Region:Middle East

Author(s):Dev

Product Code:KRAB7425

Pages:100

Published On:October 2025

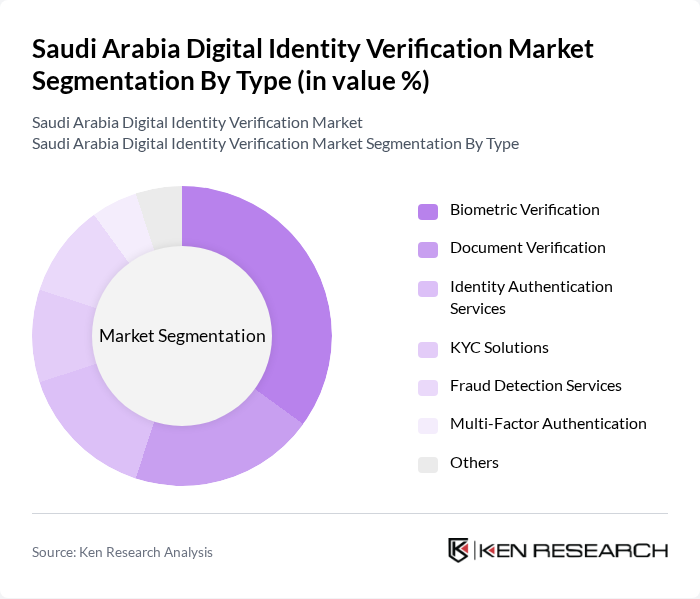

By Type:The market is segmented into various types, including Biometric Verification, Document Verification, Identity Authentication Services, KYC Solutions, Fraud Detection Services, Multi-Factor Authentication, and Others. Among these, Biometric Verification is gaining significant traction due to its high accuracy and security levels, driven by increasing consumer awareness and the need for secure transactions.

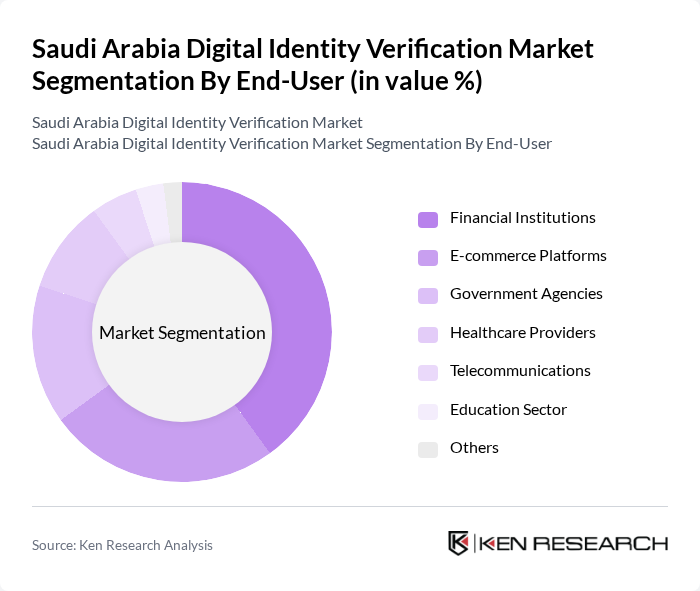

By End-User:The end-user segmentation includes Financial Institutions, E-commerce Platforms, Government Agencies, Healthcare Providers, Telecommunications, Education Sector, and Others. Financial Institutions are the leading segment, driven by the need for secure transactions and compliance with regulatory requirements, which necessitate robust identity verification solutions.

The Saudi Arabia Digital Identity Verification Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Group, IDEMIA, Jumio Corporation, Onfido, Veriff, Mitek Systems, Experian, Equifax, TransUnion, Aware, Inc., Auth0, Signicat, Yoti, Sift Science, Socure contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital identity verification market in Saudi Arabia appears promising, driven by technological advancements and increasing regulatory support. The integration of artificial intelligence and blockchain technologies is expected to enhance the security and efficiency of identity verification processes. Additionally, as consumer awareness of digital security grows, businesses will likely prioritize user-friendly solutions that comply with emerging regulations, fostering innovation and collaboration within the industry. The market is poised for significant evolution as these trends unfold.

| Segment | Sub-Segments |

|---|---|

| By Type | Biometric Verification Document Verification Identity Authentication Services KYC Solutions Fraud Detection Services Multi-Factor Authentication Others |

| By End-User | Financial Institutions E-commerce Platforms Government Agencies Healthcare Providers Telecommunications Education Sector Others |

| By Application | Online Transactions Account Opening Customer Onboarding Fraud Prevention Regulatory Compliance Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Resellers Partnerships with Financial Institutions Others |

| By Technology | Artificial Intelligence Machine Learning Blockchain Technology Cloud-Based Solutions Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Tiered Pricing Freemium Model Others |

| By Customer Segment | Small and Medium Enterprises Large Enterprises Startups Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Identity Verification | 100 | Compliance Officers, IT Security Managers |

| Healthcare Digital Identity Solutions | 80 | Healthcare Administrators, IT Directors |

| E-commerce User Authentication | 90 | eCommerce Managers, Customer Experience Leads |

| Government Digital Identity Initiatives | 70 | Policy Makers, Digital Transformation Officers |

| Telecommunications Identity Verification | 60 | Network Security Managers, Regulatory Affairs Specialists |

The Saudi Arabia Digital Identity Verification Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing demand for secure online transactions and advancements in technology such as artificial intelligence and biometrics.