Region:Middle East

Author(s):Shubham

Product Code:KRAD3552

Pages:82

Published On:November 2025

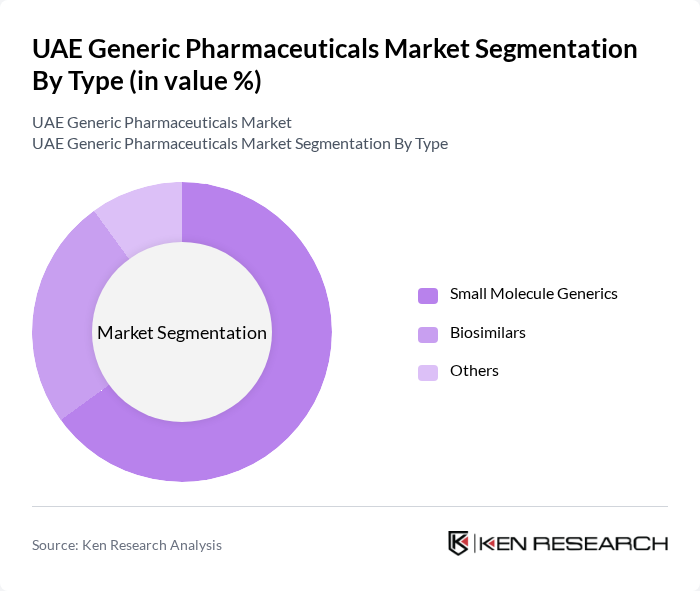

By Type:The market is segmented into Small Molecule Generics, Biosimilars, and Others. Small Molecule Generics dominate the market due to their widespread use in treating various chronic conditions, including cardiovascular diseases and diabetes. The affordability and availability of these generics have led to increased consumer acceptance and preference. Biosimilars are gaining traction as they offer similar therapeutic benefits to biologics at a lower cost, while the "Others" category includes niche products that cater to specific therapeutic needs. The largest share is held by Small Molecule Generics, with Biosimilars as the fastest-growing segment, reflecting the global trend of increasing biosimilar adoption.

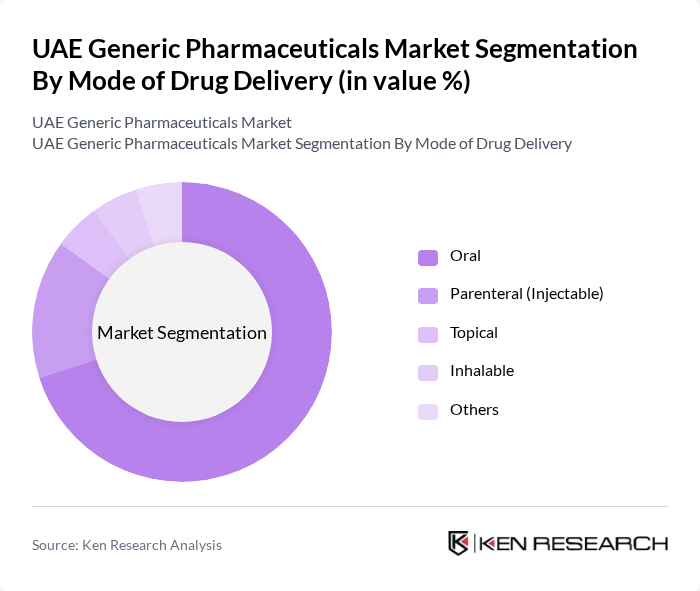

By Mode of Drug Delivery:The market is categorized into Oral, Parenteral (Injectable), Topical, Inhalable, and Others. Oral delivery systems are the most prevalent due to their convenience and ease of administration, making them the preferred choice for patients. Parenteral delivery is significant for biologics and certain medications requiring rapid action. Topical and inhalable forms cater to specific therapeutic areas, while the "Others" category includes less common delivery methods. The dominance of oral generics aligns with patient and provider preference for ease of use and broad therapeutic applicability.

The UAE Generic Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Julphar (Gulf Pharmaceutical Industries), Neopharma, Globalpharma (Sanofi), Medpharma (Dr. Reddy’s Laboratories), Pharmax Pharmaceuticals, LifePharma, Tabuk Pharmaceuticals, Hikma Pharmaceuticals, Aster DM Healthcare, Al Ain Pharmaceutical Manufacturing Co., Pharma International Company, Al Hayat Pharmaceuticals, Dar Al Dawa, United Pharmaceuticals, Emirates Pharmaceutical Manufacturing Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE generic pharmaceuticals market appears promising, driven by ongoing government support and a growing emphasis on cost-effective healthcare solutions. As the population ages and healthcare demands increase, the market is likely to see a rise in the adoption of generics. Additionally, advancements in digital health and telemedicine are expected to enhance access to medications, further stimulating market growth. The focus on preventive healthcare will also create new avenues for generic drug development, ensuring a robust market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Small Molecule Generics Biosimilars Others |

| By Mode of Drug Delivery | Oral Parenteral (Injectable) Topical Inhalable Others |

| By Form | Tablet Capsule Injection Others |

| By Source | In-House Manufacturing Contract Manufacturing Organizations |

| By Application (Therapeutic Area) | Cardiovascular Diseases Diabetes Neurology Oncology Anti-Inflammatory Diseases Infectious Diseases Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Wholesalers Direct Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Rest of UAE |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacy Retail Sector | 80 | Pharmacy Owners, Pharmacists |

| Healthcare Providers | 70 | General Practitioners, Specialists |

| Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

| Patients' Perspectives | 60 | Chronic Disease Patients, General Consumers |

| Pharmaceutical Distributors | 50 | Distribution Managers, Supply Chain Coordinators |

The UAE Generic Pharmaceuticals Market is valued at approximately USD 5 billion, driven by the increasing demand for affordable healthcare solutions and government initiatives promoting the use of generic medications.