Region:Middle East

Author(s):Rebecca

Product Code:KRAA9444

Pages:90

Published On:November 2025

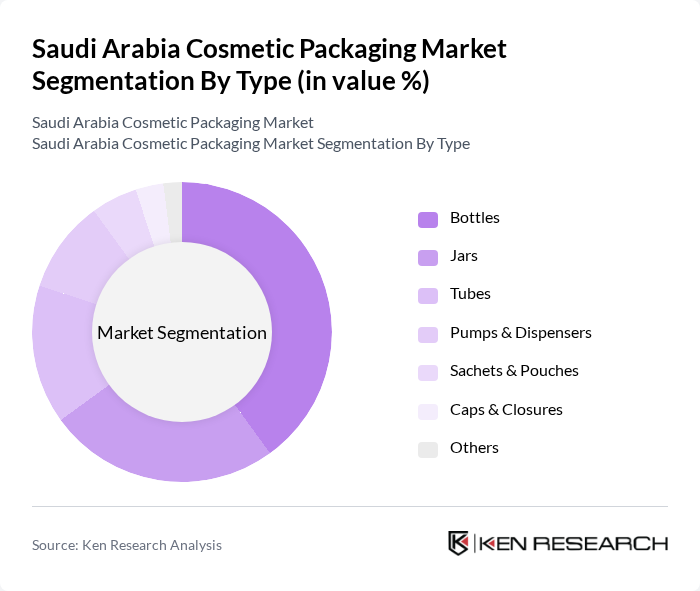

By Type:The cosmetic packaging market is segmented into bottles, jars, tubes, pumps & dispensers, sachets & pouches, caps & closures, and others. Bottles and jars remain the most widely used formats due to their versatility and strong consumer preference, particularly for liquid products and creams. The increasing demand for eco-friendly packaging is influencing both design and material selection, with brands adopting glass, aluminum, and biodegradable plastics to meet sustainability goals .

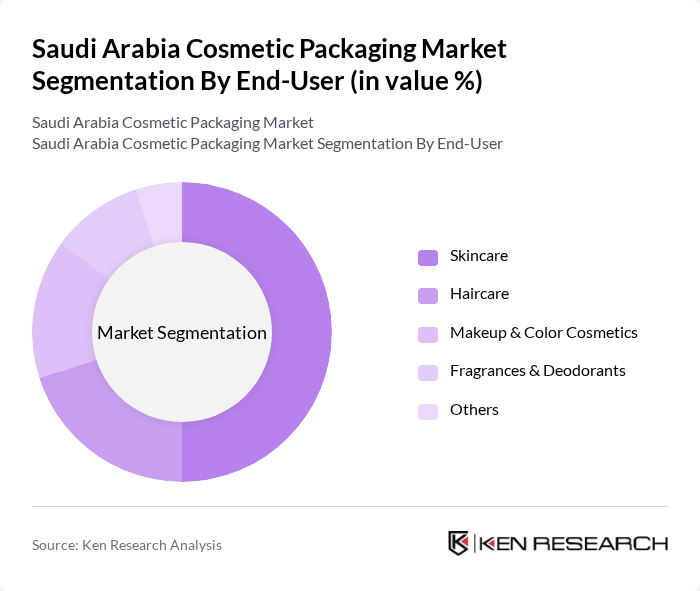

By End-User:The end-user segmentation includes skincare, haircare, makeup & color cosmetics, fragrances & deodorants, and others. Skincare products dominate the market, supported by rising consumer awareness of personal grooming and a growing preference for natural and organic products. These trends are driving packaging innovation, with brands focusing on sustainable materials and designs that reflect consumer values .

The Saudi Arabia Cosmetic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Napco National, Obeikan Industrial Group, Arabian Packaging Co., Al-Amoudi Plastic & Packaging Factory, Savola Packaging Systems Co., Al-Jazira Factory for Plastic Products, Al Qassim Plastic Factory, United Carton Industries Company (UCIC), Printopack, Al Watania Plastics, Zamil Plastic Industries Ltd., Al Bayader International, Al Rashed Plastic Factory, Al Kifah Paper Products, Al Suwaidi Paper Factory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian cosmetic packaging market appears promising, driven by ongoing trends in sustainability and technological innovation. As consumer preferences shift towards eco-friendly and personalized products, companies are expected to invest heavily in research and development. Additionally, the rise of e-commerce is likely to reshape packaging requirements, emphasizing convenience and functionality. These factors will create a dynamic environment for growth, encouraging brands to adopt innovative packaging solutions that align with consumer values and market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles Jars Tubes Pumps & Dispensers Sachets & Pouches Caps & Closures Others |

| By End-User | Skincare Haircare Makeup & Color Cosmetics Fragrances & Deodorants Others |

| By Material | Plastic Glass Metal Paper & Paperboard Biodegradable Materials Others |

| By Design | Custom Designs Standard Designs Eco-friendly Designs Others |

| By Distribution Channel | Online Retail Offline Retail (Supermarkets, Pharmacies, Specialty Stores) Direct Sales (B2B) Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Brand Managers | 60 | Marketing Directors, Product Development Managers |

| Packaging Manufacturers | 50 | Operations Managers, Production Supervisors |

| Retail Sector Insights | 40 | Retail Managers, Merchandising Specialists |

| Regulatory Compliance Experts | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Sustainability Officers | 40 | Environmental Managers, Corporate Social Responsibility Heads |

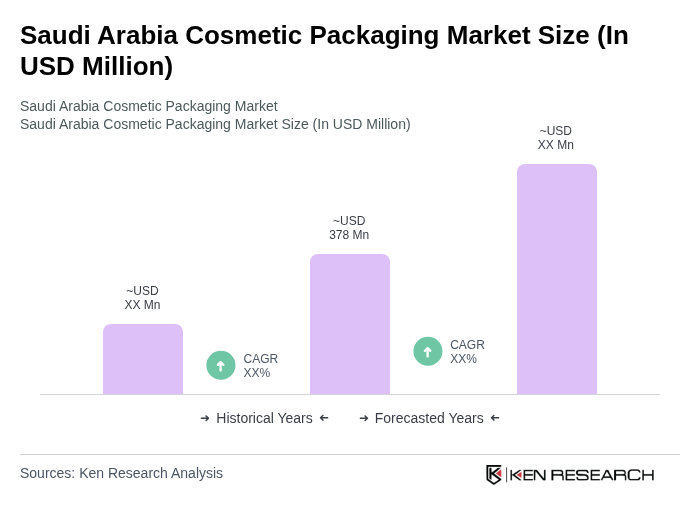

The Saudi Arabia Cosmetic Packaging Market is valued at approximately USD 378 million, reflecting a significant growth driven by increasing demand for beauty products and innovative packaging solutions, particularly among younger consumers.