Region:Asia

Author(s):Geetanshi

Product Code:KRAB5102

Pages:96

Published On:October 2025

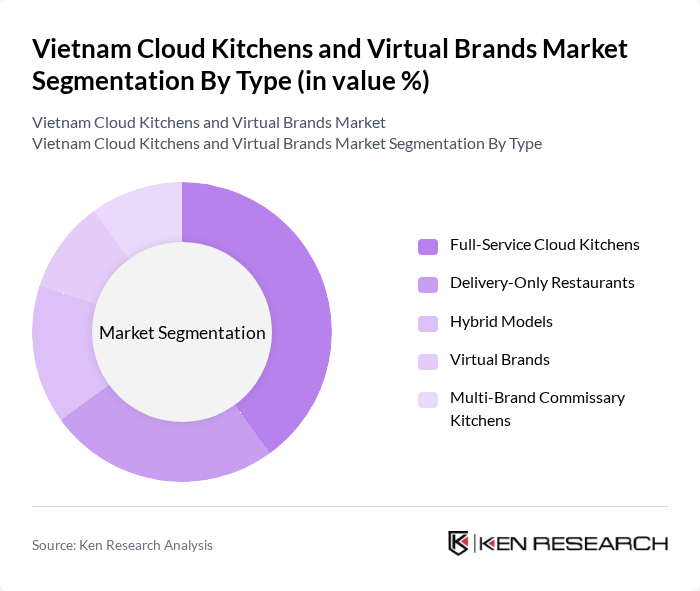

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Restaurants, Hybrid Models, Virtual Brands, and Multi-Brand Commissary Kitchens. Each of these sub-segments caters to different consumer needs and preferences.Full-Service Cloud Kitchens lead the marketdue to their broad menu offerings, operational flexibility, and ability to serve multiple cuisine types efficiently. Virtual brands and multi-brand commissary kitchens are gaining traction, particularly among younger, tech-oriented consumers seeking variety and convenience .

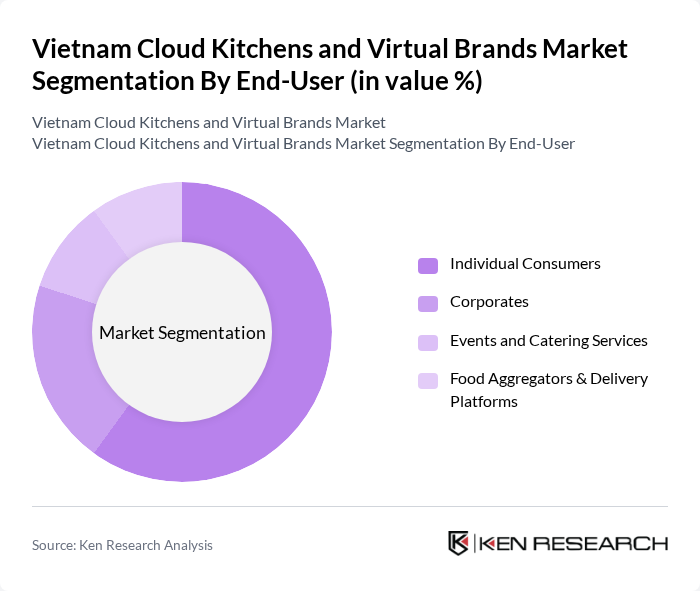

By End-User:The end-user segmentation includes Individual Consumers, Corporates, Events and Catering Services, and Food Aggregators & Delivery Platforms.Individual Consumers dominate the market, driven by the increasing trend of online food ordering and the convenience it offers, especially among younger demographics. Corporates and event organizers are also leveraging cloud kitchens for bulk and customized orders, while food aggregators play a crucial role in connecting consumers with a wide range of virtual restaurant offerings .

The Vietnam Cloud Kitchens and Virtual Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as Foody.vn, GrabFood, Now.vn, Baemin, GoFood (Gojek Vietnam), CloudKitchens Vietnam, Kitchen United Vietnam, Rebel Foods Vietnam, Eatigo Vietnam, The Pizza Company Vietnam, Vietcetera, Chopp.vn, Tasty Kitchen Vietnam, FoodHub Vietnam, Urban Kitchen Vietnam contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cloud kitchen market in Vietnam appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, operators are likely to leverage data analytics and AI to optimize operations and enhance customer experiences. Additionally, the growing trend towards health-conscious eating will push cloud kitchens to innovate their menus, offering nutritious options that cater to the changing dietary habits of consumers. This adaptability will be crucial for sustained growth in the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Delivery-Only Restaurants Hybrid Models Virtual Brands Multi-Brand Commissary Kitchens |

| By End-User | Individual Consumers Corporates Events and Catering Services Food Aggregators & Delivery Platforms |

| By Cuisine Type | Vietnamese Cuisine Asian Cuisine Western Cuisine Fast Food Healthy Options |

| By Delivery Channel | Third-Party Delivery Services (e.g., GrabFood, Baemin, Now.vn) In-House Delivery Pickup Options Dine-in Enabled Virtual Brands |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing Subscription-Based Pricing |

| By Location | Urban Areas (Hanoi, Ho Chi Minh City, Da Nang) Suburban Areas Rural Areas Tourist Zones |

| By Business Model | Franchise Models Independent Operators Partnerships (with aggregators, real estate, logistics) Aggregator-Owned Kitchens |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 60 | Founders, Operations Managers |

| Virtual Brand Owners | 50 | Brand Managers, Marketing Directors |

| Food Delivery Platforms | 40 | Business Development Managers, Partnership Leads |

| Consumer Insights | 100 | Frequent Online Food Orderers, Casual Users |

| Industry Experts | 40 | Market Analysts, Food Industry Consultants |

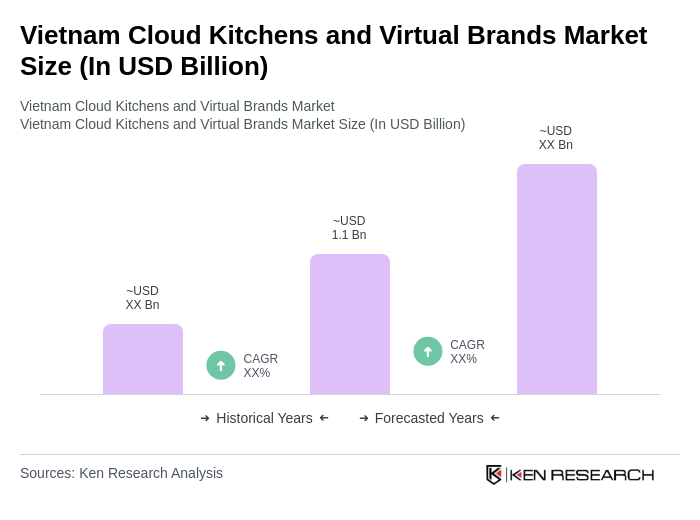

The Vietnam Cloud Kitchens and Virtual Brands Market is valued at approximately USD 1.1 billion, driven by the increasing demand for food delivery services and changing consumer preferences towards convenience, particularly during the pandemic.