Region:Asia

Author(s):Geetanshi

Product Code:KRAE0535

Pages:92

Published On:December 2025

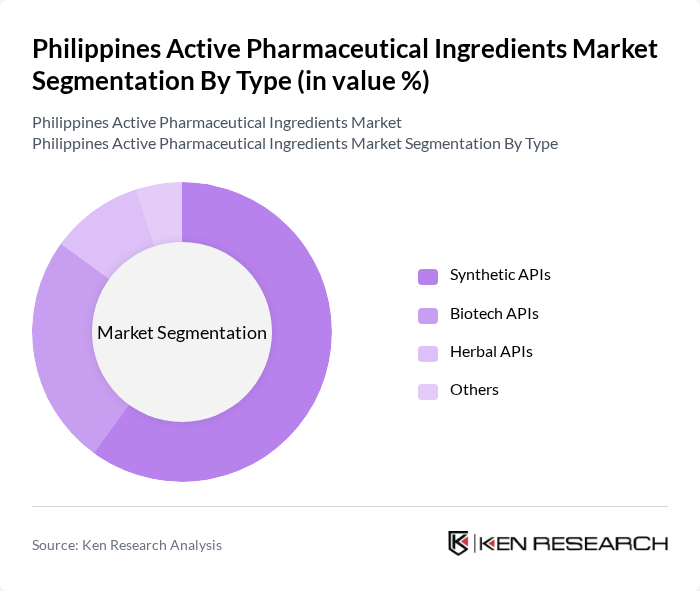

By Type:The market is segmented into various types of active pharmaceutical ingredients, including synthetic APIs, biotech APIs, herbal APIs, and others. Among these, synthetic APIs dominate the market due to their widespread use in the production of generic and branded medications. The increasing prevalence of chronic diseases and the demand for cost-effective treatment options have led to a significant rise in the production and consumption of synthetic APIs. Biotech APIs are also gaining traction, driven by advancements in biotechnology and the growing focus on personalized medicine.

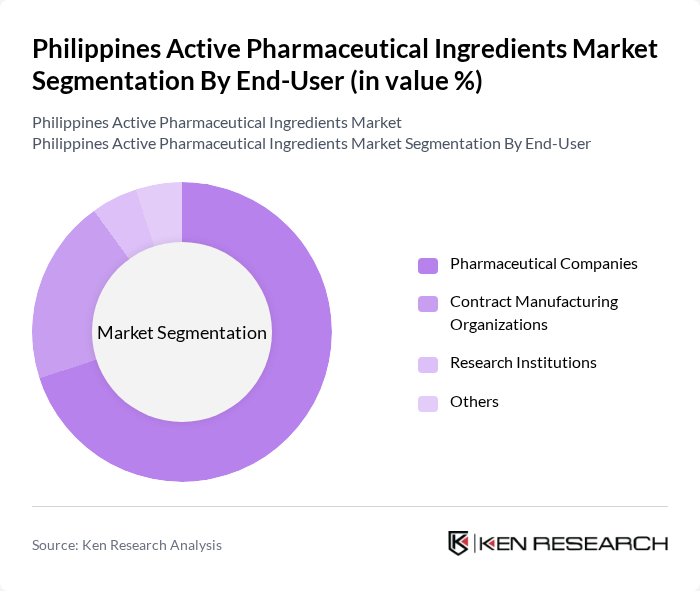

By End-User:The active pharmaceutical ingredients market is primarily segmented by end-users, which include pharmaceutical companies, contract manufacturing organizations, research institutions, and others. Pharmaceutical companies are the leading end-users, as they require a consistent supply of APIs for drug formulation and production. The increasing number of pharmaceutical firms in the Philippines, coupled with the rising demand for generic drugs, has significantly contributed to the growth of this segment. Contract manufacturing organizations are also expanding their operations to meet the growing needs of pharmaceutical companies.

The Philippines Active Pharmaceutical Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilab, Inc., Pascual Laboratories, Inc., Pharmalink, Inc., Hizon Laboratories, Inc., Apex Laboratories, Inc., United Laboratories, Inc., Interphil Laboratories, Inc., A. Menarini Philippines, Inc., Sanofi Philippines, Inc., GlaxoSmithKline Philippines, Inc., Pfizer Philippines, Inc., Novartis Healthcare Philippines, Inc., Merck Sharp & Dohme (MSD) Philippines, Inc., Johnson & Johnson Philippines, Inc., Roche Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines active pharmaceutical ingredients market appears promising, driven by ongoing government support and increasing healthcare demands. The anticipated growth in biopharmaceuticals and personalized medicine is expected to reshape the industry landscape. Furthermore, advancements in manufacturing technologies and a focus on sustainability will likely enhance production efficiency. As local manufacturers adapt to these trends, they will be better positioned to compete globally, fostering innovation and improving healthcare access for the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic APIs Biotech APIs Herbal APIs Others |

| By End-User | Pharmaceutical Companies Contract Manufacturing Organizations Research Institutions Others |

| By Application | Cardiovascular Oncology Neurology Others |

| By Source | Domestic Production Imports Exports Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Formulation | Solid Formulations Liquid Formulations Semi-solid Formulations Others |

| By Therapeutic Area | Infectious Diseases Metabolic Disorders Autoimmune Diseases Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| API Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Regulatory Compliance Perspectives | 80 | Regulatory Affairs Managers, Compliance Officers |

| Market Demand Analysis | 120 | Market Analysts, Business Development Managers |

| Supply Chain Dynamics | 90 | Supply Chain Managers, Procurement Specialists |

| Research & Development Trends | 70 | R&D Directors, Innovation Managers |

The Philippines Active Pharmaceutical Ingredients market is valued at approximately USD 1.2 billion, driven by increasing demand for pharmaceuticals, particularly for chronic disease treatments, and supported by rising healthcare expenditures and local production initiatives.