Region:Global

Author(s):Geetanshi

Product Code:KRAC2313

Pages:82

Published On:October 2025

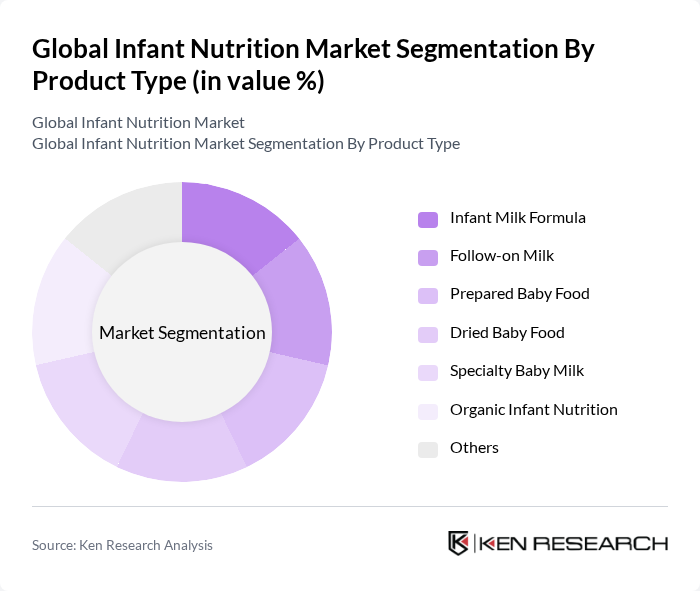

By Product Type:The product type segmentation includes various categories such as Infant Milk Formula, Follow-on Milk, Prepared Baby Food, Dried Baby Food, Specialty Baby Milk, Organic Infant Nutrition, and Others. Among these, Infant Milk Formula is the leading sub-segment due to its widespread acceptance and preference among parents for providing essential nutrients to infants. The increasing trend of working mothers and the convenience offered by these products further bolster its dominance. In 2024, Infant Milk held a significant market share, reflecting its essential role in early child development.

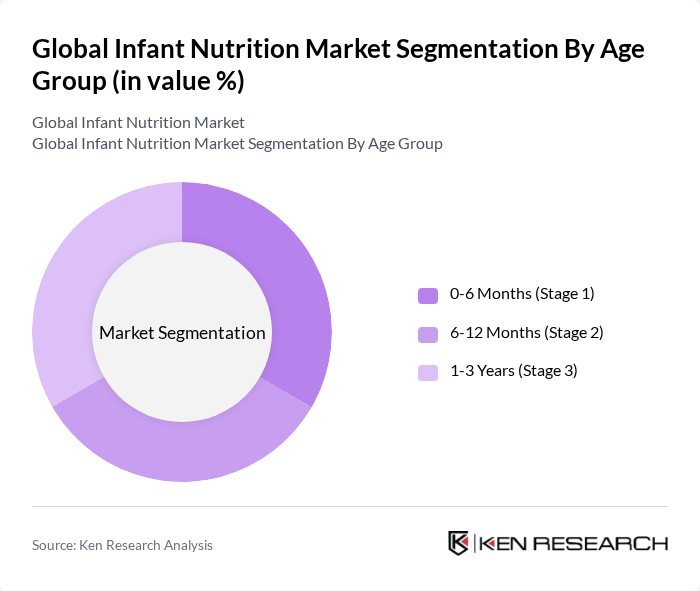

By Age Group:The age group segmentation includes 0-6 Months (Stage 1), 6-12 Months (Stage 2), and 1-3 Years (Stage 3). The 0-6 Months age group is the most significant segment, as this is the critical period for infant nutrition where breastfeeding or formula feeding is essential. The increasing awareness of the importance of nutrition during this stage drives demand for specialized products tailored to infants' needs.

The Global Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company (a Reckitt Benckiser subsidiary), Reckitt Benckiser Group plc, Hero Group, FrieslandCampina N.V., The Hain Celestial Group, Inc., Perrigo Company plc, Bubs Australia Limited, Bellamy's Organic Pty Ltd, Holle Baby Food AG, Earth's Best (The Hain Celestial Group), Baby Gourmet Foods Inc., Nutricia (Danone) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the infant nutrition market appears promising, driven by evolving consumer preferences and technological advancements. As parents increasingly seek personalized nutrition solutions, companies are likely to invest in research and development to create tailored products. Additionally, the rise of e-commerce platforms will facilitate greater access to a variety of infant nutrition products, enhancing consumer convenience and choice. This dynamic environment is expected to foster innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Infant Milk Formula Follow-on Milk Prepared Baby Food Dried Baby Food Specialty Baby Milk Organic Infant Nutrition Others |

| By Age Group | 6 Months (Stage 1) 12 Months (Stage 2) 3 Years (Stage 3) |

| By Form | Solid Liquid |

| By Nutritional Requirement | Standard Nutrition Organic Nutrition Specialty Nutrition |

| By Distribution Channel | Hypermarkets/Supermarkets Pharmacy/Medical Stores Online Channels Specialty Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Pediatricians, Nutritionists, Dietitians |

| Parents and Caregivers | 120 | New Parents, Expecting Parents, Caregivers |

| Retail Sector Insights | 80 | Store Managers, Category Managers, Buyers |

| Manufacturers and Distributors | 60 | Product Managers, Sales Directors, Supply Chain Managers |

| Market Analysts and Researchers | 50 | Market Analysts, Research Directors, Industry Experts |

The Global Infant Nutrition Market is valued at approximately USD 60 billion, reflecting a significant increase driven by rising awareness of infant health, higher disposable incomes, and the growing population of working mothers seeking convenient feeding options.