Region:Middle East

Author(s):Rebecca

Product Code:KRAD7483

Pages:98

Published On:December 2025

Market.png)

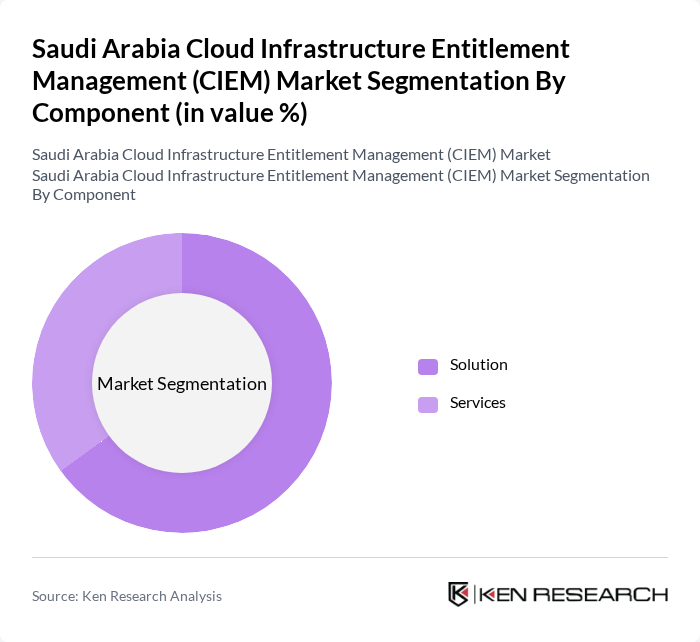

By Component:

The components of the CIEM market include Solutions and Services. The Solutions segment is currently leading the market due to the increasing need for advanced security measures to manage cloud entitlements effectively in complex, distributed cloud environments, including multi?cloud and containerized workloads. Organizations are investing in CIEM solutions to gain centralized visibility into identities and permissions across cloud platforms, enforce least?privilege policies, detect toxic permission combinations, and ensure compliance with frameworks such as NCA ECC, SAMA Cybersecurity Framework, and NDMO data governance requirements. The Services segment, while growing, primarily supports the implementation, integration, and ongoing tuning of these solutions, catering to the rising demand for expert guidance in mapping business roles to cloud permissions, developing governance processes, and operating CIEM capabilities as part of broader security operations and identity governance programs.

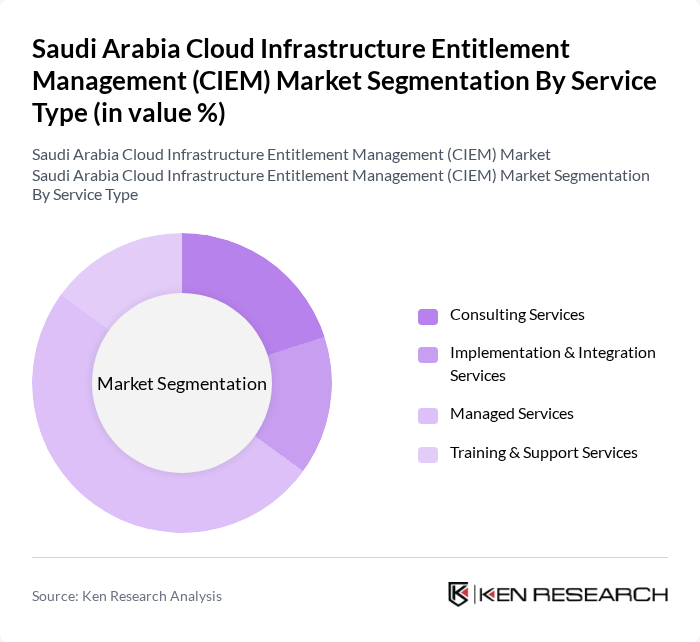

By Service Type:

The Service Type segmentation includes Consulting Services, Implementation & Integration Services, Managed Services, and Training & Support Services. Among these, Managed Services is the dominant segment, as organizations increasingly prefer outsourcing their CIEM operations and continuous entitlement monitoring to specialized providers and managed security service providers, in order to address skill shortages and ensure 24x7 oversight of cloud identities and permissions. This trend is driven by the complexity of managing large?scale cloud environments, dynamic DevOps pipelines, and frequent permission changes, as well as the need to align CIEM with existing SIEM, SOAR, IAM, and PAM tools for automated response and compliance reporting. Consulting Services also play a crucial role, helping organizations assess entitlement risks, design cloud access governance models, prioritize high?risk accounts, and develop roadmaps for CIEM implementation that are consistent with national cybersecurity controls and sectoral regulations in Saudi Arabia.

The Saudi Arabia Cloud Infrastructure Entitlement Management (CIEM) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation (Microsoft Azure), Amazon Web Services, Inc. (AWS), Google LLC (Google Cloud Platform), International Business Machines Corporation (IBM), Oracle Corporation, Palo Alto Networks, Inc. (Prisma Cloud), Zscaler, Inc., CyberArk Software Ltd., SailPoint Technologies Holdings, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., Wiz, Inc., Orca Security Ltd., Skyflow Security, Inc. (CIEM-focused), Help AG (Etisalat Digital Security Services, regional MSSP & cloud security partner) contribute to innovation, geographic expansion, and service delivery in this space.

As Saudi Arabia continues to enhance its digital landscape, the CIEM market is poised for significant growth. The increasing adoption of hybrid cloud solutions will necessitate advanced entitlement management strategies, while the integration of AI and machine learning technologies will streamline CIEM processes. Additionally, partnerships with local enterprises will foster tailored solutions, addressing specific market needs. These trends indicate a robust future for CIEM, driven by innovation and a commitment to security in the cloud environment.

| Segment | Sub-Segments |

|---|---|

| By Component | Solution Services |

| By Service Type | Consulting Services Implementation & Integration Services Managed Services Training & Support Services |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) Government and Public Sector Healthcare and Life Sciences Oil and Gas IT & Telecommunications Retail and E-Commerce Manufacturing Energy and Utilities Others |

| By Use Case | Cloud Entitlements Discovery and Visibility Least-Privilege Policy Enforcement Threat Detection & Anomaly Monitoring Compliance & Audit Management DevOps & CI/CD Integration Privileged Access & Role Management |

| By Region | Riyadh Makkah & Madinah Jeddah Eastern Province Rest of Saudi Arabia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 120 | IT Managers, Cloud Architects |

| SME CIEM Implementation | 90 | Business Owners, IT Consultants |

| Government Cloud Services | 60 | Public Sector IT Directors, Compliance Officers |

| Healthcare Cloud Solutions | 50 | Healthcare IT Managers, Data Security Officers |

| Financial Services Cloud Management | 80 | Risk Management Officers, IT Security Managers |

The Saudi Arabia CIEM Market is valued at approximately USD 140 million, reflecting significant growth driven by the increasing adoption of cloud services and the need for enhanced security measures across various sectors, including banking and healthcare.