Region:Middle East

Author(s):Dev

Product Code:KRAB8406

Pages:95

Published On:October 2025

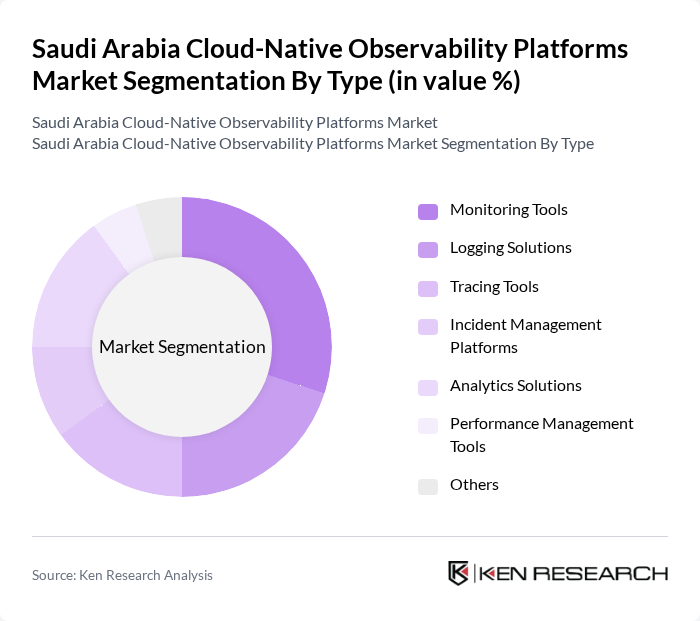

By Type:The market is segmented into various types, including Monitoring Tools, Logging Solutions, Tracing Tools, Incident Management Platforms, Analytics Solutions, Performance Management Tools, and Others. Each of these sub-segments plays a crucial role in providing comprehensive observability solutions to organizations.

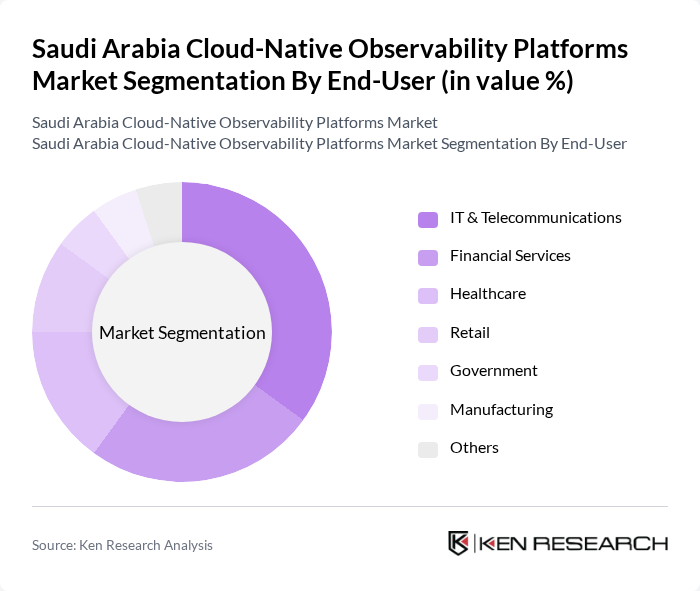

By End-User:The end-user segmentation includes IT & Telecommunications, Financial Services, Healthcare, Retail, Government, Manufacturing, and Others. Each sector has unique requirements for observability solutions, driving the demand for tailored services.

The Saudi Arabia Cloud-Native Observability Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Microsoft Azure, Google Cloud Platform, Datadog, New Relic, Splunk, Dynatrace, AppDynamics, Elastic, Sumo Logic, Grafana Labs, Prometheus, Instana, LogicMonitor, SolarWinds contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud-native observability platforms market in Saudi Arabia appears promising, driven by ongoing digital transformation initiatives and increased investment in technology infrastructure. As organizations continue to embrace hybrid cloud solutions, the demand for advanced monitoring and observability tools will rise. Furthermore, the integration of AI and machine learning technologies is expected to enhance data analytics capabilities, providing deeper insights and improving operational efficiency across various sectors, including finance, healthcare, and telecommunications.

| Segment | Sub-Segments |

|---|---|

| By Type | Monitoring Tools Logging Solutions Tracing Tools Incident Management Platforms Analytics Solutions Performance Management Tools Others |

| By End-User | IT & Telecommunications Financial Services Healthcare Retail Government Manufacturing Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Application | Application Performance Monitoring Infrastructure Monitoring Network Monitoring Security Monitoring Compliance Monitoring Others |

| By Sales Channel | Direct Sales Online Sales Resellers System Integrators Others |

| By Industry Vertical | BFSI Energy & Utilities Education Transportation & Logistics Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 150 | IT Managers, Cloud Architects |

| SME Cloud Solutions | 100 | Business Owners, IT Consultants |

| Public Sector Cloud Initiatives | 80 | Government IT Officials, Policy Makers |

| Telecommunications Cloud Services | 70 | Network Engineers, Operations Managers |

| Healthcare Cloud Implementations | 60 | Healthcare IT Directors, Compliance Officers |

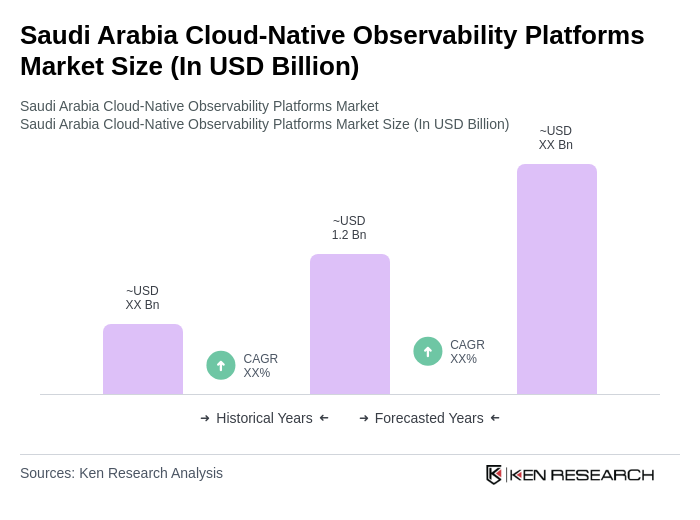

The Saudi Arabia Cloud-Native Observability Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of cloud technologies and the need for real-time monitoring in complex IT environments.