Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1020

Pages:85

Published On:October 2025

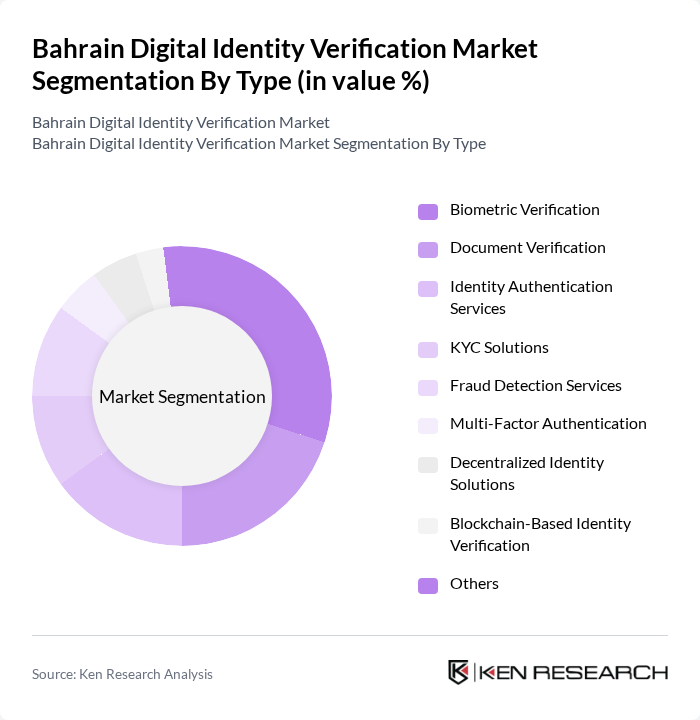

By Type:The market can be segmented into various types of digital identity verification solutions, including Biometric Verification, Document Verification, Identity Authentication Services, KYC Solutions, Fraud Detection Services, Multi-Factor Authentication, Decentralized Identity Solutions, Blockchain-Based Identity Verification, and Others. Each of these sub-segments plays a crucial role in enhancing security and compliance across different industries.

The Biometric Verification sub-segment is currently dominating the market due to its high accuracy and security features, which are increasingly being adopted by financial institutions and government agencies. The growing concerns over identity theft and fraud have led to a surge in demand for biometric solutions, such as fingerprint and facial recognition technologies. Additionally, advancements in artificial intelligence and machine learning are enhancing the capabilities of biometric systems, making them more reliable and efficient. As a result, this sub-segment is expected to maintain its leadership position in the market.

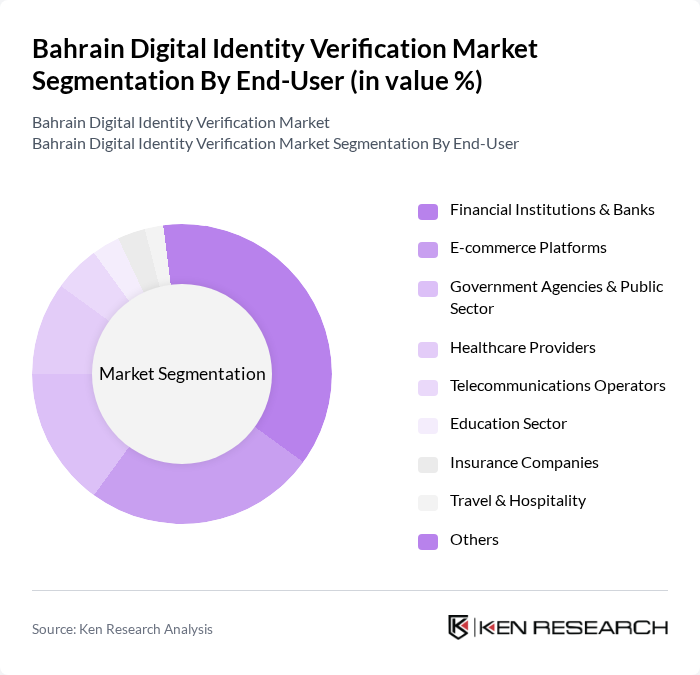

By End-User:The market can also be segmented by end-users, which include Financial Institutions & Banks, E-commerce Platforms, Government Agencies & Public Sector, Healthcare Providers, Telecommunications Operators, Education Sector, Insurance Companies, Travel & Hospitality, and Others. Each of these sectors has unique requirements for identity verification, driving the demand for tailored solutions.

The Financial Institutions & Banks segment is leading the market due to the stringent regulatory requirements for identity verification and the increasing need for secure online banking services. With the rise in digital transactions, banks are investing heavily in advanced identity verification solutions to mitigate risks associated with fraud and identity theft. This trend is further supported by the growing adoption of digital banking services, which necessitate robust identity verification processes to ensure customer trust and compliance with regulations.

The Bahrain Digital Identity Verification Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumio Corporation, Onfido, IDnow, Veriff, Trulioo, Mitek Systems, Yoti, Authenteq, Socure, Acuant, Signicat, Experian, LexisNexis Risk Solutions, Aware, Inc., Veratad Technologies, IDEMIA, Thales Group, iGA Bahrain (Information & eGovernment Authority), Gulf Data International (GDI), NEC Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain Digital Identity Verification Market is poised for significant evolution, driven by technological advancements and increasing consumer expectations. The integration of artificial intelligence and machine learning into verification processes is expected to enhance accuracy and efficiency, while the shift towards decentralized identity solutions will empower users with greater control over their personal data. As businesses adapt to these trends, the market will likely witness a surge in innovative solutions that prioritize user experience and security, fostering a more robust digital ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Biometric Verification Document Verification Identity Authentication Services KYC Solutions Fraud Detection Services Multi-Factor Authentication Decentralized Identity Solutions Blockchain-Based Identity Verification Others |

| By End-User | Financial Institutions & Banks E-commerce Platforms Government Agencies & Public Sector Healthcare Providers Telecommunications Operators Education Sector Insurance Companies Travel & Hospitality Others |

| By Application | Online Banking & Digital Payments E-Government Services & Citizen Onboarding Customer Onboarding & KYC/AML Compliance Fraud Prevention & Risk Management Access Control & Secure Login Insurance Services Retail Transactions Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Resellers Partnerships with Financial Institutions System Integrators Others |

| By Technology | Cloud-Based Solutions On-Premises Solutions Mobile Applications API Integrations Artificial Intelligence & Machine Learning Blockchain Technology Others |

| By Compliance Level | Basic Compliance (e.g., username/password) Enhanced Compliance (e.g., biometric, 2FA, KYC) Full Compliance (e.g., AML, GDPR, local data protection) Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Fee Freemium/Trial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Digital Identity Initiatives | 50 | Policy Makers, IT Directors |

| Banking Sector Identity Verification | 60 | Compliance Officers, Risk Managers |

| Healthcare Digital Identity Solutions | 50 | Healthcare Administrators, IT Managers |

| Telecommunications Identity Management | 40 | Product Managers, Customer Experience Leads |

| Private Sector Digital Identity Adoption | 60 | Business Development Managers, IT Security Officers |

The Bahrain Digital Identity Verification Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing demand for secure online transactions and advancements in technology such as biometrics and artificial intelligence.