Region:Middle East

Author(s):Dev

Product Code:KRAD5241

Pages:94

Published On:December 2025

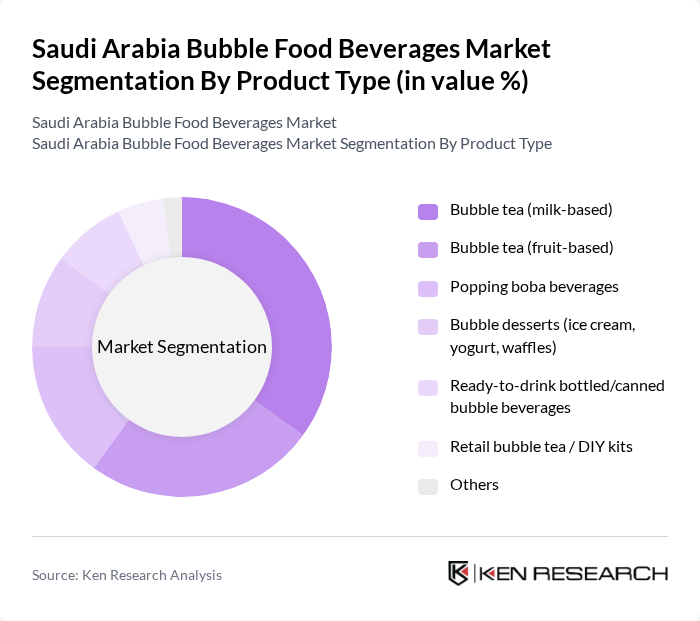

By Product Type:The product type segmentation includes various categories such as bubble tea (milk-based), bubble tea (fruit-based), popping boba beverages, bubble desserts (ice cream, yogurt, waffles), ready-to-drink bottled/canned bubble beverages, retail bubble tea / DIY kits, and others. Among these, bubble tea (milk-based) has emerged as the leading subsegment due to its rich flavor profile and widespread popularity among consumers, particularly the younger demographic. The trend of customization and the introduction of innovative flavors have further solidified its market position.

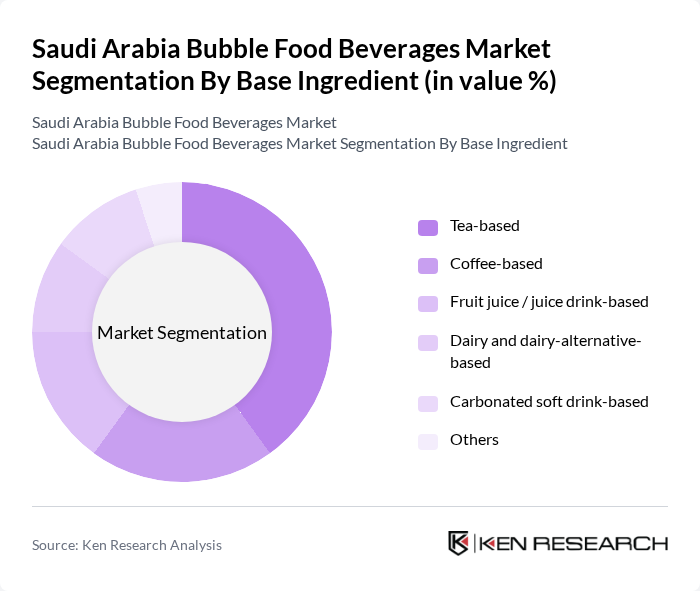

By Base Ingredient:The base ingredient segmentation includes tea-based, coffee-based, fruit juice / juice drink-based, dairy and dairy-alternative-based, carbonated soft drink-based, and others. The tea-based subsegment dominates the market, primarily due to the traditional roots of bubble tea in tea culture, with black tea holding the highest share for its authentic flavor and health benefits such as reducing blood sugar and cholesterol. The increasing health consciousness among consumers has also led to a preference for tea-based beverages, which are perceived as healthier alternatives compared to sugary drinks.

The Saudi Arabia Bubble Food Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gong cha Saudi Arabia, Sharetea Saudi Arabia, Tiger Sugar Saudi Arabia, Chatime Saudi Arabia, CoCo Fresh Tea & Juice (Saudi Arabia), Presotea Saudi Arabia, The Alley Saudi Arabia, Bobabox Saudi Arabia, Bubbles & Boba (Saudi local brand), Tapioca House (Saudi Arabia), Almarai Company, PepsiCo (Saudi snack & beverage portfolio including bubble concepts), Coca-Cola Bottling Company of Saudi Arabia, Saudi Ice Cream Factory (Baskin-Robbins Saudi master franchise – bubble-inspired desserts), Local specialty dessert cafés offering popping boba and bubble desserts contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bubble food beverages market in Saudi Arabia appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious trends continue to shape product offerings, brands are likely to innovate with functional ingredients and sustainable practices. Additionally, the integration of technology in beverage preparation and customization will enhance consumer engagement, creating a dynamic market environment. The anticipated growth in e-commerce will further facilitate access to diverse beverage options, catering to the increasing demand for convenience and variety.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Bubble tea (milk-based) Bubble tea (fruit-based) Popping boba beverages Bubble desserts (ice cream, yogurt, waffles) Ready-to-drink bottled/canned bubble beverages Retail bubble tea / DIY kits Others |

| By Base Ingredient | Tea-based Coffee-based Fruit juice / juice drink-based Dairy and dairy-alternative-based Carbonated soft drink-based Others |

| By End-User / Serving Format | On-trade cafés and bubble tea shops Quick-service restaurants and dessert parlors Hotels and specialty foodservice Home consumption (retail & DIY kits) Events and catering services |

| By Packaging Type | On-premise cups and takeaway cups PET bottles Cans Cartons (e.g., Tetra Pak) Pouches and sachets Others |

| By Distribution Channel | On-trade (cafés, QSRs, dessert shops) Supermarkets and hypermarkets Convenience and neighborhood stores Online delivery platforms and e-grocery Specialty beverage and dessert outlets Others |

| By Consumer Demographics | Teenagers (13–19 years) Young adults (20–29 years) Adults (30–44 years) Adults 45 years and above |

| By Region | Riyadh & Central Region Makkah Region (including Jeddah) Eastern Province (including Dammam, Khobar, Dhahran) Madinah Region Other regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Bubble Beverages | 120 | Young Adults (18-30 years), College Students |

| Retail Outlet Insights | 100 | Store Managers, Beverage Retailers |

| Market Trends in Urban Areas | 110 | Urban Consumers, Trendsetters |

| Health and Wellness Impact | 80 | Health-Conscious Consumers, Nutritionists |

| Brand Loyalty and Marketing Effectiveness | 90 | Frequent Buyers, Brand Advocates |

The Saudi Arabia Bubble Food Beverages Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the popularity of bubble tea and innovative beverage concepts among consumers, particularly the youth.