Region:Middle East

Author(s):Dev

Product Code:KRAC1378

Pages:87

Published On:October 2025

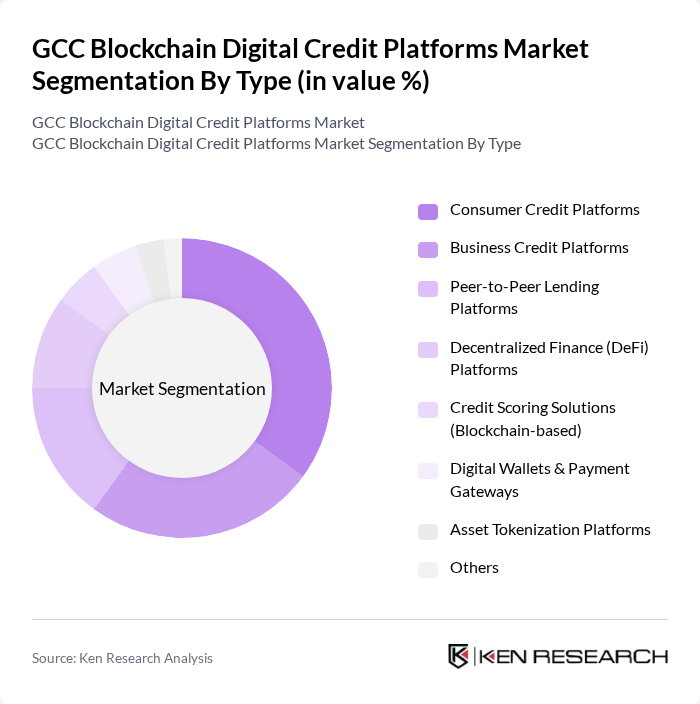

By Type:The market is segmented into Consumer Credit Platforms, Business Credit Platforms, Peer-to-Peer Lending Platforms, Decentralized Finance (DeFi) Platforms, Credit Scoring Solutions (Blockchain-based), Digital Wallets & Payment Gateways, Asset Tokenization Platforms, and Others. Among these, Consumer Credit Platforms are currently leading the market, driven by rising demand for personal loans, instant credit, and flexible repayment options among individuals. The convenience, speed, and accessibility of digital credit platforms have significantly influenced consumer behavior, accelerating the growth of this segment .

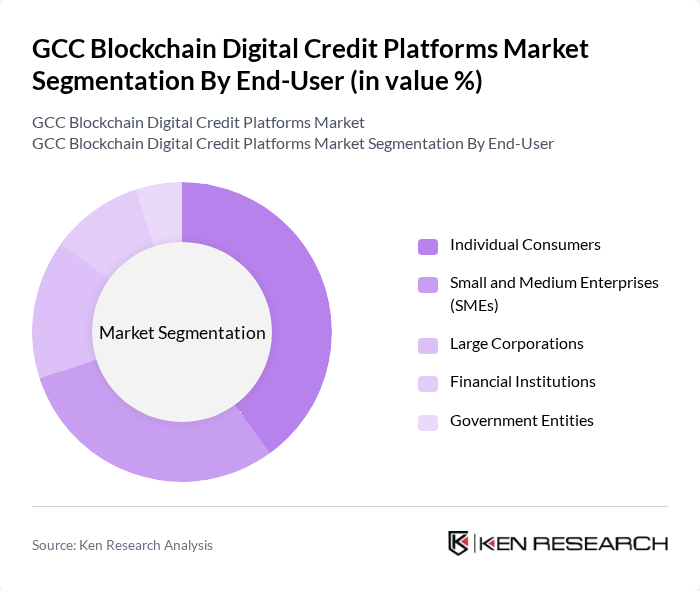

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, and Government Entities. Individual Consumers dominate this segment, driven by the increasing need for personal loans and credit facilities. The proliferation of digital platforms and mobile-first financial solutions has made it easier for consumers to access credit, leading to a surge in demand for personal financing solutions .

The GCC Blockchain Digital Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Binance, BitOasis, Rain Financial, RAKBANK, Abu Dhabi Commercial Bank, Emirates NBD, Finterra, Dinarak, PayBy, Nomo Bank, Al Hilal Bank, Dubai Islamic Bank, Noor Bank, Al Baraka Banking Group, Qatar National Bank, Wethaq Capital Markets, Matrix Exchange, Mashreq Bank, National Commercial Bank (NCB), Kuwait Finance House contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC blockchain digital credit platforms market appears promising, driven by increasing digitalization and government initiatives. In future, the integration of artificial intelligence and machine learning with blockchain is expected to enhance credit assessment processes, improving efficiency and reducing risks. Additionally, the rise of decentralized finance (DeFi) is likely to reshape traditional lending models, offering innovative solutions that cater to the unbanked population, thereby expanding market reach and inclusivity.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Credit Platforms Business Credit Platforms Peer-to-Peer Lending Platforms Decentralized Finance (DeFi) Platforms Credit Scoring Solutions (Blockchain-based) Digital Wallets & Payment Gateways Asset Tokenization Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Government Entities |

| By Application | Personal Loans Business Loans Credit Scoring & Risk Assessment Investment & Asset Management Platforms Supply Chain Financing |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales API Integrations |

| By Regulatory Compliance | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| By Investment Source | Venture Capital Private Equity Crowdfunding Corporate Investments |

| By Policy Support | Government Grants Tax Incentives Subsidized Loans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Credit Platform Users | 120 | Individual Consumers, Small Business Owners |

| Financial Institutions Utilizing Blockchain | 70 | Banking Executives, Risk Management Officers |

| Regulatory Bodies and Compliance Experts | 40 | Regulators, Compliance Officers |

| Technology Providers in Blockchain | 60 | CTOs, Product Managers |

| Investors in Fintech Startups | 50 | Venture Capitalists, Angel Investors |

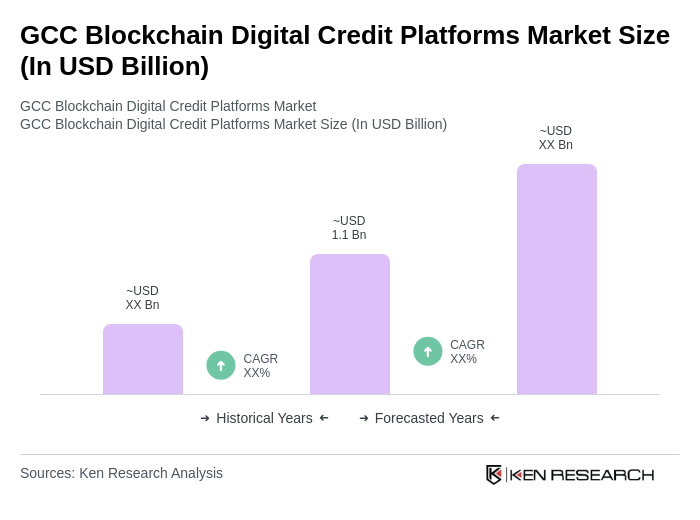

The GCC Blockchain Digital Credit Platforms Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of blockchain technology in financial services, digital payment solutions, and advanced credit scoring mechanisms.