Saudi Arabia Cloud Kitchens and Virtual Brands Market Overview

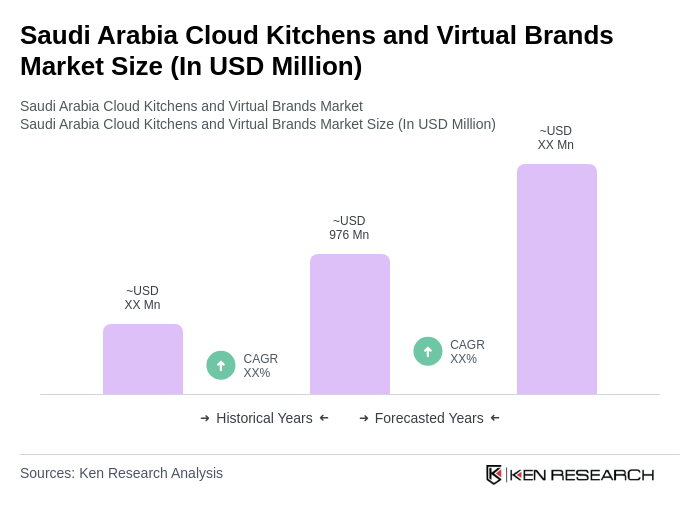

- The Saudi Arabia Cloud Kitchens and Virtual Brands Market is valued at USD 976 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for food delivery services, changing consumer preferences towards convenience, and the rise of digital platforms facilitating online orders. The market has seen a significant shift towards virtual dining experiences, especially in urban areas where consumers seek diverse culinary options without the need for traditional dine-in services. The rapid adoption of food delivery platforms such as Uber Eats, Zomato, Talabat, and the recent entry of Meituan’s Keeta has further accelerated market expansion, with consumers increasingly valuing speed, variety, and ease of digital ordering.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their high population density, urbanization, and a growing middle class with disposable income. These cities are also witnessing a surge in food delivery apps and cloud kitchen establishments, making them hotspots for virtual dining experiences. The concentration of technology and logistics infrastructure in these urban centers further enhances their market dominance. The expansion of internet penetration and smartphone usage has enabled even broader access to cloud kitchen services beyond traditional workforce demographics, including a notable increase in female consumers and younger generations embracing digital food solutions.

- In 2023, the Saudi government implemented the Food Safety Law and its Executive Regulations, issued by the Saudi Food and Drug Authority (SFDA), which mandate that all cloud kitchen operators must comply with health and safety guidelines, including regular inspections, certifications, and adherence to strict hygiene standards. These regulations aim to ensure consumer safety and enhance the overall quality of food delivery services in the market. Compliance is enforced through licensing requirements and periodic audits, with non-compliant operators subject to penalties and operational restrictions.

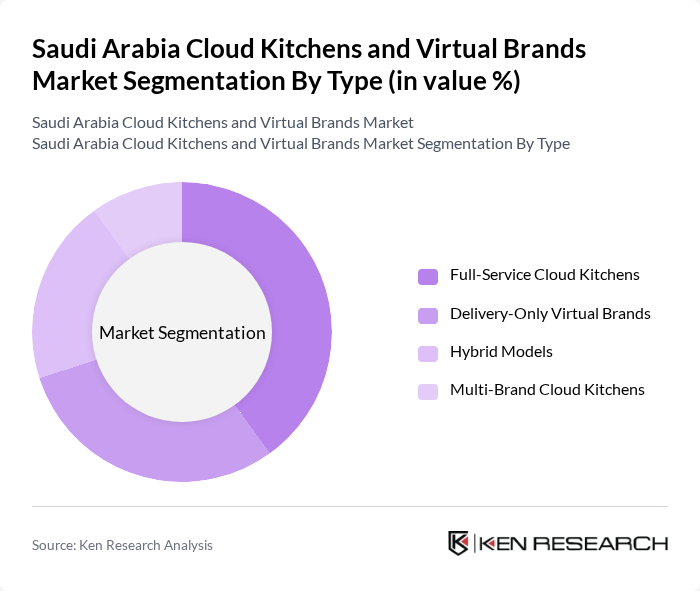

Saudi Arabia Cloud Kitchens and Virtual Brands Market Segmentation

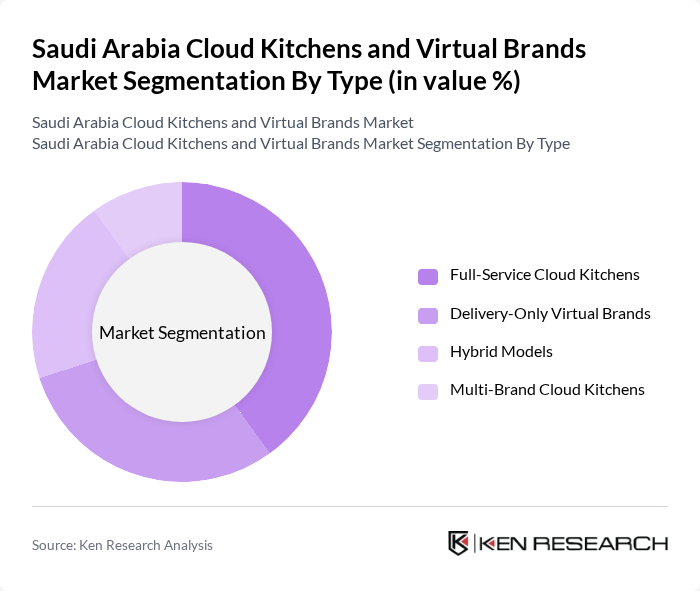

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Virtual Brands, Hybrid Models, and Multi-Brand Cloud Kitchens. Among these, Full-Service Cloud Kitchens are gaining traction due to their ability to offer a wide range of cuisines and services under one roof, catering to diverse consumer preferences. Delivery-Only Virtual Brands are also on the rise, driven by the increasing demand for convenience and the popularity of food delivery apps. The market is witnessing experimentation with technology such as robotics, drones, and AI to improve kitchen efficiency and delivery speed, with some players exploring autonomous delivery vehicles to further reduce costs and enhance customer experience.

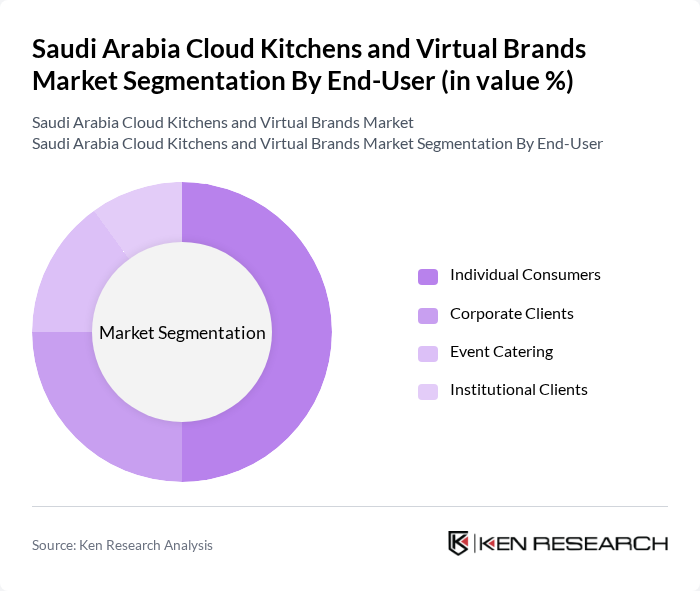

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Event Catering, and Institutional Clients. Individual Consumers represent the largest segment, driven by the growing trend of online food ordering and the convenience it offers. Corporate Clients and Event Catering are also significant, as businesses increasingly rely on cloud kitchens for catering services and meal provisions for employees. The rise of remote work and busy lifestyles, especially among millennials and Gen Z, has further boosted demand from individual and corporate segments.

Saudi Arabia Cloud Kitchens and Virtual Brands Market Competitive Landscape

The Saudi Arabia Cloud Kitchens and Virtual Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kitopi, Kaykroo, IKCON, Talabat, Kitchen Park, Matbakhi, Grubtech, Kook, Rebel Foods, Deliveroo, Uber Eats, Foodics, Al Baik, Shawarmer, Kudu contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Cloud Kitchens and Virtual Brands Market Industry Analysis

Growth Drivers

- Increasing Demand for Food Delivery Services:The food delivery market in Saudi Arabia is projected to reach approximately SAR 10 billion in future, driven by a growing urban population and changing lifestyles. The convenience of food delivery services has led to a 30% increase in demand over the past two years. This trend is further supported by the rise of mobile applications, which facilitate easy access to various cuisines, catering to the busy schedules of consumers in urban areas.

- Rise of Online Food Ordering Platforms:The number of online food ordering platforms in Saudi Arabia has surged to over 50, with major players like Talabat and HungerStation leading the market. In future, these platforms are expected to process over 80 million orders, reflecting a 25% increase from previous periods. This growth is fueled by enhanced internet penetration, which reached 99% in future, allowing consumers to easily access diverse food options from the comfort of their homes.

- Shift in Consumer Preferences Towards Convenience:A significant 70% of Saudi consumers now prefer ordering food online rather than dining out, highlighting a cultural shift towards convenience. This trend is particularly pronounced among millennials and Gen Z, who prioritize quick and easy meal solutions. The increasing availability of cloud kitchens, which offer streamlined operations and reduced overhead costs, aligns perfectly with this consumer preference, further driving market growth.

Market Challenges

- Intense Competition Among Cloud Kitchen Operators:The cloud kitchen sector in Saudi Arabia is experiencing fierce competition, with over 200 operators vying for market share. This saturation has led to price wars, reducing profit margins for many businesses. As operators strive to differentiate themselves, the need for innovative marketing strategies and unique culinary offerings becomes critical to survive in this highly competitive landscape.

- Regulatory Compliance and Licensing Issues:Navigating the regulatory landscape poses significant challenges for cloud kitchen operators in Saudi Arabia. The licensing process can take up to six months, and compliance with food safety regulations is stringent. In future, the government is expected to introduce new regulations that may further complicate operational requirements, increasing the burden on new entrants and established players alike.

Saudi Arabia Cloud Kitchens and Virtual Brands Market Future Outlook

The future of the cloud kitchen and virtual brands market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As the market matures, operators are likely to adopt more sophisticated data analytics and AI tools to enhance customer experiences and streamline operations. Additionally, the increasing focus on health-conscious food options will likely shape menu offerings, catering to the growing demand for nutritious meals among consumers, particularly in urban areas.

Market Opportunities

- Growth of Health-Conscious Food Options:The demand for health-oriented meals is on the rise, with a projected increase of 40% in health-focused menu items in future. This trend presents a significant opportunity for cloud kitchens to innovate and cater to health-conscious consumers, tapping into a lucrative segment of the market that prioritizes nutrition and wellness.

- Potential for Partnerships with Delivery Platforms:Collaborations with established delivery platforms can enhance visibility and reach for cloud kitchens. By future, partnerships are expected to increase order volumes by up to 30%, allowing operators to leverage the platforms' extensive customer bases and marketing capabilities, ultimately driving sales and brand recognition.