Region:Middle East

Author(s):Shubham

Product Code:KRAD1036

Pages:98

Published On:November 2025

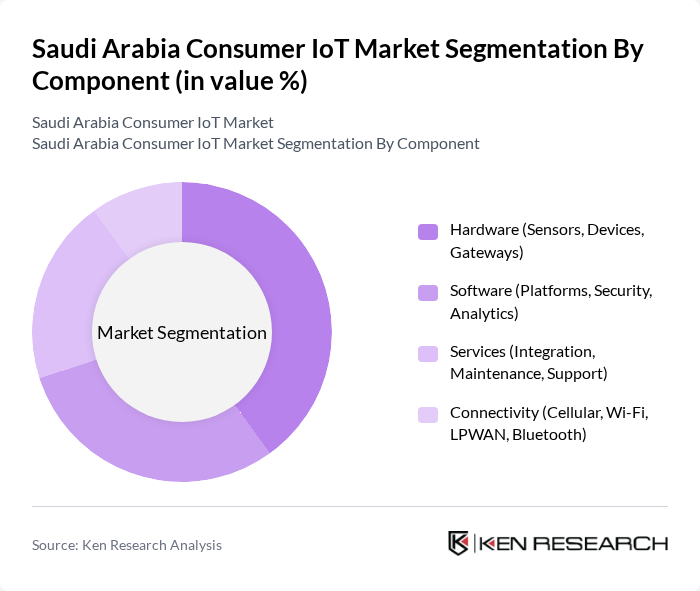

By Component:The segmentation by component includes Hardware, Software, Services, and Connectivity. Hardware encompasses sensors, devices, and gateways that form the backbone of IoT systems. Software includes platforms, security solutions, and analytics tools that enable data processing and management. Services cover integration, maintenance, and support, while connectivity refers to the various communication technologies used in IoT applications .

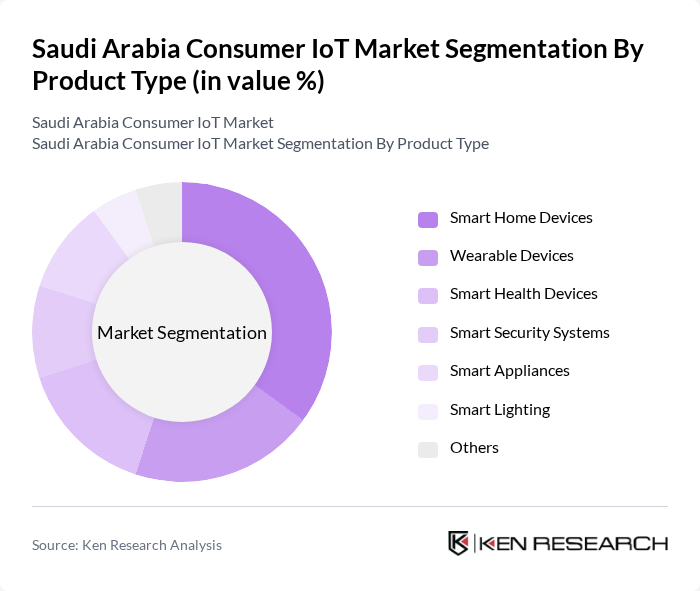

By Product Type:The product type segmentation includes Smart Home Devices, Wearable Devices, Smart Health Devices, Smart Security Systems, Smart Appliances, Smart Lighting, and Others. Smart Home Devices are increasingly popular due to their convenience and energy efficiency. Wearable Devices are gaining traction among health-conscious consumers, while Smart Health Devices are essential for remote monitoring and telehealth services. Smart Security Systems enhance safety, and Smart Appliances and Lighting contribute to energy management and automation .

The Saudi Arabia Consumer IoT Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA, Siemens Saudi Arabia, Cisco Systems Saudi Arabia, Honeywell Saudi Arabia, Samsung Electronics, LG Electronics, Signify (Philips Lighting), Amazon Web Services (AWS) Saudi Arabia, Google Cloud Saudi Arabia, IBM Saudi Arabia, Oracle Saudi Arabia, Huawei Technologies Saudi Arabia, Xiaomi, Legrand Saudi Arabia, Schneider Electric Saudi Arabia, Aqara (by Lumi United Technology), Fibaro (Nice Group), Ezviz (Hikvision) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Consumer IoT market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer interest. The expansion of 5G networks is expected to enhance connectivity, enabling faster and more reliable IoT applications. Additionally, the integration of artificial intelligence with IoT devices will likely lead to smarter, more efficient solutions. As urbanization continues, the demand for innovative smart city solutions will further propel market growth, creating a dynamic landscape for IoT technologies in the region.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Sensors, Devices, Gateways) Software (Platforms, Security, Analytics) Services (Integration, Maintenance, Support) Connectivity (Cellular, Wi-Fi, LPWAN, Bluetooth) |

| By Product Type | Smart Home Devices Wearable Devices Smart Health Devices Smart Security Systems Smart Appliances Smart Lighting Others |

| By Application | Home Automation Health Monitoring Security and Surveillance Energy Management Smart Cities Connected Cars Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Cloud-based IoT Solutions Edge Computing Artificial Intelligence Integration Machine Learning Applications Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies for IoT Devices Tax Exemptions for IoT Companies Regulatory Support for Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Home Device Adoption | 120 | Homeowners, Tech-savvy Consumers |

| Wearable Technology Usage | 85 | Fitness Enthusiasts, Health-conscious Individuals |

| Connected Appliances Insights | 75 | Household Decision Makers, Appliance Retailers |

| Consumer Attitudes Towards IoT Security | 95 | General Consumers, Technology Adopters |

| Smart City Initiatives Feedback | 80 | Urban Residents, Community Leaders |

The Saudi Arabia Consumer IoT Market is valued at approximately USD 9.5 billion, driven by the increasing adoption of smart devices, 5G connectivity, and consumer preferences for automation and convenience in daily life.