Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7731

Pages:95

Published On:October 2025

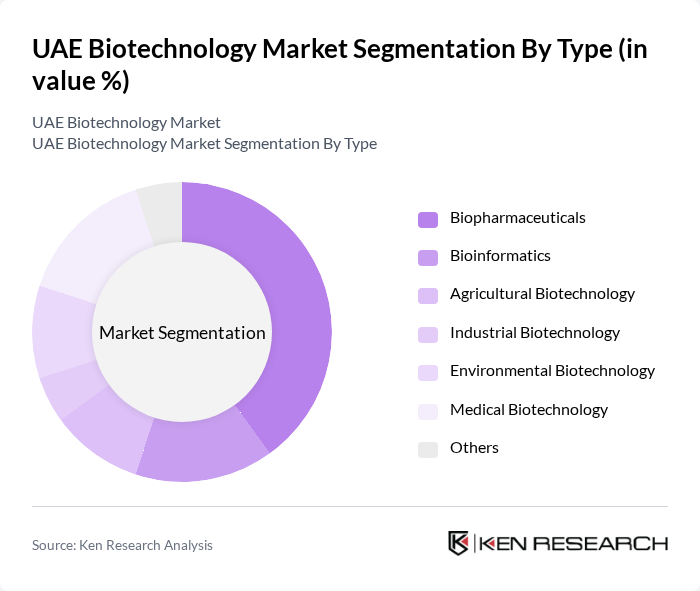

By Type:The biotechnology market can be segmented into various types, including biopharmaceuticals, bioinformatics, agricultural biotechnology, industrial biotechnology, environmental biotechnology, medical biotechnology, and others. Each of these segments plays a crucial role in addressing specific needs within the healthcare and agricultural sectors. Biopharmaceuticals, in particular, have gained significant traction due to the increasing demand for innovative therapies and personalized medicine.

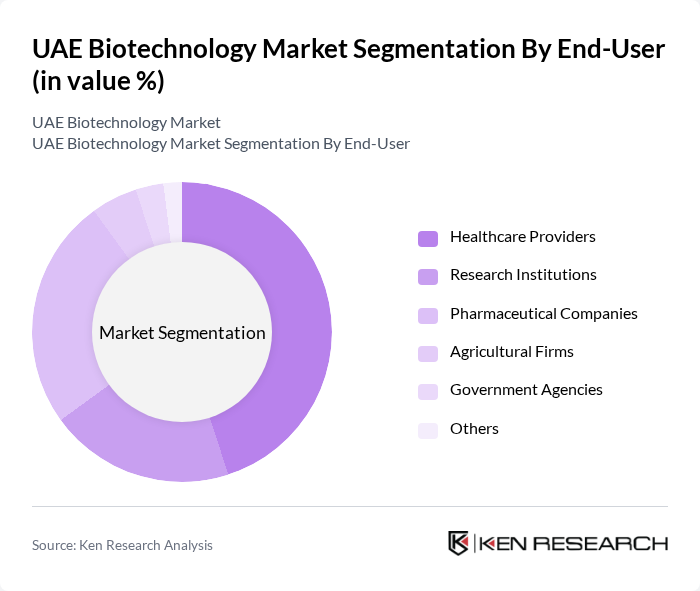

By End-User:The end-user segmentation includes healthcare providers, research institutions, pharmaceutical companies, agricultural firms, government agencies, and others. Each of these end-users contributes to the demand for biotechnology products and services, with healthcare providers and pharmaceutical companies being the most significant consumers due to their need for innovative therapies and diagnostics.

The UAE Biotechnology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi University, Dubai Biotechnology and Research Park, Gulf Biotechnology, Al Ain Biotechnology, Emirates Biotechnology Company, Biogenix, Genpharm, Novartis Pharmaceuticals, Roche Diagnostics, Pfizer UAE, Merck Group, Amgen, Sanofi, GSK, Bayer AG contribute to innovation, geographic expansion, and service delivery in this space.

The UAE biotechnology market is poised for significant advancements, driven by a combination of government initiatives and private sector investments. The focus on sustainable practices and the integration of digital health solutions are expected to reshape the industry landscape. Furthermore, the collaboration between local firms and international biotech companies will enhance knowledge transfer and innovation, positioning the UAE as a regional hub for biotechnology research and development, particularly in personalized medicine and agricultural biotechnology.

| Segment | Sub-Segments |

|---|---|

| By Type | Biopharmaceuticals Bioinformatics Agricultural Biotechnology Industrial Biotechnology Environmental Biotechnology Medical Biotechnology Others |

| By End-User | Healthcare Providers Research Institutions Pharmaceutical Companies Agricultural Firms Government Agencies Others |

| By Application | Drug Development Diagnostics Genetic Testing Vaccine Development Agricultural Enhancement Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Investment Source | Government Funding Private Equity Venture Capital Corporate Investments Others |

| By Research Phase | Preclinical Clinical Trials Market Launch Post-Market Surveillance Others |

| By Policy Support | Subsidies for Research Tax Incentives Grants for Startups Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Biotechnology | 100 | R&D Directors, Regulatory Affairs Managers |

| Agricultural Biotechnology | 80 | Crop Scientists, Agronomists |

| Industrial Biotechnology | 70 | Process Engineers, Production Managers |

| Biotechnology Startups | 60 | Founders, Business Development Managers |

| Healthcare Biotechnology | 90 | Clinical Research Coordinators, Healthcare Executives |

The UAE Biotechnology Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by advancements in healthcare, increased investment in research and development, and a focus on sustainable agricultural practices.