Region:Middle East

Author(s):Dev

Product Code:KRAD5193

Pages:83

Published On:December 2025

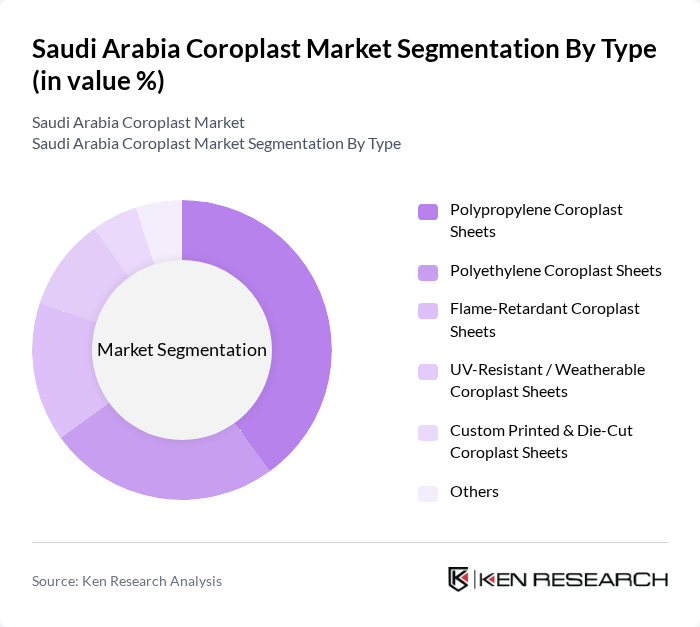

By Type:The market is segmented into various types of coroplast sheets, including Polypropylene Coroplast Sheets, Polyethylene Coroplast Sheets, Flame-Retardant Coroplast Sheets, UV-Resistant / Weatherable Coroplast Sheets, Custom Printed & Die-Cut Coroplast Sheets, and Others. Among these, Polypropylene Coroplast Sheets dominate the market due to their lightweight, durability, and cost-effectiveness, making them a preferred choice for a wide range of applications, particularly in packaging and signage.

By End-User:The end-user segmentation includes Graphic Arts & Advertising, Packaging & Storage, Building & Construction, Agriculture & Horticulture, Automotive & Industrial, and Others. The Graphic Arts & Advertising sector is the leading end-user, driven by the increasing demand for signage and display boards, which utilize coroplast for its lightweight and customizable features, making it ideal for promotional materials.

The Saudi Arabia Coroplast Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), Tasnee (National Industrialization Company), Rowad National Plastic Company, Saudi Arabian Packaging Industry (SAPI), Zamil Plastic Industries Co., Saudi Arabian Amiantit Company, Arabian Plastic Manufacturing Company (APM), Takween Advanced Industries, National Plastic Factory Co. (NPF), Al Watania Plastics, Interplast Co. Ltd. (Harwal Group – Saudi Operations), Palram Industries Ltd. – Saudi & GCC Distribution, Coroplast (Inteplast Group) – Regional Supply to Saudi Arabia, Simona AG – Middle East Subsidiary & Distribution in Saudi Arabia, Local SME Converters & Print Service Providers (signage & display applications) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia coroplast market is poised for significant growth, driven by increasing investments in infrastructure and a shift towards sustainable practices. As the construction sector expands, the demand for lightweight and durable materials will rise. Additionally, the growing e-commerce sector will further enhance the need for innovative packaging solutions. Companies that adapt to these trends and invest in eco-friendly technologies will likely capture a larger market share, positioning themselves favorably in the evolving landscape of the coroplast industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Polypropylene Coroplast Sheets Polyethylene Coroplast Sheets Flame-Retardant Coroplast Sheets UV-Resistant / Weatherable Coroplast Sheets Custom Printed & Die-Cut Coroplast Sheets Others |

| By End-User | Graphic Arts & Advertising (signage, display boards) Packaging & Storage (returnable boxes, totes, layer pads) Building & Construction (floor protection, wall cladding, formwork) Agriculture & Horticulture (plant protection, greenhouse panels) Automotive & Industrial (dunnage, component separators) Others |

| By Application | Temporary & Outdoor Signage Returnable & Protective Packaging Construction Site Protection & Barriers Agricultural Protection & Enclosures Industrial Handling & Storage Systems Others |

| By Thickness | Up to 3 mm mm to 5 mm mm to 8 mm Above 8 mm |

| By Color | White Black Transparent & Natural Standard Colors (blue, yellow, red, green) Custom Colors Others |

| By Distribution Channel | Direct Sales to End-Users Industrial Distributors & Dealers Online B2B Platforms Retail & Trade Counters Others |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Al Khobar, Jubail) Western Region (incl. Jeddah, Makkah, Madinah) Northern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coroplast Manufacturing Insights | 110 | Production Managers, Quality Control Supervisors |

| Distribution Channel Analysis | 85 | Logistics Coordinators, Sales Representatives |

| Retail Market Demand | 70 | Store Managers, Category Buyers |

| End-User Preferences | 95 | Consumers, Business Owners in Packaging |

| Regulatory Impact Assessment | 55 | Compliance Officers, Industry Regulators |

The Saudi Arabia Coroplast Market is valued at approximately USD 1.4 billion, driven by the increasing demand for lightweight and durable materials across various sectors, including construction, packaging, and advertising.