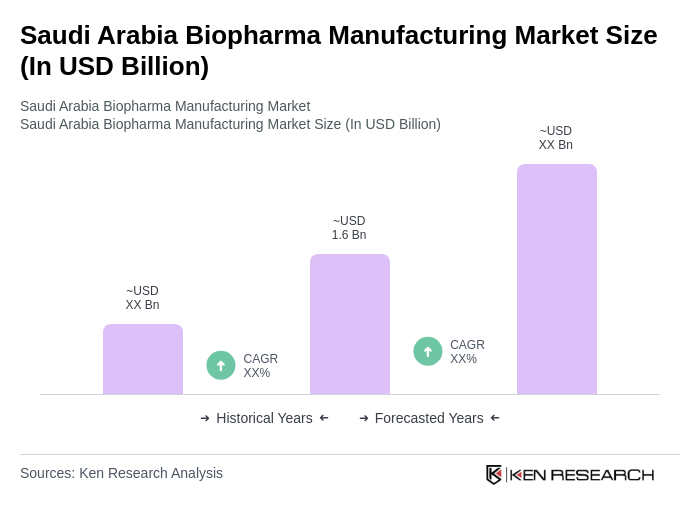

The Saudi Arabia Biopharma Manufacturing Market is valued at approximately USD 1.6 billion, driven by investments in healthcare infrastructure and a growing demand for innovative biologic therapies, particularly in response to chronic diseases like diabetes and cardiovascular conditions.