Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3822

Pages:80

Published On:October 2025

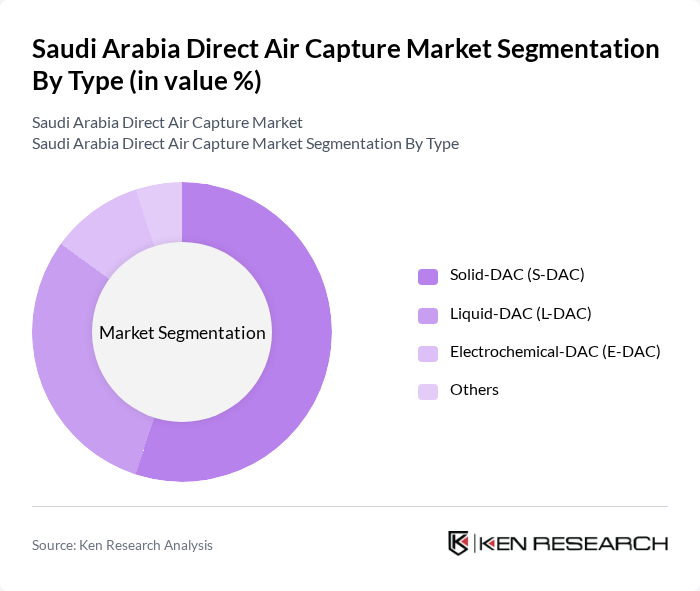

By Type:The market is segmented into four types: Solid-DAC (S-DAC), Liquid-DAC (L-DAC), Electrochemical-DAC (E-DAC), and Others. Solid-DAC is currently leading the market due to its efficiency and lower operational costs, making it a preferred choice for large-scale applications. Liquid-DAC is also gaining traction, particularly in industries requiring high CO2 removal rates. Electrochemical-DAC is emerging as a promising technology, while the 'Others' category includes various innovative methods that are still in the developmental phase.

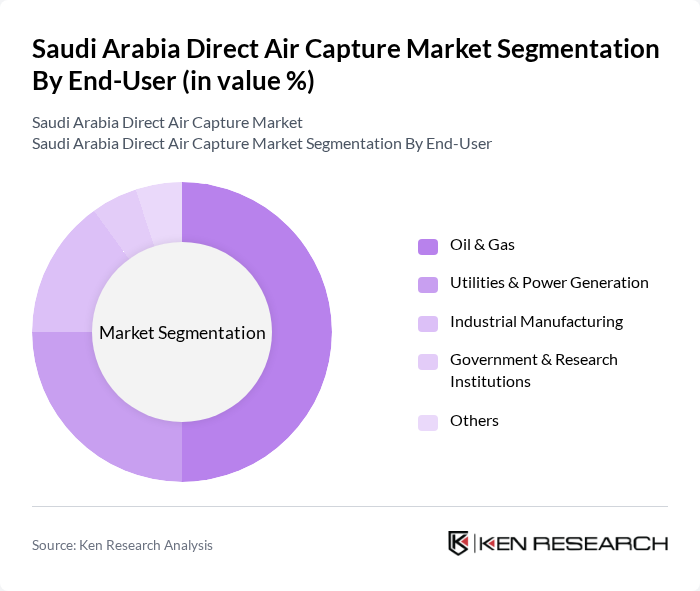

By End-User:The end-user segmentation includes Oil & Gas, Utilities & Power Generation, Industrial Manufacturing, Government & Research Institutions, and Others. The Oil & Gas sector is the dominant end-user, driven by the industry's need to offset emissions and enhance oil recovery processes. Utilities & Power Generation are also significant users, as they seek to comply with environmental regulations. Industrial Manufacturing is increasingly adopting DAC technologies to meet sustainability goals, while government institutions are investing in research and development to promote innovation.

The Saudi Arabia Direct Air Capture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Climeworks AG, Saudi Aramco, KAPSARC (King Abdullah Petroleum Studies and Research Center), Siemens Energy, Carbon Engineering Ltd., Rondo Energy, Linde plc, SLB (Schlumberger), Global Thermostat, Heirloom Carbon Technologies, CarbonCapture Inc., Soletair Power, Samsung Engineering & Construction, Blue Planet Systems, 8 Rivers Capital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the direct air capture market in Saudi Arabia appears promising, driven by increasing government support and technological advancements. As the nation strives to meet its carbon neutrality goals, investments in DAC technologies are expected to rise significantly. Furthermore, the integration of renewable energy sources into DAC operations will enhance efficiency and sustainability. Collaborative efforts between public and private sectors will likely accelerate innovation, positioning Saudi Arabia as a leader in carbon capture technologies in the Middle East.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid-DAC (S-DAC) Liquid-DAC (L-DAC) Electrochemical-DAC (E-DAC) Others |

| By End-User | Oil & Gas Utilities & Power Generation Industrial Manufacturing Government & Research Institutions Others |

| By Application | Carbon Offset Projects Enhanced Oil Recovery (EOR) Synthetic Fuels & Chemicals Direct Utilization in Building Materials Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits (RECs) Others |

| By Technology | Membrane Technology Sorbent Technology Hybrid Systems Others |

| By Distribution Mode | Direct Sales Online Platforms Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Energy Sector Stakeholders | 80 | Energy Executives, Policy Makers |

| Environmental Researchers | 60 | Academics, Research Scientists |

| Technology Providers | 55 | Product Managers, Engineers |

| Government Officials | 45 | Regulatory Authorities, Environmental Policy Advisors |

| Investors in Clean Technology | 40 | Venture Capitalists, Private Equity Investors |

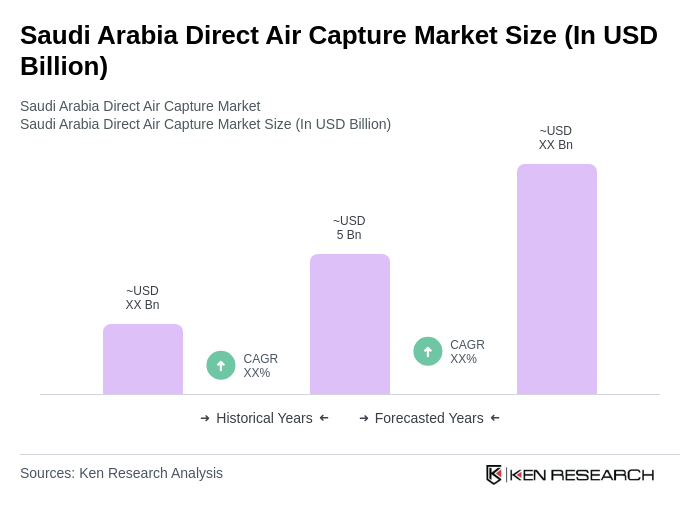

The Saudi Arabia Direct Air Capture Market is valued at approximately USD 5 billion, reflecting a significant investment in carbon capture technologies driven by the government's commitment to carbon neutrality and economic diversification away from oil dependency.