Region:Middle East

Author(s):Shubham

Product Code:KRAC1423

Pages:86

Published On:October 2025

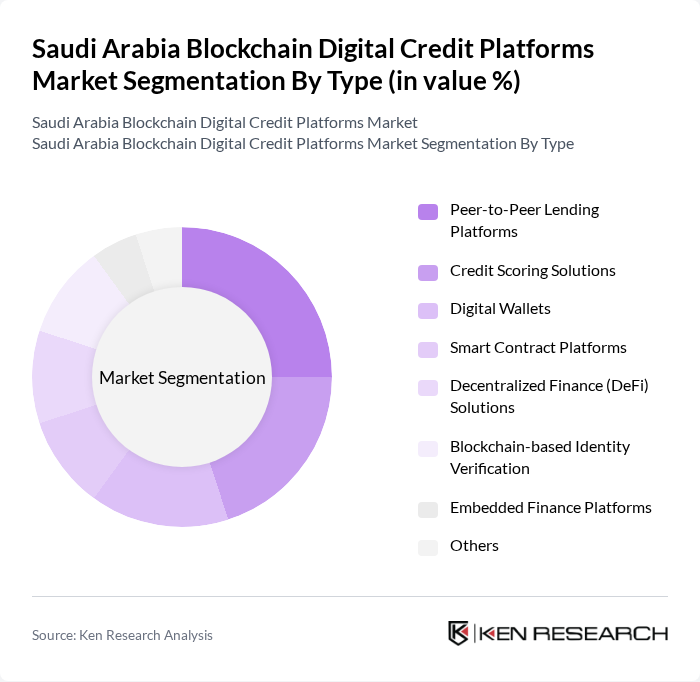

By Type:The market is segmented into Peer-to-Peer Lending Platforms, Credit Scoring Solutions, Digital Wallets, Smart Contract Platforms, Decentralized Finance (DeFi) Solutions, Blockchain-based Identity Verification, Embedded Finance Platforms, and Others. Peer-to-Peer Lending Platforms and Credit Scoring Solutions are gaining traction due to their ability to streamline credit access and risk assessment, while Digital Wallets and Smart Contract Platforms support secure, automated transactions. DeFi Solutions and Blockchain-based Identity Verification are increasingly adopted for transparency and fraud prevention, and Embedded Finance Platforms enable seamless integration of credit services into digital ecosystems .

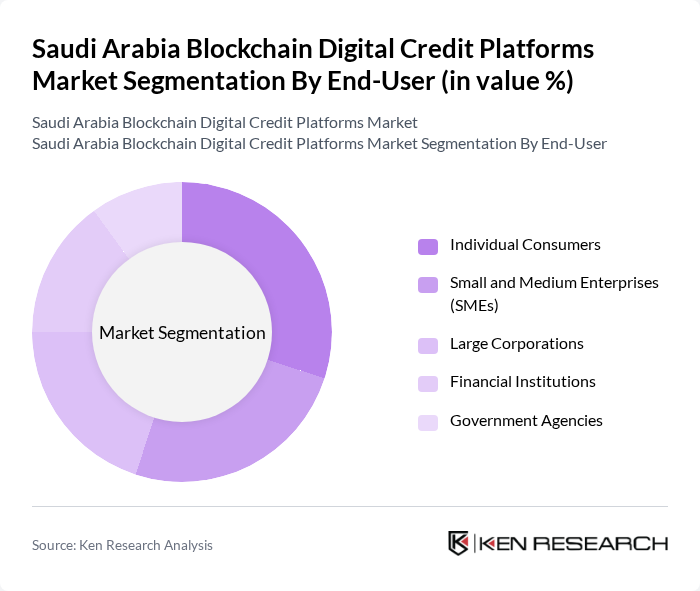

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, and Government Agencies. Individual Consumers and SMEs are the primary drivers, leveraging digital credit platforms for faster, more inclusive access to financing. Large Corporations and Financial Institutions utilize blockchain for operational efficiency and risk management, while Government Agencies focus on digital transformation and public sector innovation .

The Saudi Arabia Blockchain Digital Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Pay, Raqamyah, Lendo, Lean Technologies, Tamam, Halalah, BayanPay, PayTabs, BitOasis, Rain Financial, MenaPay, CoinMENA, YAP, NymCard, Fintor contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain digital credit platforms in Saudi Arabia appears promising, driven by increasing government support and technological advancements. As regulatory frameworks evolve, they are expected to provide clearer guidelines, fostering a more conducive environment for innovation. Additionally, the integration of blockchain with emerging technologies like AI and IoT will likely enhance user experiences and operational efficiencies, paving the way for broader adoption and more diverse financial products tailored to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-Peer Lending Platforms Credit Scoring Solutions Digital Wallets Smart Contract Platforms Decentralized Finance (DeFi) Solutions Blockchain-based Identity Verification Embedded Finance Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Government Agencies |

| By Application | Personal Loans Business Loans Credit Scoring Asset-backed Lending Supply Chain Financing |

| By Investment Source | Venture Capital Private Equity Government Grants Crowdfunding Corporate Investment |

| By Policy Support | Regulatory Frameworks Tax Incentives Subsidies for Technology Adoption Public-Private Partnerships |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales API Integrations |

| By User Demographics | Age Groups Income Levels Geographic Distribution Digital Literacy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain Adoption in Banking | 100 | Banking Executives, IT Managers |

| Fintech Startups Offering Digital Credit | 60 | Founders, Product Managers |

| Consumer Attitudes Towards Digital Credit | 120 | End-users, Financial Advisors |

| Regulatory Perspectives on Blockchain | 40 | Regulatory Officials, Compliance Officers |

| Investment Trends in Blockchain Technology | 50 | Venture Capitalists, Financial Analysts |

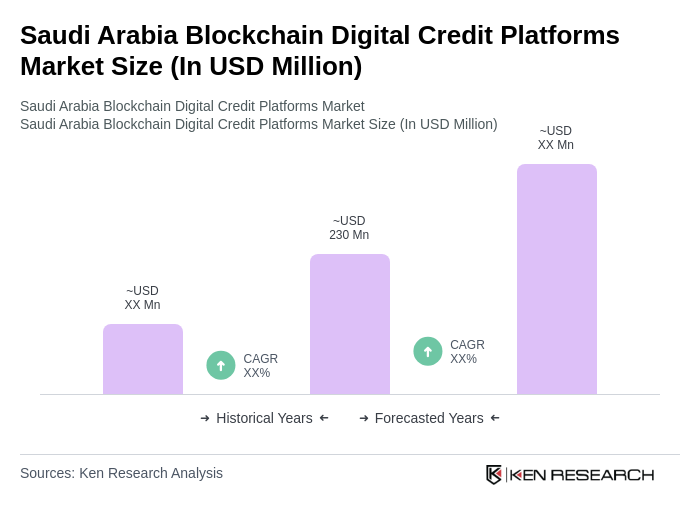

The Saudi Arabia Blockchain Digital Credit Platforms Market is valued at approximately USD 230 million, reflecting significant growth driven by the adoption of blockchain technology in financial services and the expansion of digital payments.