Region:Middle East

Author(s):Dev

Product Code:KRAD7750

Pages:92

Published On:December 2025

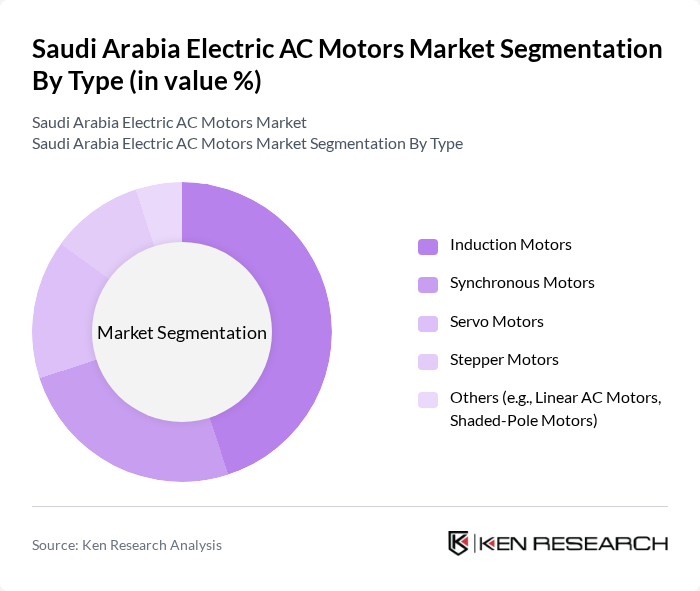

By Type:The market is segmented into various types of electric AC motors, including Induction Motors, Synchronous Motors, Servo Motors, Stepper Motors, and Others (e.g., Linear AC Motors, Shaded-Pole Motors). Induction Motors are the most widely used due to their robustness and cost-effectiveness, making them suitable for a variety of applications. Synchronous Motors are gaining traction in applications requiring precise speed control, while Servo Motors are preferred in automation and robotics. Stepper Motors are utilized in applications requiring precise positioning, and the 'Others' category includes specialized motors catering to niche markets.

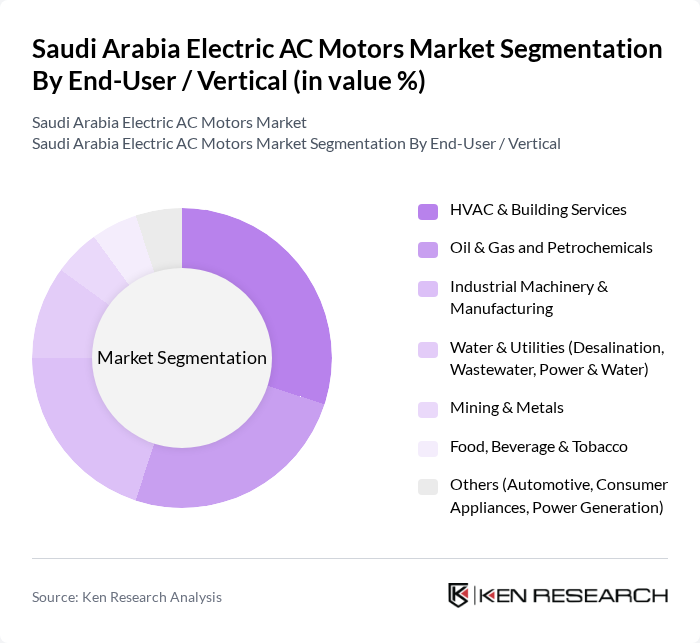

By End-User / Vertical:The electric AC motors market is segmented by end-user industries, including HVAC & Building Services, Oil & Gas and Petrochemicals, Industrial Machinery & Manufacturing, Water & Utilities (Desalination, Wastewater, Power & Water), Mining & Metals, Food, Beverage & Tobacco, and Others (Automotive, Consumer Appliances, Power Generation). The HVAC & Building Services sector is a significant contributor due to the increasing demand for energy-efficient heating and cooling solutions amid subtropical weather conditions. The Oil & Gas sector also drives demand due to the need for reliable and efficient motors in extraction and processing operations.

The Saudi Arabia Electric AC Motors Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Electrical Industries Co. Ltd. (ABB Saudi Arabia), Siemens Ltd. Saudi Arabia, Ashoor Electric Motors, WEG Saudi Arabia (WEG Industries), Nidec Corporation, TECO Group, CG Power and Industrial Solutions Ltd., ATB Group, Schneider Electric Saudi Arabia, Mitsubishi Electric Saudi Ltd., Toshiba Corporation, Rockwell Automation, Emerson Electric Co., Regal Rexnord Corporation, Local Distributors & System Integrators (e.g., Alfanar, Zamil Industrial for HVAC-related motors) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric AC motors market in Saudi Arabia appears promising, driven by ongoing industrial automation and a strong focus on energy efficiency. As the government continues to invest in renewable energy projects, the demand for advanced motor technologies is expected to rise. Additionally, the integration of smart technologies and IoT applications will likely enhance motor performance and efficiency, creating new avenues for growth. The market is poised for transformation as these trends unfold, fostering innovation and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Induction Motors Synchronous Motors Servo Motors Stepper Motors Others (e.g., Linear AC Motors, Shaded-Pole Motors) |

| By End-User / Vertical | HVAC & Building Services Oil & Gas and Petrochemicals Industrial Machinery & Manufacturing Water & Utilities (Desalination, Wastewater, Power & Water) Mining & Metals Food, Beverage & Tobacco Others (Automotive, Consumer Appliances, Power Generation) |

| By Application | Pumps (including Water, Process and Oil & Gas Pumps) Fans & Blowers Compressors Conveyors & Material Handling HVAC Equipment (Chillers, Air Handlers, AHUs) Others (Machine Tools, Mixers, Extruders, Ventilators) |

| By Voltage Rating | Low Voltage (Up to 690V) Medium Voltage (691V – 3300V) High Voltage (Above 3300V) |

| By Phase | Single Phase Three Phase |

| By Cooling Method | Air-Cooled Water-Cooled Others (Forced Ventilation, Oil-Cooled) |

| By Efficiency Class / Policy-Linked Segment | Standard Efficiency Motors (IE1) High Efficiency Motors (IE2) Premium & Super Premium Efficiency Motors (IE3 and above) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Manufacturing Sector | 100 | Production Managers, Plant Engineers |

| HVAC Applications | 80 | HVAC Technicians, System Designers |

| Transportation and Automotive | 70 | Fleet Managers, Automotive Engineers |

| Renewable Energy Sector | 60 | Project Managers, Energy Consultants |

| Commercial Building Management | 90 | Facility Managers, Energy Efficiency Experts |

The Saudi Arabia Electric AC Motors Market is valued at approximately USD 790 million, driven by increasing demand for energy-efficient solutions across various sectors, including industrial and commercial applications, as well as urbanization and infrastructure developments under Vision 2030.