Region:Middle East

Author(s):Geetanshi

Product Code:KRAE3227

Pages:85

Published On:December 2025

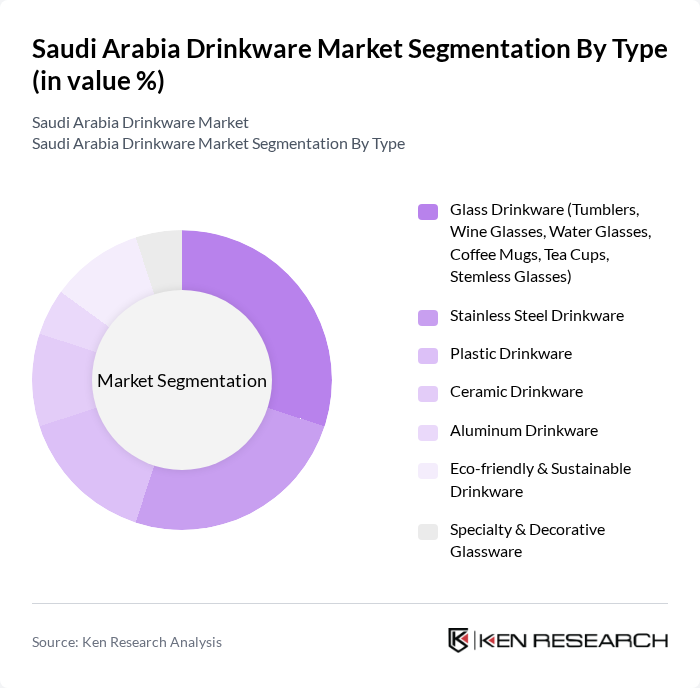

By Type:The drinkware market can be segmented into various types, including glass drinkware, stainless steel drinkware, plastic drinkware, ceramic drinkware, aluminum drinkware, eco-friendly & sustainable drinkware, and specialty & decorative glassware. Among these, glass drinkware, particularly wine glasses, tumblers, and coffee mugs, is gaining significant traction due to its aesthetic appeal and functionality. Wine glass segments accounted for a noticeable share in 2025 and are projected to experience significant growth in the near future. The trend towards sustainable options is also driving the growth of eco-friendly drinkware, with metal segments emerging as the fastest-growing category with growth rates exceeding 8% annually.

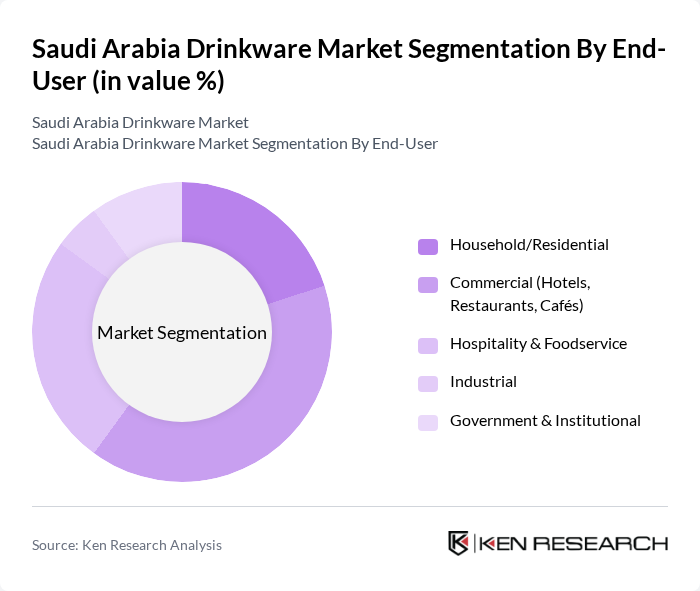

By End-User:The end-user segmentation includes household/residential, commercial (hotels, restaurants, cafés), hospitality & foodservice, industrial, and government & institutional. The commercial segment is particularly robust, driven by the booming hospitality sector in Saudi Arabia, which is experiencing growth due to increased tourism and local dining experiences. The household segment is expected to expand at a significant rate, retaining its position throughout the forecast period.

The Saudi Arabia Drinkware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Jazeera Factory for Glass Products, Saudi Glass Industries, Al-Qassim Glass Factory, Al-Muhaidib Glass, Middle East Glass Manufacturing Company, ARC International (Saudi Arabia), Libbey Inc. (Saudi Distributor), Bormioli Rocco (Saudi Distributor), Crystal Arc Factory, Al-Suwaidi Industrial Services, Al-Hamrani Group, Al-Fahad Group, Al-Babtain Group, Al-Rajhi Group, Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia drinkware market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-conscious behaviors continue to rise, the demand for innovative, smart drinkware is expected to increase. Additionally, the focus on sustainability will likely lead to more brands adopting eco-friendly practices. The integration of technology, such as hydration tracking and smart features, will further enhance consumer engagement, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Glass Drinkware (Tumblers, Wine Glasses, Water Glasses, Coffee Mugs, Tea Cups, Stemless Glasses) Stainless Steel Drinkware Plastic Drinkware Ceramic Drinkware Aluminum Drinkware Eco-friendly & Sustainable Drinkware Specialty & Decorative Glassware |

| By End-User | Household/Residential Commercial (Hotels, Restaurants, Cafés) Hospitality & Foodservice Industrial Government & Institutional |

| By Material | Soda-lime Glass Borosilicate Glass Tempered Glass Stainless Steel Plastic (BPA-free) |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Wholesale/B2B Direct Sales |

| By Price Range | Budget Mid-range Premium Luxury |

| By Brand Type | Local Brands International Brands Private Labels |

| By Occasion | Everyday Use Special Events Gifting Promotional Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Drinkware Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Drinkware | 120 | General Consumers, Eco-conscious Shoppers |

| Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 80 | Wholesalers, Distributors |

| Market Trends and Innovations | 60 | Product Development Managers, Designers |

The Saudi Arabia Drinkware Market is valued at approximately USD 1.15 billion, reflecting a significant growth trend driven by consumer demand for diverse and sustainable drinkware options across residential and commercial sectors.