Region:Asia

Author(s):Dev

Product Code:KRAA9685

Pages:86

Published On:November 2025

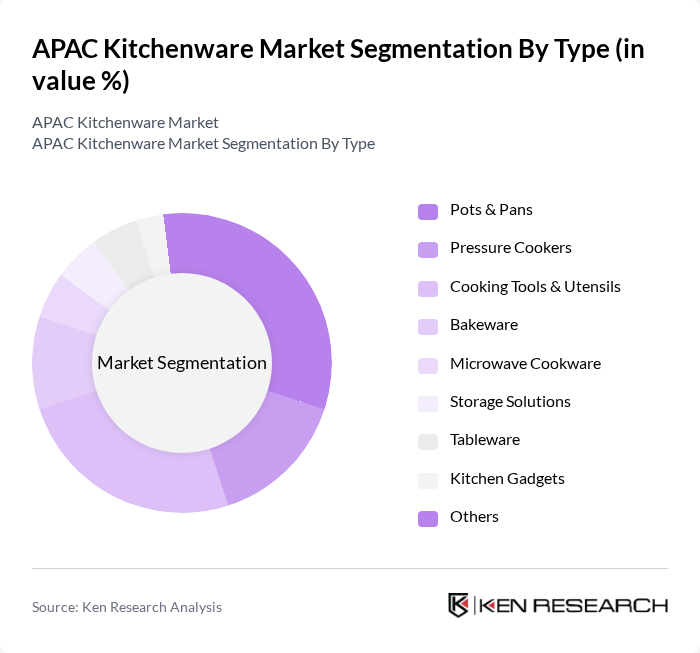

By Type:The kitchenware market can be segmented into various types, including pots & pans, pressure cookers, cooking tools & utensils, bakeware, microwave cookware, storage solutions, tableware, kitchen gadgets, and others. Among these, pots & pans and cooking tools & utensils are particularly dominant due to their essential role in everyday cooking. The increasing trend of home cooking, culinary experimentation, and demand for versatile, high-quality, and sustainable kitchenware are driving growth in these segments. Stainless steel and non-stick cookware are especially popular, reflecting consumer interest in durability and health-conscious cooking .

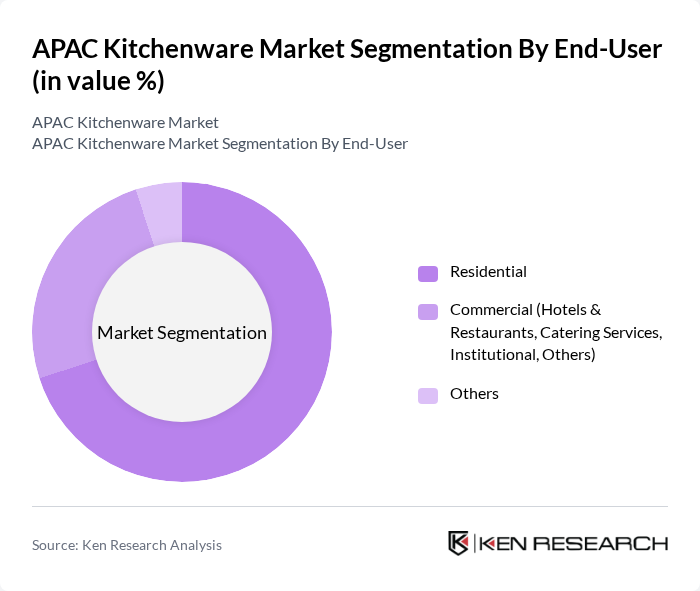

By End-User:The kitchenware market is segmented by end-user into residential, commercial (including hotels & restaurants, catering services, institutional), and others. The residential segment is the largest, driven by the increasing number of households, urbanization, and the growing trend of home cooking. Consumers are investing in quality kitchenware to enhance their cooking experience, with a rising preference for innovative, multifunctional, and sustainable products .

The APAC Kitchenware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Supor (SEB Group), Meyer Corporation, ASD Cookware, Zojirushi Corporation, Lock & Lock, Tefal (Groupe SEB), Hawkins Cookers, Butterfly Gandhimathi Appliances, Prestige (TTK Prestige Limited), Panasonic Corporation, Philips (Koninklijke Philips N.V.), Cuckoo Holdings, Joyoung Co., Ltd., Tiger Corporation, WMF Group (Groupe SEB) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC kitchenware market is poised for significant transformation as consumer preferences evolve towards sustainability and technology integration. In future, the demand for eco-friendly kitchen products is expected to surge, driven by heightened environmental awareness. Additionally, the rise of smart kitchen appliances, which enhance convenience and efficiency, will likely reshape consumer purchasing behavior. Companies that adapt to these trends will be better positioned to capture market share and meet the changing needs of consumers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Pots & Pans Pressure Cookers Cooking Tools & Utensils Bakeware Microwave Cookware Storage Solutions Tableware Kitchen Gadgets Others |

| By End-User | Residential Commercial (Hotels & Restaurants, Catering Services, Institutional, Others) Others |

| By Region | China Japan South Korea India Australia Singapore Taiwan Southeast Asia Rest of APAC |

| By Material | Stainless Steel Aluminum Non-stick Coatings Glass Silicone Others |

| By Distribution Channel | Offline (Supermarkets/Hypermarkets, Specialty Stores, Department Stores, Others) Online Retail Others |

| By Price Range | Low Mid-range Premium Luxury Others |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Quality-focused Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cookware Sales Insights | 100 | Product Managers, Retail Buyers |

| Tableware Consumer Preferences | 80 | End Consumers, Market Analysts |

| Utensils Market Trends | 60 | Manufacturers, Supply Chain Managers |

| Kitchenware E-commerce Insights | 90 | E-commerce Managers, Digital Marketing Specialists |

| Sustainability Practices in Kitchenware | 70 | Sustainability Officers, Product Development Managers |

The APAC Kitchenware Market is valued at approximately USD 23 billion, driven by factors such as rising disposable incomes, urbanization, and the increasing popularity of digital retail platforms. This market reflects a significant shift towards premium and sustainable kitchen products.