Region:Middle East

Author(s):Dev

Product Code:KRAD5115

Pages:94

Published On:December 2025

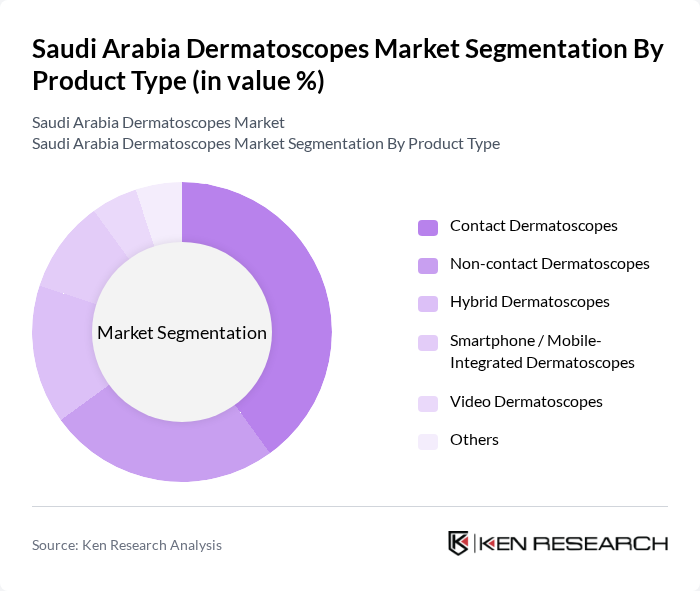

By Product Type:The product type segmentation includes various categories of dermatoscopes, each catering to different diagnostic needs and preferences. The subsegments are Contact Dermatoscopes, Non-contact Dermatoscopes, Hybrid Dermatoscopes, Smartphone / Mobile-Integrated Dermatoscopes, Video Dermatoscopes, and Others. Among these, Contact Dermatoscopes are leading the market due to their precision, familiarity in routine clinical examinations, and widespread adoption in dermatology centers and hospitals, while digital and smartphone?enabled solutions are gaining share in teledermatology and remote consultations.

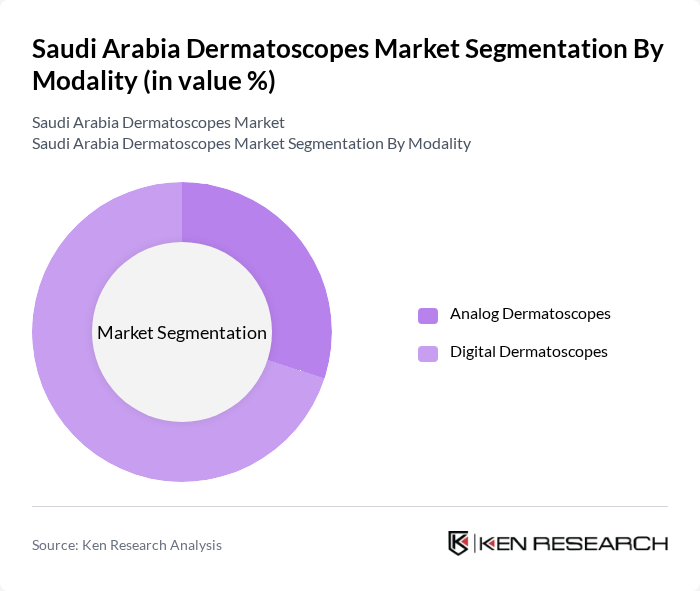

By Modality:The modality segmentation consists of Analog Dermatoscopes and Digital Dermatoscopes. Digital Dermatoscopes are gaining traction due to their advanced imaging capabilities, ability to store and compare serial images, and integration with electronic medical records and teledermatology platforms, making them the preferred choice among healthcare professionals for both diagnostic and follow?up assessments. The demand for Digital Dermatoscopes is driven by the need for accurate diagnostics, efficient patient management, and the expansion of dermatology imaging services within hospitals, specialized dermatology centers, and aesthetic clinics.

The Saudi Arabia Dermatoscopes Market is characterized by a dynamic mix of regional and international players. Leading participants such as DermLite (3Gen Inc.), Heine Optotechnik GmbH & Co. KG, Canfield Scientific Inc., FotoFinder Systems GmbH, Optomed Plc, Rudolf Riester GmbH (Riester), Firefly Global, MedX Health Corp, KaWe – Kirchner & Wilhelm GmbH + Co. KG, Dino-Lite (AnMo Electronics Corporation), Illuco Corporation Ltd., Lumio (DermLite Brand), Adamo Srl (DermoScan Line), Local Saudi Medical Distributors (e.g., Al-Jeel Medical, Gulf Medical Co.), Other Emerging MEA Dermatoscope Suppliers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia dermatoscopes market appears promising, driven by technological innovations and increasing healthcare investments. The integration of AI and mobile applications into dermatoscopes is expected to enhance diagnostic accuracy and accessibility. Additionally, the expansion of teledermatology services will facilitate remote consultations, making skin health management more efficient. As healthcare infrastructure improves, the market is likely to witness a surge in demand for advanced diagnostic tools, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Contact Dermatoscopes Non-contact Dermatoscopes Hybrid Dermatoscopes Smartphone / Mobile-Integrated Dermatoscopes Video Dermatoscopes Others |

| By Modality | Analog Dermatoscopes Digital Dermatoscopes |

| By Application | Skin Cancer & Melanoma Diagnosis General Dermatology Cosmetic & Aesthetic Dermatology Teledermatology & Remote Consultations Others |

| By End-User | Public Hospitals Private Hospitals Dermatology & Aesthetic Clinics Academic & Research Institutes Home-Use / Consumer Segment Others |

| By Distribution Channel | Direct Tenders to Hospitals & Government Entities Local Medical Device Distributors Manufacturer Direct Sales E-commerce & Online Platforms Others |

| By Technology | Optical Dermatoscopes Digital Imaging Dermatoscopes Polarized Light Dermatoscopes Non-polarized Light Dermatoscopes Others |

| By Price Range | Entry-Level Dermatoscopes (< USD 1,000) Mid-Range Dermatoscopes (USD 1,000 – 3,000) Premium Dermatoscopes (> USD 3,000) Others |

| By Region | Central Region (including Riyadh) Western Region (including Makkah, Madinah, Jeddah) Eastern Region (including Dammam, Khobar) Northern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 120 | Dermatologists, Clinic Managers |

| Hospitals with Dermatology Departments | 90 | Hospital Administrators, Medical Equipment Buyers |

| Medical Equipment Distributors | 70 | Sales Managers, Product Specialists |

| Research Institutions | 50 | Research Scientists, Academic Professors |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Experts |

The Saudi Arabia Dermatoscopes Market is valued at approximately USD 25 million, making it the largest revenue-generating segment within the dermatology imaging devices category in the country.