Region:Middle East

Author(s):Shubham

Product Code:KRAC1401

Pages:85

Published On:October 2025

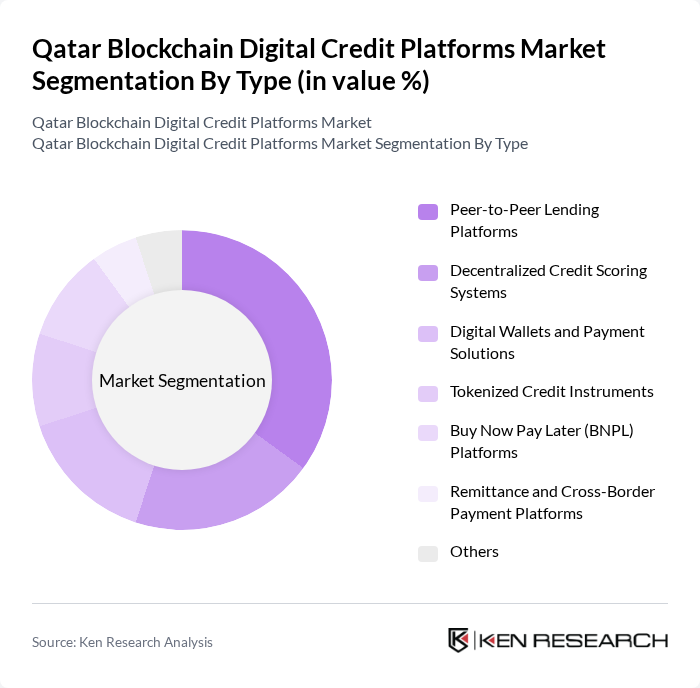

By Type:The market is segmented into Peer-to-Peer Lending Platforms, Decentralized Credit Scoring Systems, Digital Wallets and Payment Solutions, Tokenized Credit Instruments, Buy Now Pay Later (BNPL) Platforms, Remittance and Cross-Border Payment Platforms, and Others. Peer-to-Peer Lending Platforms are currently leading, driven by their ability to directly connect borrowers and lenders, reduce transaction costs, and improve accessibility for both consumers and SMEs. The growing adoption of BNPL and digital wallets is also notable, reflecting consumer demand for flexible, instant, and mobile-first credit solutions .

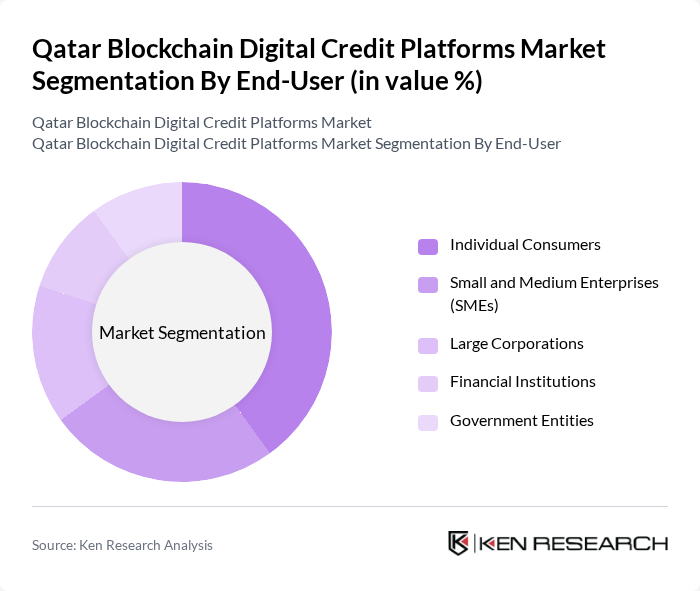

By End-User:End-user segments include Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, and Government Entities. Individual Consumers remain the dominant segment, reflecting the rising demand for personal loans, microcredit, and instant digital lending. SMEs are also significant adopters, leveraging digital credit platforms for working capital and business expansion, while financial institutions and corporates are increasingly integrating blockchain for secure, efficient credit operations .

The Qatar Blockchain Digital Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank (QNB), Doha Bank, Commercial Bank of Qatar, Qatar Islamic Bank (QIB), Masraf Al Rayan, Barwa Bank, Al Khaliji Bank, Qatar Development Bank (QDB), Ooredoo, Vodafone Qatar, SkipCash, CWallet, Karty, Qatar FinTech Hub (QFTH), and Qatar Financial Centre (QFC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar blockchain digital credit platforms market appears promising, driven by increasing digitalization and government initiatives. As the demand for innovative financial solutions grows, platforms are likely to enhance their offerings through advanced technologies. Additionally, the integration of artificial intelligence with blockchain could streamline operations and improve customer experiences. The focus on sustainable finance will also shape product development, aligning with global trends towards environmentally responsible investing and lending practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-Peer Lending Platforms Decentralized Credit Scoring Systems Digital Wallets and Payment Solutions Tokenized Credit Instruments Buy Now Pay Later (BNPL) Platforms Remittance and Cross-Border Payment Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Government Entities |

| By Application | Personal Loans Business Loans Credit Scoring Payment Processing Supply Chain Financing |

| By Distribution Channel | Online Platforms Mobile Applications Financial Institutions Third-Party Fintech Aggregators |

| By Regulatory Compliance | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| By Customer Segment | Retail Customers Corporate Clients Institutional Investors Unbanked and Underbanked Populations |

| By Geographic Focus | Urban Areas Rural Areas International Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain Adoption in Banking | 100 | Banking Executives, IT Managers |

| Fintech Startups Utilizing Blockchain | 60 | Founders, Product Managers |

| SME Credit Access via Blockchain | 50 | Business Owners, Financial Officers |

| Consumer Perspectives on Digital Credit | 80 | Individual Borrowers, Financial Advisors |

| Regulatory Insights on Blockchain Credit | 40 | Regulatory Officials, Compliance Officers |

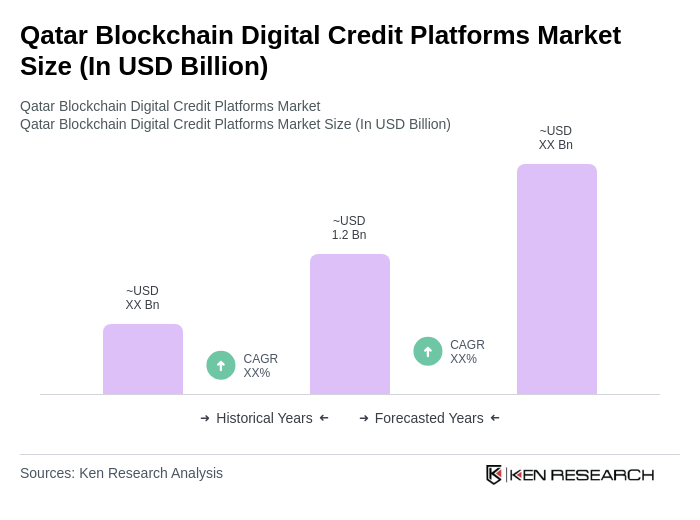

The Qatar Blockchain Digital Credit Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital lending and blockchain solutions, supported by a robust digital infrastructure and regulatory backing.