Region:Middle East

Author(s):Shubham

Product Code:KRAD6742

Pages:94

Published On:December 2025

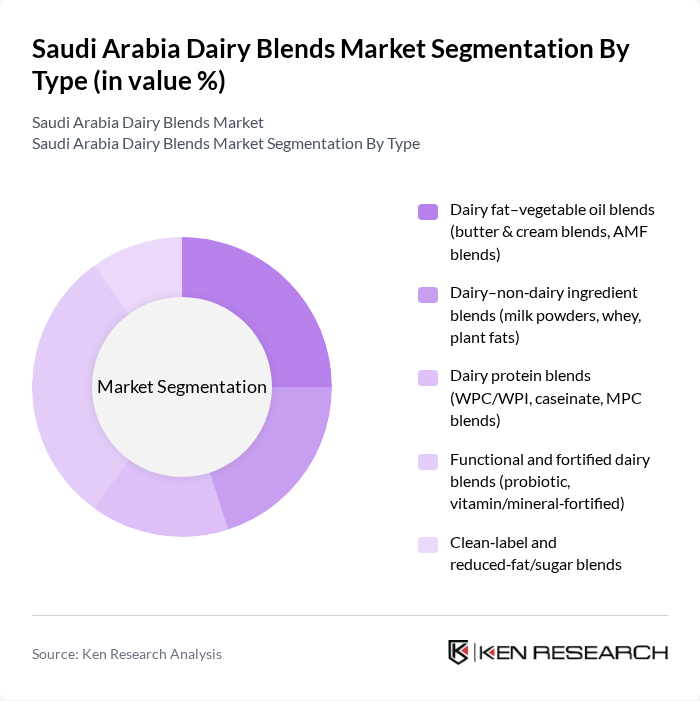

By Type:The market is segmented into various types of dairy blends, including Dairy fat–vegetable oil blends, Dairy–non-dairy ingredient blends, Dairy protein blends, Functional and fortified dairy blends, and Clean-label and reduced-fat/sugar blends. These subsegments reflect the industry’s shift toward cost optimization (through fat–oil blends and recombined powders), higher protein content, and value?added claims such as probiotic, vitamin/mineral fortification and cleaner ingredient lists, in line with trends seen in the global dairy blends and functional dairy markets.

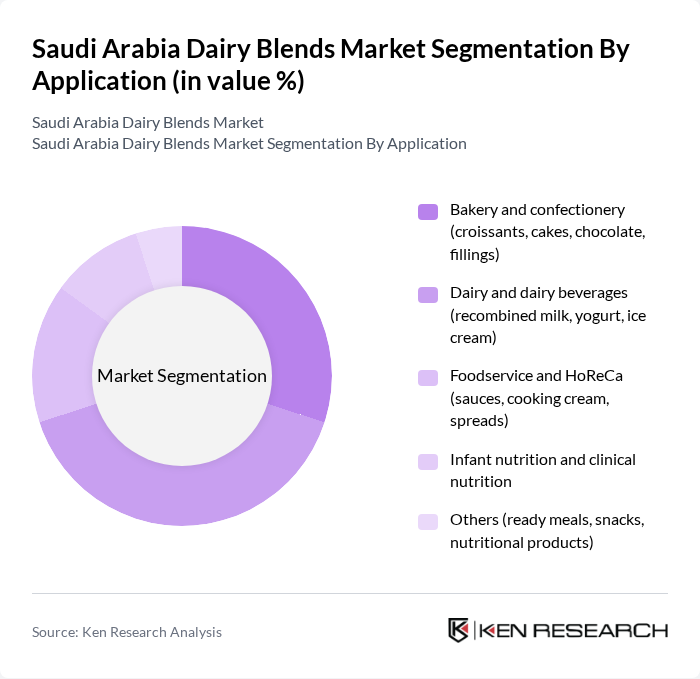

By Application:The applications of dairy blends in Saudi Arabia include Bakery and confectionery, Dairy and dairy beverages, Foodservice and HoReCa, Infant nutrition and clinical nutrition, and Others. This reflects the versatility of dairy blends as recombined milk and cream bases, fat?filled powders, and tailored functional systems used in bakery fats, chocolates, ice cream, yogurt drinks, ready meals, and nutritional products, supporting the broader growth of dairy snacks, convenience foods, and fortified beverages in the Kingdom.

The Saudi Arabia Dairy Blends Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, National Agricultural Development Company (NADEC), Saudia Dairy & Foodstuff Company (SADAFCO), Al Safi Danone Company, Almarai–PRIME Dairy Blends (industrial ingredients division), Arla Foods Saudi Arabia, Fonterra (Saudi Arabia operations), FrieslandCampina Middle East (Saudi Arabia), Kerry Group (Saudi Arabia taste & nutrition, dairy blends), Savola Foods Company (oils and fat–dairy blends for foodservice), Al Watania Dairy, Al Rawabi Dairy Company – KSA presence, United National Dairy Co. (UND), Al Jazeera Dairy Company, Al Ain Dairy – GCC exports to Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space, supported by strong investments in processing capacity, cold?chain distribution, and value?added dairy product development across the Kingdom.

The Saudi Arabia dairy blends market is poised for significant growth, driven by evolving consumer preferences and technological advancements. The increasing focus on health and wellness will likely lead to a surge in demand for fortified and organic dairy blends. Additionally, the expansion of e-commerce platforms will enhance product accessibility, allowing consumers to explore diverse offerings. As manufacturers innovate and adapt to these trends, the market is expected to witness a dynamic transformation, fostering competition and enhancing product variety.

| Segment | Sub-Segments |

|---|---|

| By Type | Dairy fat–vegetable oil blends (butter & cream blends, AMF blends) Dairy–non?dairy ingredient blends (milk powders, whey, plant fats) Dairy protein blends (WPC/WPI, caseinate, MPC blends) Functional and fortified dairy blends (probiotic, vitamin/mineral?fortified) Clean?label and reduced?fat/sugar blends |

| By Application | Bakery and confectionery (croissants, cakes, chocolate, fillings) Dairy and dairy beverages (recombined milk, yogurt, ice cream) Foodservice and HoReCa (sauces, cooking cream, spreads) Infant nutrition and clinical nutrition Others (ready meals, snacks, nutritional products) |

| By Form | Powder blends Liquid blends Paste and spreadable blends Concentrates Others |

| By Distribution Channel | B2B ingredients (industrial users, food manufacturers) Foodservice distributors Modern retail (supermarkets/hypermarkets) Online and direct-to-customer Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Consumer / Buyer Type | Large food & beverage manufacturers SMEs and local processors HoReCa and catering operators Retail and private?label brands |

| By Nutritional / Functional Positioning | High protein and high solids blends Low fat and low cholesterol blends Sugar?reduced and lactose?modified blends Fortified with vitamins, minerals, probiotics, or fibers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Dairy Blends Sales | 150 | Store Managers, Category Buyers |

| Food Service Sector Insights | 100 | Restaurant Owners, Menu Planners |

| Consumer Preferences in Dairy Blends | 120 | Household Decision Makers, Health-Conscious Consumers |

| Distribution Channel Analysis | 80 | Logistics Managers, Supply Chain Coordinators |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

The Saudi Arabia Dairy Blends Market is valued at approximately USD 1.0 billion, contributing to a broader dairy products market exceeding USD 5.56.0 billion. This growth is driven by increasing consumer demand and health consciousness.