Region:Middle East

Author(s):Dev

Product Code:KRAD3351

Pages:98

Published On:November 2025

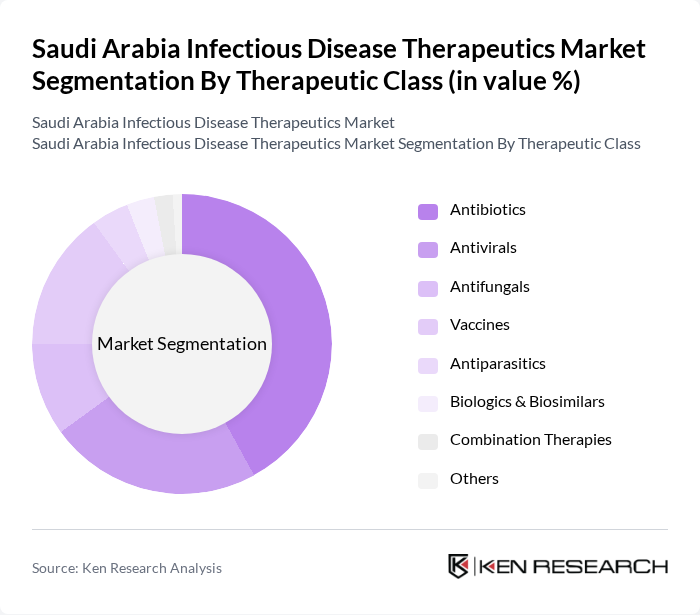

By Therapeutic Class:The therapeutic class segmentation includes various categories of treatments used to combat infectious diseases. The dominant sub-segment in this category isantibiotics, which are widely prescribed for bacterial infections and account for the largest share of the market. Antivirals and vaccines also play significant roles, especially in the context of recent global health challenges and ongoing vaccination drives. The increasing incidence of infectious diseases, along with the expansion of hospital-based treatments and the adoption of biologics and biosimilars, has led to a surge in demand for these therapeutics. Healthcare providers are focusing on effective treatment protocols and the integration of advanced therapies to improve patient outcomes .

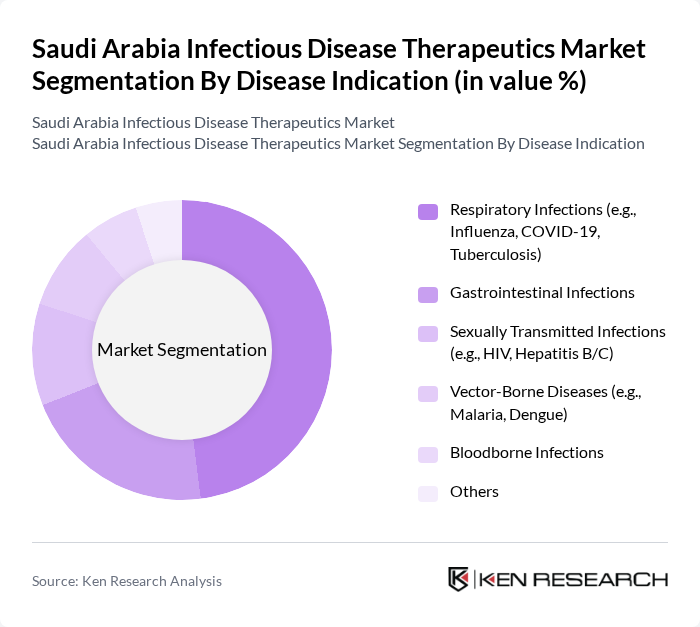

By Disease Indication:The disease indication segmentation encompasses various infectious diseases that require therapeutic intervention.Respiratory infections, particularly those caused by viruses like COVID-19 and influenza, dominate this segment due to their high prevalence and significant impact on public health. Other important indications include gastrointestinal infections, sexually transmitted infections, and vector-borne diseases, all of which contribute to the overall demand for therapeutics. The market is also influenced by the increasing incidence of bloodborne infections and the need for targeted therapies for emerging pathogens .

The Saudi Arabia Infectious Disease Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Al-Dawaa Pharmacies, Riyadh Pharma, Tabuk Pharmaceuticals Manufacturing Company, Gulf Pharmaceutical Industries (Julphar), United Pharmacies, Nahdi Medical Company, Aster DM Healthcare, Sanofi Saudi Arabia, Pfizer Saudi Arabia, Novartis Saudi Arabia, Merck Sharp & Dohme (MSD) Saudi Arabia, GlaxoSmithKline (GSK) Saudi Arabia, AstraZeneca Saudi Arabia, and Roche Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the infectious disease therapeutics market in Saudi Arabia appears promising, driven by ongoing government investments and technological advancements. The integration of telemedicine and digital health solutions is expected to enhance patient access to therapies, particularly in underserved areas. Additionally, the focus on personalized medicine will likely lead to more effective treatment options tailored to individual patient needs, fostering a more responsive healthcare system that can adapt to emerging infectious disease challenges.

| Segment | Sub-Segments |

|---|---|

| By Therapeutic Class | Antibiotics Antivirals Antifungals Vaccines Antiparasitics Biologics & Biosimilars Combination Therapies Others |

| By Disease Indication | Respiratory Infections (e.g., Influenza, COVID-19, Tuberculosis) Gastrointestinal Infections Sexually Transmitted Infections (e.g., HIV, Hepatitis B/C) Vector-Borne Diseases (e.g., Malaria, Dengue) Bloodborne Infections Others |

| By Route of Administration | Oral Parenteral (Injectable) Topical Inhalation Others |

| By End-User | Hospitals Clinics Home Healthcare Research Institutions Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Wholesalers/Distributors Others |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infectious Disease Specialists | 60 | Doctors, Researchers, Clinical Practitioners |

| Pharmaceutical Procurement Officers | 50 | Purchasing Managers, Supply Chain Directors |

| Hospital Administrators | 40 | CEOs, CFOs, Operations Managers |

| Patient Advocacy Groups | 40 | Patient Representatives, Community Health Workers |

| Healthcare Policy Makers | 45 | Government Officials, Health Economists |

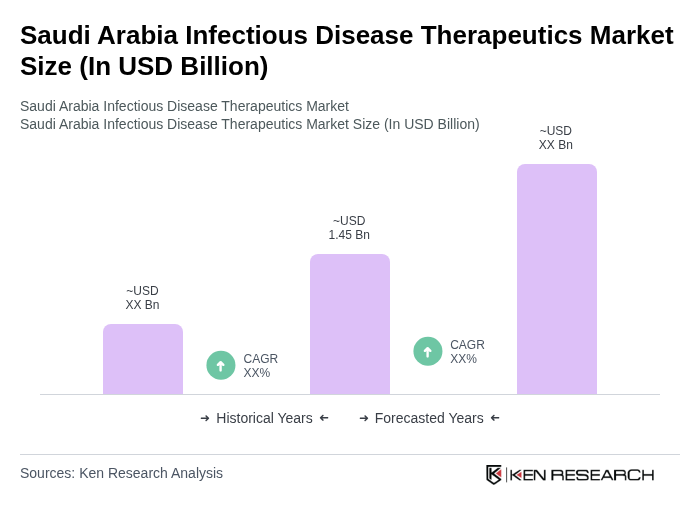

The Saudi Arabia Infectious Disease Therapeutics Market is valued at approximately USD 1.45 billion, reflecting a significant growth driven by the rising prevalence of infectious diseases and government initiatives to enhance healthcare infrastructure.