Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7128

Pages:88

Published On:December 2025

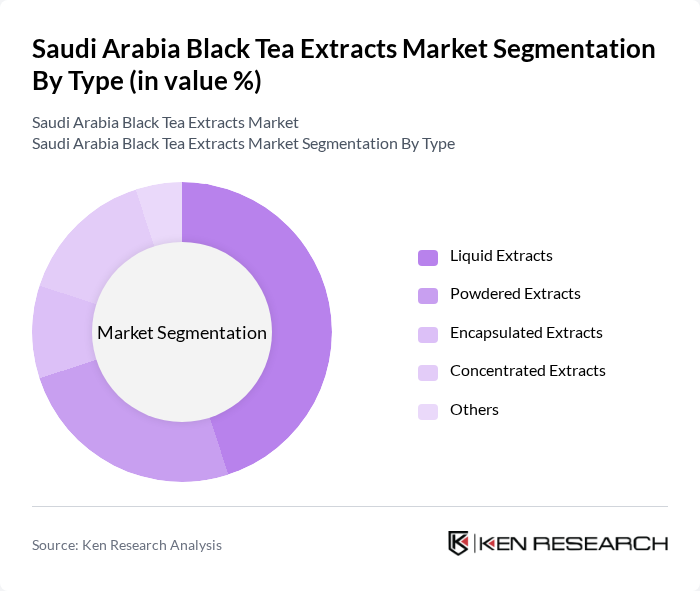

By Type:The market is segmented into various types of black tea extracts, including Liquid Extracts, Powdered Extracts, Encapsulated Extracts, Concentrated Extracts, and Others, in line with global segmentation by form for black tea and tea extracts. Among these, Liquid Extracts are currently leading the market due to their versatility and ease of use in various applications, particularly in beverages, ready-to-drink formulations, and dietary supplements, where immediate solubility and process efficiency are critical. The growing trend of ready-to-drink (RTD) beverages and functional drinks in Saudi Arabia and the wider Middle East has significantly boosted the demand for liquid forms, as they offer convenience, faster processing for manufacturers, and immediate consumption options for health-conscious consumers seeking natural and antioxidant-rich ingredients.

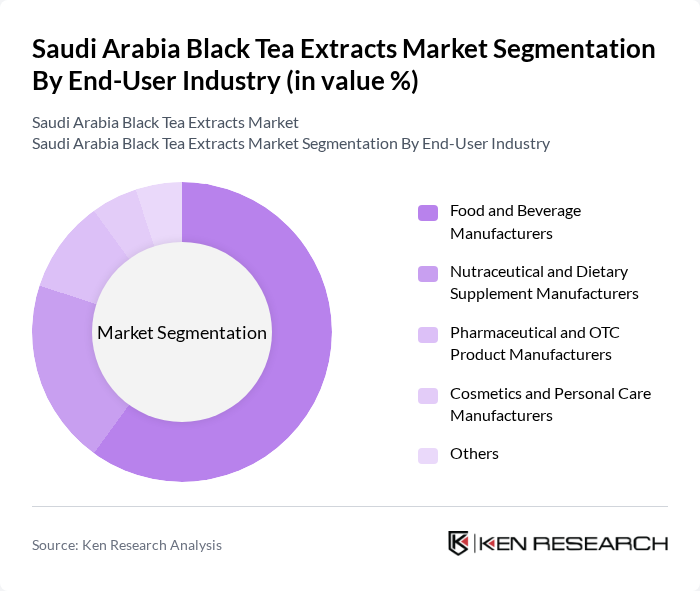

By End-User Industry:The black tea extracts market serves various end-user industries, including Food and Beverage Manufacturers, Nutraceutical and Dietary Supplement Manufacturers, Pharmaceutical and OTC Product Manufacturers, Cosmetics and Personal Care Manufacturers, and Others, mirroring the main global application clusters of functional foods, beverages, nutraceuticals, and personal care. The Food and Beverage sector is the most significant contributor, driven by the increasing incorporation of black tea extracts in hot and cold beverages, RTD teas, energy and wellness drinks, flavored waters, and better?for?you snacks and bakery, as manufacturers respond to consumer demand for clean-label, plant-based, and low-sugar formulations. The rising trend of health and wellness among consumers has led to a surge in demand for functional beverages and dietary supplements, which often include black tea extracts for their antioxidant, anti-inflammatory, and metabolism-supporting benefits, as well as their role as natural flavor and color contributors in cosmetics and personal care products.

The Saudi Arabia Black Tea Extracts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Synthite Industries Pvt. Ltd., Finlays (James Finlay Limited), Kemin Industries, Inc., Martin Bauer Group, Aarkay Food Products Ltd., Cymbio Pharma Pvt. Ltd., Taiyo Kagaku Co., Ltd., AVT Natural Products Ltd., Döhler Group SE, Givaudan SA, Sensient Technologies Corporation, Dohler Saudi Arabia Trading (Representative Office), Local Saudi Ingredient Importers and Distributors (e.g., Al Kharj-based Food Ingredients Traders), Leading GCC-Based Tea and Extract Traders Supplying Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space, leveraging portfolios that span liquid, powder, and customized extract solutions for food, beverage, nutraceutical, and personal care applications.

The future of the black tea extracts market in Saudi Arabia appears promising, driven by increasing health awareness and a shift towards natural ingredients. As consumers continue to seek healthier beverage options, the demand for black tea extracts is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, allowing manufacturers to reach a broader audience. Companies that adapt to these trends and invest in innovative product development will likely thrive in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Extracts Powdered Extracts Encapsulated Extracts Concentrated Extracts Others |

| By End-User Industry | Food and Beverage Manufacturers Nutraceutical and Dietary Supplement Manufacturers Pharmaceutical and OTC Product Manufacturers Cosmetics and Personal Care Manufacturers Others |

| By Distribution Channel (B2B/Bulk) | Direct Sales to Manufacturers Distributors and Trading Companies Online B2B Platforms Others |

| By Specification | Caffeine-based Black Tea Extracts Polyphenol/Rich-in-Theaflavins Extracts Decaffeinated Black Tea Extracts Organic Certified Extracts Conventional Extracts |

| By Import Source Region | Asia-Pacific Suppliers (e.g., India, China, Sri Lanka) Europe-based Ingredient Suppliers Middle East and North Africa Suppliers Others |

| By Application | Beverages (RTD, Concentrates, Tea Bags with Extracts) Functional Foods and Bakery Dietary Supplements Pharmaceutical and Herbal Products Cosmetics and Personal Care Others |

| By Buyer Type | Large Food & Beverage Corporates Medium-sized Manufacturers Contract Manufacturers and Private Labelers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Black Tea Extracts | 120 | Retail Managers, Category Buyers |

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Officers |

| Health and Wellness Sector | 80 | Nutraceutical Product Managers, Health Food Retailers |

| Cosmetics Industry | 70 | Formulation Chemists, Brand Managers |

| Consumer Insights | 100 | Health-Conscious Consumers, Tea Enthusiasts |

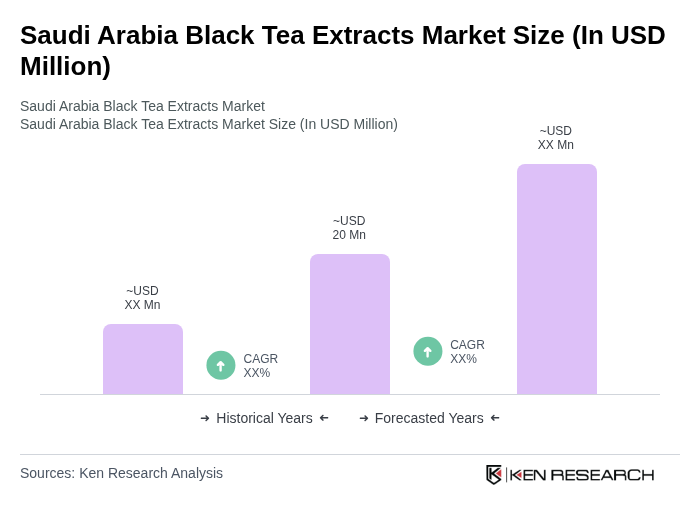

The Saudi Arabia Black Tea Extracts Market is valued at approximately USD 20 million, reflecting a five-year historical analysis that highlights the growing demand for natural ingredients in food and beverages, alongside increased awareness of health benefits associated with black tea extracts.