Region:Middle East

Author(s):Shubham

Product Code:KRAA8778

Pages:83

Published On:November 2025

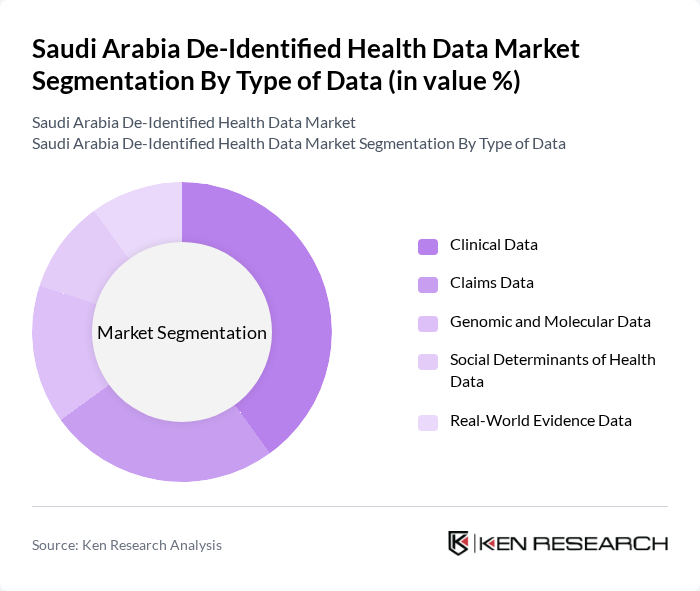

By Type of Data:The market is segmented into various types of data, including Clinical Data, Claims Data, Genomic and Molecular Data, Social Determinants of Health Data, and Real-World Evidence Data. Among these, Clinical Data is the most dominant segment due to its critical role in patient care and treatment outcomes. The increasing focus on personalized medicine and evidence-based practices drives the demand for comprehensive clinical datasets, which are essential for healthcare providers and researchers alike.

By End-User:The end-user segmentation includes Healthcare Providers, Pharmaceutical Companies, Research Institutions and Academic Centers, Insurance Companies, and Contract Research Organizations (CROs). Healthcare Providers dominate this segment as they increasingly rely on de-identified health data to enhance patient care, streamline operations, and comply with regulatory requirements. The growing emphasis on data-driven decision-making in healthcare is propelling the demand for de-identified data among these users.

The Saudi Arabia De-Identified Health Data Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Health Information Exchange (SHIE), King Faisal Specialist Hospital & Research Centre, Saudi Data and Artificial Intelligence Authority (SDAIA), Ministry of Health, Saudi Arabia, Dallah Healthcare Company, Al-Faisal University, Koninklijke Philips N.V. (Saudi Operations), GE HealthCare (Saudi Operations), Epic Systems Corporation (Saudi Implementations), Al Nahdi Medical Company, Mouwasat Medical Services, Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Al-Jazeera Medical Company, Accenture (Healthcare Consulting in Saudi Arabia), IBM (Healthcare Analytics Solutions in Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the de-identified health data market in Saudi Arabia appears promising, driven by ongoing digital transformation initiatives and increasing investments in health technology. As the government continues to prioritize healthcare innovation, the integration of advanced analytics and AI-driven solutions will likely enhance patient care. Additionally, the expansion of telehealth services will facilitate broader access to healthcare, further propelling the demand for de-identified health data solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type of Data | Clinical Data Claims Data Genomic and Molecular Data Social Determinants of Health Data Real-World Evidence Data |

| By End-User | Healthcare Providers Pharmaceutical Companies Research Institutions and Academic Centers Insurance Companies Contract Research Organizations (CROs) |

| By Data Source | Electronic Health Records (EHR) Wearable Devices and IoT Sensors Mobile Health Applications Health Information Exchanges (HIE) Laboratory and Diagnostic Systems |

| By Application | Clinical Research and Trials Population Health Management Predictive Analytics and AI Training Quality Improvement Initiatives Drug Development and Safety Monitoring |

| By Component | Services (Data Anonymization, Consulting, Compliance Auditing) Software and Platforms Data Integration and Management Solutions Security and Risk Assessment Tools |

| By Geographic Distribution | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region (Abha, Jizan) Northern Region |

| By Data Usage | Research and Development Clinical Decision Support Operational Efficiency and Cost Optimization Regulatory Compliance and Reporting Market Intelligence and Competitive Analysis |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Hospital Administrators, IT Directors |

| Health Data Analytics Firms | 60 | Data Scientists, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Research Institutions | 50 | Research Directors, Health Economists |

| Health Tech Startups | 45 | Founders, Product Managers |

The Saudi Arabia De-Identified Health Data Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for data analytics in healthcare and advancements in digital health technologies.