Region:North America

Author(s):Rebecca

Product Code:KRAD7448

Pages:95

Published On:December 2025

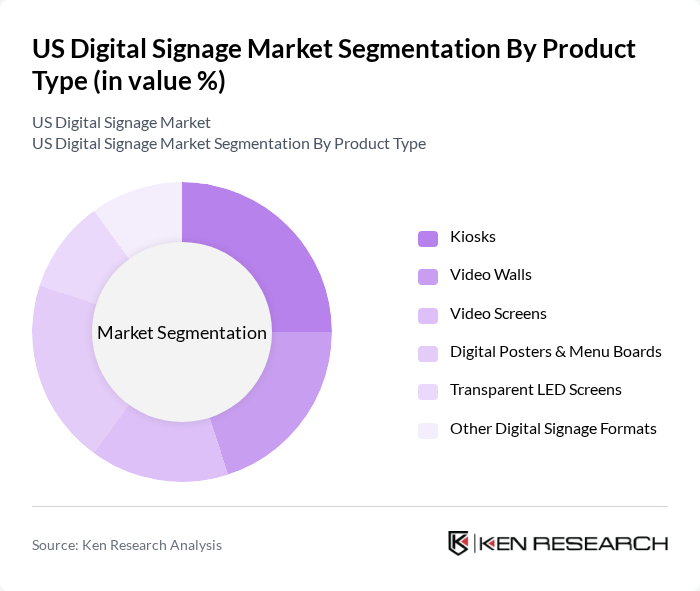

By Product Type:The product type segmentation includes various formats of digital signage that cater to different consumer needs and preferences. Kiosks, video walls, and video screens are among the most popular formats, driven by their ability to deliver dynamic content and engage audiences effectively. Digital posters and menu boards are also gaining traction, particularly in retail and food service sectors, as they offer flexibility and ease of content updates. Transparent LED screens and other digital signage formats are emerging trends, appealing to businesses looking for innovative ways to attract customers.

By Component:The component segmentation encompasses hardware, software, and services that are essential for the effective deployment and management of digital signage solutions. Hardware, including displays, media players, and mounts, constitutes a significant portion of the market, driven by the demand for high-quality visual experiences. Software solutions, particularly content management systems (CMS) and analytics tools, are increasingly important for businesses to optimize their digital signage strategies. Services such as installation, managed services, and content creation are also critical, as they ensure that digital signage systems operate efficiently and deliver impactful messaging.

The US Digital Signage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd. (Samsung Display Solutions), LG Electronics Inc. (LG Business Solutions USA), Sharp NEC Display Solutions of America, Inc., Sony Corporation (Sony Professional Displays & Solutions), Panasonic Corporation of North America, Cisco Systems, Inc., Intel Corporation, Microsoft Corporation, Daktronics, Inc., BrightSign LLC, Scala, Inc. (STRATACACHE Company), STRATACACHE, Inc., Four Winds Interactive LLC (now Poppulo), Visix, Inc., Mvix, Inc., Userful Corporation, Signagelive (Remote Media Limited) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US digital signage market appears promising, driven by ongoing technological advancements and increasing consumer expectations for interactive experiences. As businesses continue to prioritize customer engagement, the integration of AI and machine learning into digital signage solutions is expected to enhance content personalization and effectiveness. Additionally, the growing trend of cloud-based solutions will facilitate easier management and scalability, allowing businesses to adapt quickly to changing market demands and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Kiosks Video Walls Video Screens Digital Posters & Menu Boards Transparent LED Screens Other Digital Signage Formats |

| By Component | Hardware (Displays, Media Players, Mounts) Software (CMS & Analytics) Services (Installation, Managed Services, Content) |

| By Display Technology | LCD/LED OLED Projection e-Paper and Reflective Displays |

| By Location | Indoor Outdoor |

| By Application | Retail Hospitality & Restaurants (QSR/Fast Casual) Transportation (Airports, Rail, Transit) Corporate & Banking Healthcare Education Stadiums, Arenas & Entertainment Venues Government & Public Spaces Other Applications |

| By Deployment Mode | On-Premise Cloud-Based (SaaS) Hybrid |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Digital Signage Usage | 120 | Marketing Managers, Store Operations Directors |

| Transportation Sector Signage | 100 | Facility Managers, Transportation Coordinators |

| Corporate Communication Displays | 80 | IT Managers, Corporate Communications Heads |

| Hospitality Industry Applications | 70 | Guest Experience Managers, Marketing Executives |

| Healthcare Facility Signage | 60 | Facility Managers, Patient Experience Coordinators |

The US Digital Signage Market is valued at approximately USD 9 billion, reflecting significant growth driven by digital advertising adoption, advancements in display technologies, and the demand for interactive customer experiences across various sectors.