Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5837

Pages:86

Published On:December 2025

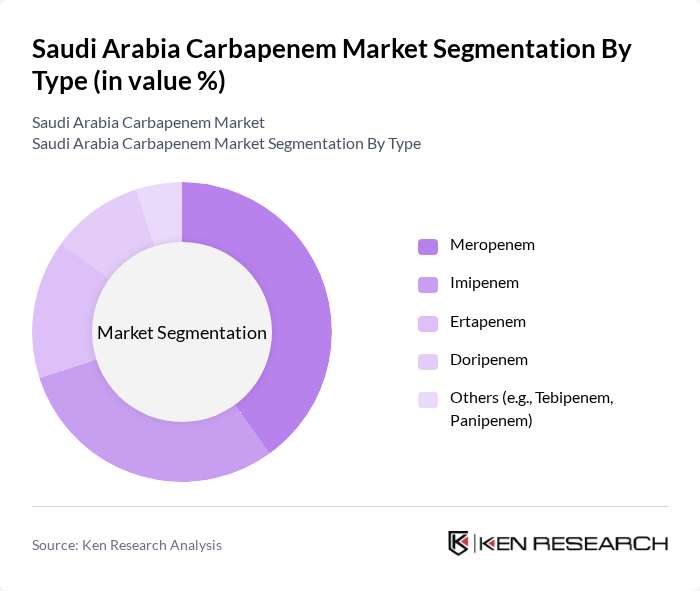

By Type:The market is segmented into various types of carbapenems, including Meropenem, Imipenem, Ertapenem, Doripenem, and others. Each type serves specific therapeutic needs, with Meropenem and Imipenem being the most widely used due to their broad-spectrum activity against resistant bacteria and their central role in managing severe hospital-acquired and intensive care infections, consistent with global prescribing patterns. The increasing incidence of hospital-acquired infections and the growing burden of multidrug-resistant Gram-negative organisms in Saudi hospitals have led to a higher demand for these antibiotics, particularly in intensive care units, surgical wards, and high-dependency settings.

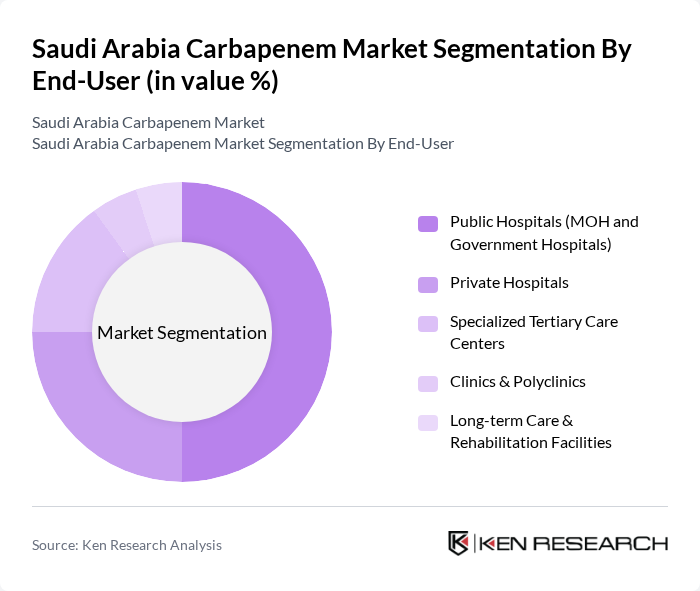

By End-User:The end-user segmentation includes public hospitals, private hospitals, specialized tertiary care centers, clinics, and long-term care facilities. Public hospitals dominate the market due to their extensive patient base, their central role in managing severe and complicated infections, and higher procurement volumes through national and regional tenders. Specialized tertiary care centers also play a significant role, as they often handle complex, multidrug-resistant cases requiring advanced intravenous antibiotic regimens, including carbapenems, while large private hospitals and long-term care facilities contribute to demand through management of chronic and post-acute infection cases.

The Saudi Arabia Carbapenem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc. (MSD), Hikma Pharmaceuticals PLC, Sandoz Group AG, Fresenius Kabi AG, Tabuk Pharmaceuticals Manufacturing Company, Jamjoom Pharma, SPIMACO (Saudi Pharmaceutical Industries & Medical Appliances Corporation), Julphar Gulf Pharmaceutical Industries, Sun Pharmaceutical Industries Ltd., Aurobindo Pharma Ltd., Gland Pharma Ltd., SAVIOR Lifetec Corporation, Meiji Seika Pharma Co., Ltd., ACS Dobfar S.p.A. contribute to innovation, geographic expansion, and service delivery in this space, broadly aligning with the global carbapenem supplier base.

The future of the Saudi Arabia carbapenem market appears promising, driven by increasing awareness of antibiotic resistance and the need for effective treatment options. As healthcare expenditure continues to rise, investments in advanced medical technologies and infrastructure will likely enhance the availability of carbapenem antibiotics. Additionally, the growing emphasis on antibiotic stewardship programs will foster responsible usage, ensuring that these critical medications remain effective in combating resistant infections in the long term.

| Segment | Sub-Segments |

|---|---|

| By Type | Meropenem Imipenem Ertapenem Doripenem Others (e.g., Tebipenem, Panipenem) |

| By End-User | Public Hospitals (MOH and Government Hospitals) Private Hospitals Specialized Tertiary Care Centers Clinics & Polyclinics Long-term Care & Rehabilitation Facilities |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Tender / Institutional Procurement Online Pharmacies & E?procurement Portals Wholesalers / Distributors |

| By Formulation | Injectable (IV/IM) Oral (including Prodrugs) Fixed-Dose Combinations |

| By Therapeutic Area | Hospital-acquired & Ventilator-associated Pneumonia Complicated Intra-abdominal Infections Complicated Urinary Tract Infections Bloodstream Infections & Sepsis Others (e.g., Skin & Soft Tissue Infections, Surgical Prophylaxis) |

| By Geography | Central Region (including Riyadh) Eastern Region (including Dammam/Al Khobar) Western Region (including Jeddah/Makkah/Medina) Southern Region Northern Region |

| By Policy Support | Government Centralized Procurement & Tendering Localization & Industrial Clusters (Vision 2030) Research & Innovation Grants Pricing & Reimbursement Framework |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Pharmacists | 120 | Pharmacy Directors, Clinical Pharmacists |

| Infectious Disease Specialists | 90 | Consultants, Attending Physicians |

| Healthcare Administrators | 80 | Hospital Managers, Health Policy Makers |

| Microbiologists | 70 | Laboratory Directors, Research Scientists |

| Clinical Researchers | 60 | Research Coordinators, Academic Researchers |

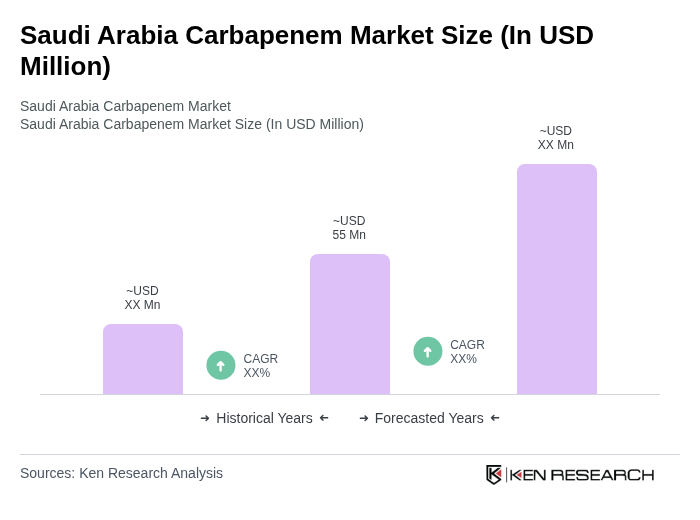

The Saudi Arabia Carbapenem Market is valued at approximately USD 55 million, reflecting the significant role of carbapenems within the national antibiotics market, driven by the rising prevalence of antibiotic-resistant infections and the demand for effective treatment options.