Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3493

Pages:98

Published On:January 2026

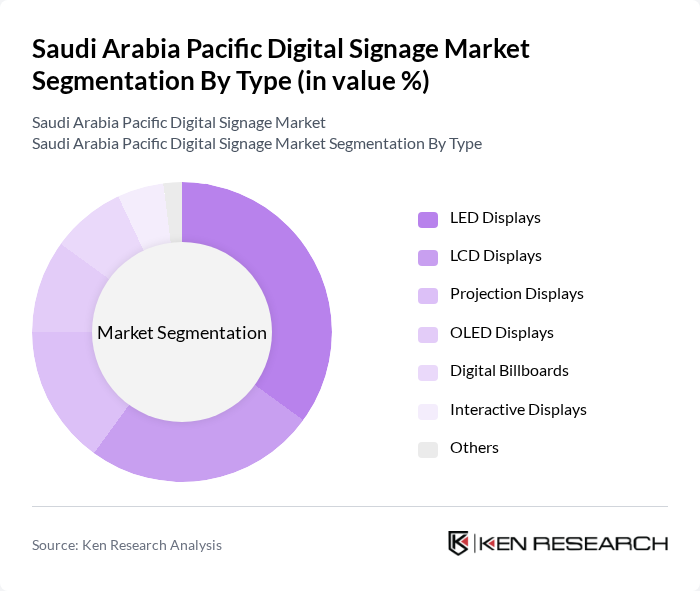

By Type:The market is segmented into various types of digital signage solutions, including LED Displays, LCD Displays, Projection Displays, OLED Displays, Digital Billboards, Interactive Displays, and Others. Among these, LED Displays are currently the most dominant segment due to their high visibility, energy efficiency, and versatility in various applications. The increasing trend of outdoor advertising and the demand for vibrant displays in retail environments further bolster the growth of LED technology.

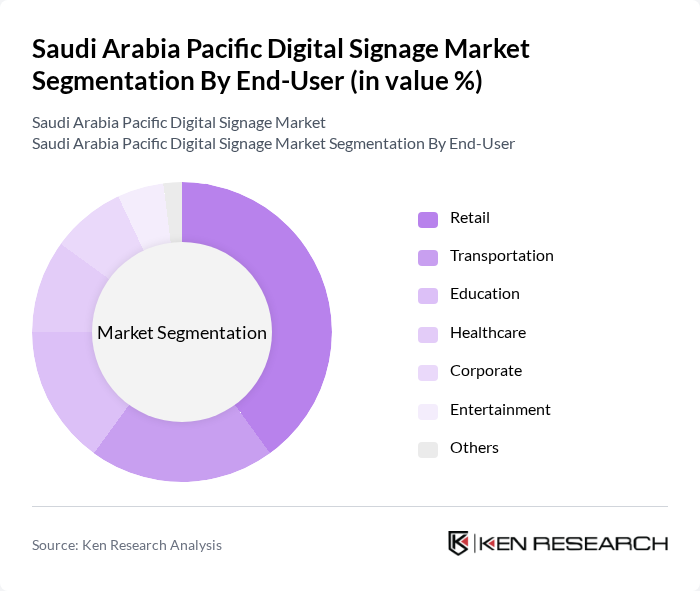

By End-User:The end-user segmentation includes Retail, Transportation, Education, Healthcare, Entertainment, Corporate, and Others. The retail sector is the leading segment, driven by the need for engaging customer experiences and effective advertising strategies. Retailers increasingly utilize digital signage to attract customers, promote products, and provide real-time information, making it a critical component of modern retail environments.

The Saudi Arabia Pacific Digital Signage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Display, NEC Display Solutions, Sharp Corporation, Panasonic Corporation, Sony Corporation, Daktronics, ViewSonic Corporation, Christie Digital Systems, Epson, Barco, Planar Systems, Leyard, Digital Signage Group, BrightSign contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Pacific digital signage market appears promising, driven by increasing investments in technology and infrastructure. As businesses continue to prioritize digital marketing, the integration of AI and IoT technologies is expected to enhance the functionality and effectiveness of digital signage. Additionally, the growing trend towards sustainability will likely influence the development of eco-friendly digital signage solutions, aligning with global environmental goals and consumer preferences for responsible advertising practices.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Displays LCD Displays Projection Displays OLED Displays Digital Billboards Interactive Displays Others |

| By End-User | Retail Transportation Education Healthcare Entertainment Corporate Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Digital Signage Software Content Management Systems Network Infrastructure Display Technologies Others |

| By Application | Advertising Information Display Wayfinding Event Management Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships International Investments Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Digital Signage Solutions | 120 | Marketing Managers, Store Managers |

| Corporate Communication Displays | 100 | IT Managers, Facilities Managers |

| Transportation Information Systems | 80 | Transport Coordinators, Operations Managers |

| Hospitality Digital Signage | 70 | Hotel Managers, Event Coordinators |

| Healthcare Digital Information Boards | 60 | Healthcare Administrators, IT Directors |

The Saudi Arabia Pacific Digital Signage Market is valued at approximately USD 300 million, reflecting a significant growth driven by the increasing adoption of digital advertising solutions and advancements in display technologies.