Region:Global

Author(s):Dev

Product Code:KRAA3071

Pages:96

Published On:August 2025

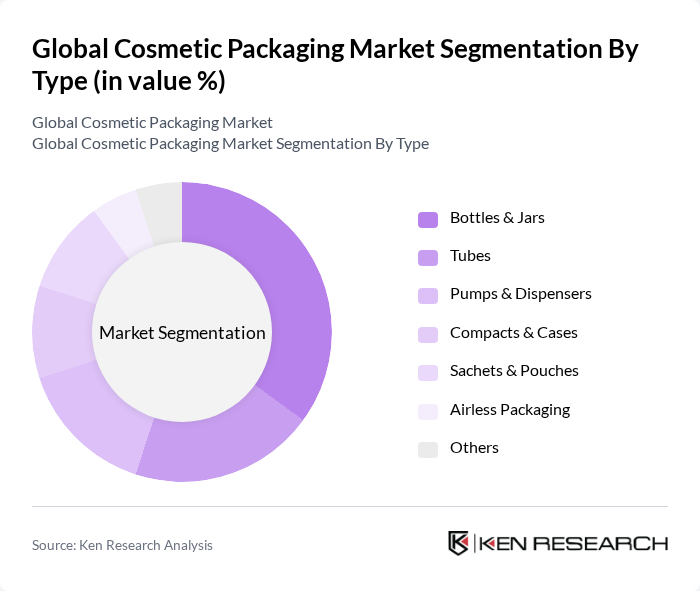

By Type:The market is segmented into various types of packaging solutions, including bottles & jars, tubes, pumps & dispensers, compacts & cases, sachets & pouches, airless packaging, and others. Among these, bottles & jars dominate the market due to their versatility and widespread use in skincare and makeup products. The trend towards premium packaging, clean design, and the adoption of refillable formats has also led to increased demand for aesthetically pleasing and functional designs in this segment .

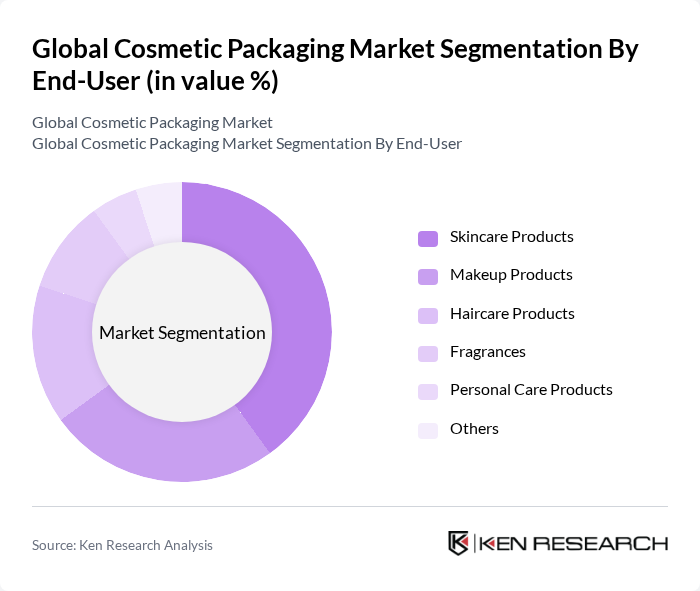

By End-User:The end-user segmentation includes skincare products, makeup products, haircare products, fragrances, personal care products, and others. Skincare products hold the largest share of the market, driven by the increasing focus on skincare routines, demand for high-quality packaging that preserves product integrity, and the rise of clean beauty trends. Consumers are increasingly seeking eco-friendly and refillable packaging options, influencing packaging choices across all end-user segments .

The Global Cosmetic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Berry Global, Inc., AptarGroup, Inc., Silgan Holdings Inc., Albéa S.A., Quadpack Industries S.A., HCP Packaging, RPC Group Plc, Gerresheimer AG, Cosmopak Ltd., M&H Plastics (Berry Global), WWP Beauty, Sealed Air Corporation, Sonoco Products Company, and WestRock Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cosmetic packaging market in None is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt smart packaging solutions, such as QR codes and augmented reality features, consumer engagement is expected to enhance. Additionally, the focus on aesthetic appeal and minimalist designs will likely shape packaging trends, aligning with the growing demand for visually appealing products that resonate with eco-conscious consumers, ensuring a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles & Jars Tubes Pumps & Dispensers Compacts & Cases Sachets & Pouches Airless Packaging Others |

| By End-User | Skincare Products Makeup Products Haircare Products Fragrances Personal Care Products Others |

| By Material | Plastic (PET, PP, PE, etc.) Glass Metal (Aluminum, Tin, etc.) Paper & Cardboard Biodegradable & Sustainable Materials Others |

| By Design | Rigid Packaging Flexible Packaging Semi-Rigid Packaging Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Price Range | Low Price Mid Price Premium Price Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Brand Managers | 100 | Product Development Managers, Marketing Directors |

| Packaging Suppliers | 80 | Sales Managers, Technical Support Engineers |

| Retail Buyers | 60 | Category Managers, Procurement Officers |

| Consumer Focus Groups | 50 | Regular Cosmetic Users, Eco-conscious Consumers |

| Regulatory Experts | 40 | Compliance Officers, Environmental Consultants |

The Global Cosmetic Packaging Market is valued at approximately USD 36 billion, driven by increasing demand for innovative and sustainable packaging solutions, along with the growth of the beauty and personal care industry.