Region:Middle East

Author(s):Rebecca Mary Reji

Product Code:KRO198

Pages:90

Published On:February 2026

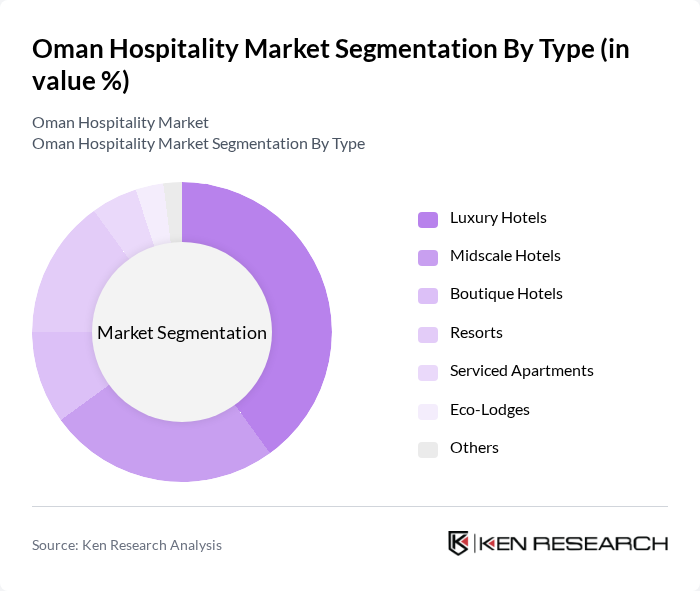

By Type:The market is segmented into various types of accommodations, including Luxury Hotels, Midscale Hotels, Boutique Hotels, Resorts, Serviced Apartments, Eco-Lodges, and Others. Among these, Luxury Hotels are currently dominating the market due to the increasing number of affluent travelers seeking high-end experiences. The demand for unique and personalized services in luxury accommodations is driving growth in this segment, as consumers are willing to pay a premium for exceptional hospitality and exclusive amenities.

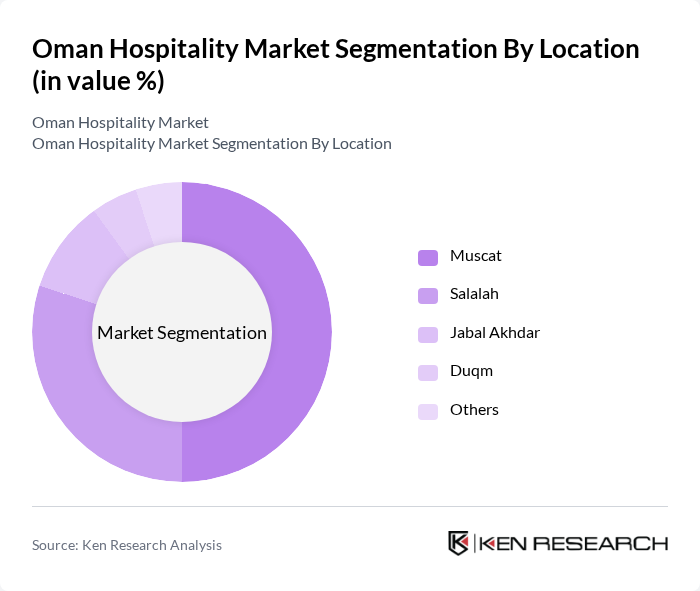

By Location:The market is further segmented by location, including Muscat, Salalah, Jabal Akhdar, Duqm, and Others. Muscat leads the market due to its status as the capital and a major tourist destination, offering a wide range of accommodations and attractions. Salalah follows closely, appealing to tourists with its unique climate and natural beauty. The ongoing development in Duqm is also positioning it as a significant player in the hospitality sector.

The Oman Hospitality Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shangri-La Barr Al Jissah Resort & Spa, Alila Jabal Akhdar, Crowne Plaza Muscat, InterContinental Muscat, Millennium Resort Mussanah, Radisson Blu Hotel, Muscat, Anantara Al Jabal Al Akhdar Resort, Hilton Garden Inn Muscat, Kempinski Hotel Muscat, Muscat Hills Resort, The Chedi Muscat, Al Bustan Palace, A Ritz-Carlton Hotel, Salalah Rotana Resort, Oman Convention & Exhibition Centre, Al Waha Hotel contribute to innovation, geographic expansion, and service delivery in this space.

The Oman hospitality market is poised for significant transformation, driven by increasing tourism arrivals and government investments in infrastructure. As the country enhances its appeal through eco-tourism and luxury offerings, the market is expected to adapt to evolving consumer preferences. The integration of technology in guest services will further elevate the hospitality experience. With a focus on sustainability and personalized services, Oman is likely to position itself as a premier destination in the Middle East, attracting diverse tourist demographics.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Hotels Midscale Hotels Boutique Hotels Resorts Serviced Apartments Eco-Lodges Others |

| By Location | Muscat Salalah Jabal Akhdar Duqm Others |

| By Star Rating | Star Star Star Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 120 | General Managers, Marketing Directors |

| Mid-range Accommodation | 100 | Operations Managers, Front Office Supervisors |

| Guesthouse and Boutique Hotels | 80 | Owners, Customer Experience Managers |

| Travel Agency Insights | 90 | Travel Consultants, Sales Managers |

| Tourist Feedback | 110 | International Tourists, Local Visitors |

The Oman Hospitality Market is valued at approximately USD 500 million, reflecting a five-year historical analysis. This growth is attributed to increased international tourism, government initiatives, and infrastructure development, catering to both leisure and business travelers.